Blog Archive ETFs You Should Include In Your Portfolio

Post on: 29 Март, 2015 No Comment

ETFs You Should Include In Your Portfolio

Posted on Tuesday, 13th October 2009 by admin

I am actually a very big fan of ETFs (Exchange Traded Funds). If you like managing your own portfolio and doing research on the internet, you should consider building an ETF portfolio. Why? Here are some reasons why an ETFs portfolio would perform well throughout the years:

#1 ETFs have low MERs

For those who have mutual funds, you should look at something very important on your investment statement: management fees! Most equity funds (unless they are from Vanguard) show fees over 1%. This means that if your fund returns 8% at the end of year, you will only get 7% in your pocket. ETF fees are usually below 0.50%. Therefore, in my previous example, you would increase your yield to 7.5% by doing nothing. While 0.5% doesn’t mean much over a year, it makes a difference of $6,709 on $10,000 invested for 25 years.

#2 70% of portfolio managers don’t beat the market

The ultimate goal of a mutual fund is to beat its index of reference. However, statistics show that 70% of portfolio managers don’t beat the market year after year. Considering this fact and adding higher MERs, you are almost 100% sure to make more money with ETFs!

#3 ETFs offer a better diversification than stocks

If you have an investment account value below $100,000, you will have a really hard time getting diversified among fixed income, US equity and international equity. Chances are that you will be holding 10 to 12 stocks. Buying ETF does allow you to hold the Dow Jones 30 or the S&P 500 in a single transaction. You then decrease your investment fluctuation with a smaller price.

#4 You can benefit from leveraging as well!

A few years ago, some ETF companies created leveraged ETFs (click on the link to see a full definition). While they can be very risky to trade, they allow you to make twice and three times the index return. This would be quite interesting if you can mix it with the Trade Triangle technique over at MarketClub!

#5 ETFs allow you to be specific

If you believe in a specific sector or industry (such as financial during 2009!), you can buy an ETFs replicating exactly how this industry reacts on the market. This allows you to become very specific in your trading strategy.

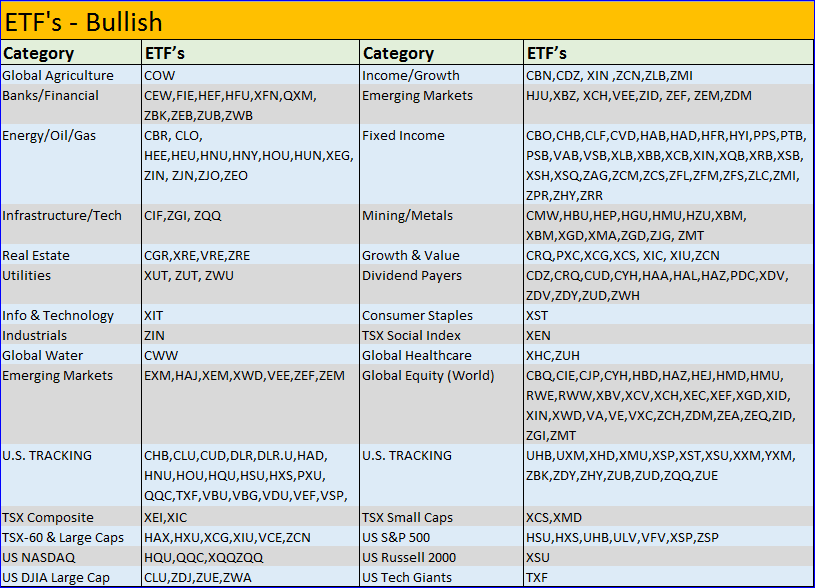

So where can I find these ETFs?

At the bottom of this post, you will find a quick list of diversified ETFs that could be part of your new investing portfolio. I managed to put the ticker, the name, the yield to date and the last price as of September 23 rd. If you go on my blog, you can also find the best ETFs related to gold .