BlackRock s iShares bets cheap isn t better for ETFs

Post on: 7 Апрель, 2015 No Comment

Robert Kapito, president of BlackRock Inc. gives a thumbs up after ringing the opening bell with employees at the New York Stock Exchange, July 10, 2012.

Analysis & Opinion

NEW YORK (Reuters) — BlackRock Inc, the largest global exchange-traded fund provider, has been aggressive in its efforts to maintain U.S. market share but has still found itself losing ground to a cheaper, smaller rival.

Since January, its San Francisco-based iShares ETF unit has started 42 ETFs and has at least 20 more planned this year. Its executives have been out front on regulatory issues and calls for more transparency in ETF labeling and the increasingly popular ETF managed portfolio space.

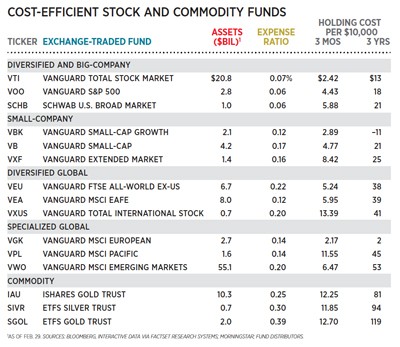

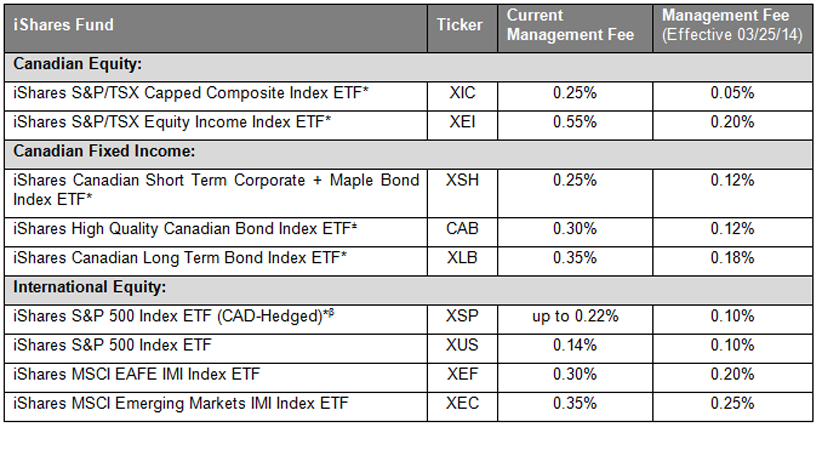

But, one thing iShares has refused to do is cut costs to compete with rivals like Vanguard, whose ETFs, in some cases cost as little as a third of their iShares equivalents.

The situation at iShares, which BlackRock bought from Barclays PLC for $13.5 billion in 2009, is emblematic of the challenges the asset manager faces as it moves from acquisition mode to management of its $3.68 trillion empire.

Exchange-traded funds are baskets of securities, like mutual funds, but they trade on exchanges, like individual securities. They are cheaper than mutual funds and allow investors to trade throughout the day, with simultaneous pricing, unlike mutual funds, which price at the end of the day.

While iShares is still thriving, competitors are chipping away.

BlackRock’s iShares ETFs made up 40.7 percent of the $1.2 trillion U.S. ETF market as of July 9, down from 43.2 percent two years ago. Vanguard’s ETFs held 17.7 percent of U.S. ETF assets, up from 15.9 percent two years ago, according to ETF-tracking firm IndexUniverse LLC.

They are in the middle of a price war whether they admit it or not, said David Nadig, director of research at IndexUniverse.

Some industry experts say iShares’ pricing puts the firm at a disadvantage when cost is a key reason investors choose one ETF over another. They say it will eventually be forced to lower fees to compete.

What’s more, some iShares ETFs have underperformed similar less-pricey Vanguard funds, resulting in a slow defection from some of iShares’ ETFs.

One of BlackRock’s biggest ETFs, the $33.6 billion iShares MSCI Emerging Markets Index Fund, has seen $2.9 billion in investor money leave over the past three years as of June 30. Meanwhile, the $50.3 billion Van guard MSCI Emerging Markets ETF, gained $39 billion, according to Morningstar Inc. That’s about $280 million in lost revenue for iShares.

The iShares ETF, at more than triple the cost, also performed worse than the Vanguard fund for the past one, three and five years as of June 30, according to IndexUniverse.

