BlackRock and Vanguard Take Lead in ETF Bond Rush and Today’s Other Top Stories

Post on: 1 Июнь, 2015 No Comment

To get the Best of the Bond Market delivered to your email daily click here .

Individual investors are flooding back into bonds, but far from investing in traditional mutual funds, this time investors are choosing more flexible ETFs.

This has provided a rush of money into plain old vanilla ETFs from providers such as BlackRock and Vanguard.

According to data from Bloomberg, bond ETFs have gathered a net $10 billion this year. Fixed-income mutual funds have recovered from redemptions last year to take in $14.9 billion in 2014 through March 12, according to the Investment Company institute.

The long-term trend shows ETFs, which typically track a basket of securities and trade throughout the day like stocks, grabbing a bigger proportion of bond fund deposits. Fixed-income ETFs took in a net $9.7 billion in 2013, even as bond mutual funds lost $83.4 billion to redemptions.

This is bad news for Pimco which has suffered from $236 billion in redemptions from their flagship Pimco Total Return Fund (PTTRX), amid underperformance in the past year and a shakeup of the firm’s management.

Pimco has tired to fight back with the launch of 19 actively run ETFs in January . but it appears they have brought a sword to a gunfight. Pimco is playing a different game here, eight of Pimco’s existing ETFs are actively run. Funds that track an index account for more than 99 percent of U.S. ETF assets.

“Most investors are drawn to plain vanilla, super-low-cost fixed-income products,” according to David Nadig, director of research at San Francisco–based ETF.com. “Pimco is not playing that game, and to me, it’s a miracle they are getting any flows.”

And there’s another problem affecting the bond giant. “Pimco came in a bit late and they are considerably smaller,” Todd Rosenbluth, director of mutual-fund and ETF research at S&P Capital IQ in New York, told Bloomberg. “If they’re shifting within fixed income, investors are more inclined to go with BlackRock or Vanguard.”

Pimco could have done better with additional short-term funds, or from an earlier introduction of its Low Duration ETF, Rosenbluth said. That fund, which opened in January, has about $23 million in assets. Had it launched a year ago before rates moved higher, it’s a product that would have been positioned to gather assets.”

Todays Other Top Stories

Municipal Bonds

Bond Buyer: – Fund managers eye economy as they set 2nd quarter strategy. – Municipal portfolio managers are keeping a wary eye on the economy as the second quarter approaches.

Reuters: – Municipal bond represent compelling value in the current environment. – Schroder’s fixed-income portfolio manager says that municipal bonds are one of the most compelling relative value opportunities in the fixed-income market.

Businessweek: – Muni returns to fade as interest rates rise, Morgan Stanley says. – Returns in the $3.7 trillion municipal bond market are set to “cool off” in the next three months amid rising interest rates, according to a report from Morgan Stanley analysts led by Michael Zezas.

Education

LearnBonds: – Long term rates locked-up in chains? – Investors often misunderstand that when the Fed is raising policy rates, all rates must rise. Although it might appear this way at the beginning of a policy-tightening cycle, rising short-term rates often result in stalling and, eventually, declining long-term interest rates. The cycle typically plays out as follows.

Market Realist: – Credit spreads: A fixed income investors must-know guide. – Credit spreads are the difference in yield between U.S. Treasuries and corporate bonds of the same maturity. Corporate bonds yield more than Treasury bonds, as they carry a risk of default. The difference in yields between a corporate bond and a Treasury of the same maturity is actually the premium that investors require for undertaking the additional credit risk associated with the corporate bond.

Treasury Bonds

St Louis Post: – Foreign grip loosens on Treasuries as U.S. investors buy. – Overseas creditors such as China and Japan enabled the U.S. to spend its way out of the recession as they gobbled up 80 percent of the nations Treasuries. Now, their holdings are dropping toward the lowest level in a decade, while homegrown investors have picked up the slack.

USA Today: – Fears of rising rates killing bull overblown? – The higher the yields rise on long-term government bonds the more expensive the stock market gets vs. bonds. If yields on the 30-year bond spike to, say, 5%, investors will likely want to lock in a sure thing and buy bonds. Rising rates will eventually be an impediment to stocks, but we are not there yet.

High Yield

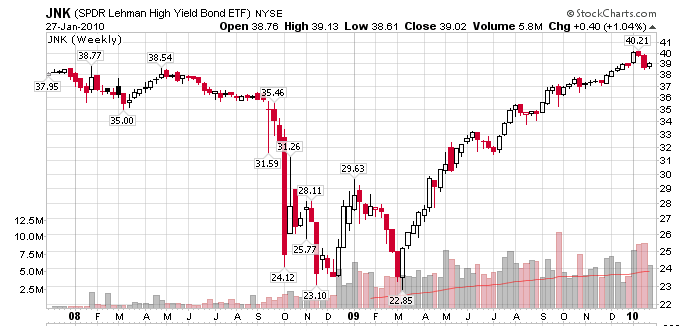

Investorplace: – It’s time to sell high-yield bonds. – High-yield bonds have been an outstanding investment in recent years, but investors would do well to look forward, not back, when assessing the outlook for the asset class. At this point, the potential rewards are no longer compensating investors for the risk.

NASDAQ: – HYG: Large outflows detected at ETF. – Looking today at week-over-week shares outstanding changes among the universe of ETFs covered at ETF Channel. one standout is the iShares iBoxx $ High Yield Corporate Bond ETF (Symbol: HYG) where we have detected an approximate $394.6 million dollar outflow.

Emerging Markets

ETF Trends: – Warming up to Brazilian bonds with ETFs. – Brazilian assets and related exchange traded funds experienced a huge sell-off over the past couple of months. Now, some fund managers are taking a second look at the developing market as cheap valuations begin to look enticing.

WSJ: – Zambia, Kenya still looking to issue international bond. – The U.S.s pullback from the cheap money era is rattling markets across Africa, but Zambia and Kenya are still testing the waters to potentially raise billions of dollars in financing through international bonds.

Peer to Peer

FTSE Global Markets: – Alternative asset managers tap peer-to-peer loan market. – Alternative asset managers with expertise in high-yield fixed income and distressed assets are upping their investments in the peer-to-peer loan market, according to a new report from Cerulli Associates.

Investment Strategy

Catastrophe Bonds

Financial Express: – Catastrophe bonds: An idea whose time has come. – Adopting new technology may be challenging and even disruptive. But it has been proved that the future belongs to those who anticipated change and prepared themselves for challenges to stay ahead of the curve.

Bond Funds

Minyanville: – Treasury ETFs diverge in two fundamental directions. – The initial reaction to Janet Yellens comments last week bode well