Still. iShares remains the industry leader. With $480 billion in assets in the United States, it eclipses the No. 2 player, State Street Global Advisors, which has $298.3 billion, and dwarfs Vanguard’s $211.3 billion of ETF assets, according to IndexUniverse.

Even if it bleeds assets, the (iShares) fund still gets the revenue from the money that remains in the fund, said an industry insider who asked not to be named.

BlackRock says investors are looking at other factors — not just cost — when choosing ETFs.

ETFs are not commodities, a BlackRock spokesman said in an e-mailed statement. Buyers care a lot about liquidity, brand, product quality and accuracy of exposure.

iShares this year has focused on products such as fixed income, equity income and low volatility emerging markets ETFs, according to BlackRock.

In the first half of this year, iShares’s 50 fixed income ETFs gained $33.3 billion in investor money, according to Morningstar. That’s nearly double its inflow for the same period last year and accounts for 49 percent of year-to-date flows into all fixed income ETFs, according to Morningstar.

CHEAPER ALTERNATIVES

Vanguard has rolled out lower-cost products like those BlackRock already has, prompting some advisers and 401(k) administrators to shift to Vanguard.

In February 2011, ShareBuilder 401(k), which provides plans to over 3,500 small employers, replaced four iShares funds with similar Vanguard funds because they were cheaper and tracked their indices more precisely, said Stuart Robinson, head of ShareBuilder 401(k).

Similarly, Ronald Colson, president of Lakewood, Colorado-based Colson Financial Group Inc, a registered investment adviser with $18 million in assets under management, said he switched out of a handful of iShares ETFs in January.

If Vanguard has the same ETFs that are identical in makeup to iShares and two-third of the cost, it is my fiduciary responsibility to my clients to switch, Colson said.

iShares is not the only ETF provider grappling with how to compete with Vanguard. As a mutual company, Vanguard is owned by its customers, and thus its profits go back into its business. That advantage makes it nearly impossible for competitors who answer to shareholders to compete on cost, experts said.

Many people underestimated the long-term value of the brand and the experience of Vanguard, said Lee Kranefuss, the former chairman of iShares who helped launch its ETF lineup and is now an industry consultant.

MAKING OF A GIANT

For BlackRock, growing the iShares business by adding products has been key to bolstering its bottom line.

In the first quarter of 2012, BlackRock said, investors added $25.7 billion to its portfolios, with $18.2 billion going to iShares ETFs. BlackRock reports second-quarter earnings on Wednesday.

Being first-to-market with many types of ETFs has helped iShares gain assets, experts said. At the same time, deep relationships with market makers who facilitate the creation and redemption of ETF shares, index providers like Standard & Poor’s and brokerage firms provide iShares with the ability to secure good pricing and liquidity on its portfolios.

The firm says it has 207 equity ETFs, 50 fixed-income ETFs, three commodity ETFs and 16 mixed-allocation ETFs, with 64 people on its capital markets team.

In contrast, Vanguard has 64 ETFs — 52 equity and 12 fixed-income — and a capital markets team of 10.

A Vanguard spokesman said its strategy to offer lowest cost ETFs is not aimed at competing with iShares.

iShares has garnered loyalty from managers and advisers by acting as a matchmaker for advisers looking for model ETF portfolio providers. In May the firm held its first conference for model ETF portfolio managers, hosting 160 clients and trading firms.

BlackRock projects the ETF model portfolio market, now at around $46 billion, will climb to $120 billion by 2016.

iShares recognized this model ETF portfolio market before anyone else and helped us grow, said Robert Williams, director of research at Sage Advisory Services, an Austin, Texas-based firm with $11 billion in assets. He says iShares’ lower trading costs can offset higher expenses.

For now, BlackRock’s size and position in the market give iShares the leeway to wait to cut fees until investors take greater notice.

Even so, many experts and advisers believe iShares will eventually have to lower expenses on its ETFs that compete with Vanguard’s. Even then, iShares could charge more than Vanguard and still make an impact, said Tom Lydon, president of Global Trend Investments, a registered investment adviser.

I think they can pick their moment, Lydon said. Investors and advisers are still somewhat checked out, but once they start coming back to the markets, I believe iShares will. cut fees. (Reporting by Jessica Toonkel; Editing by Jennifer Merritt, Walden Siew )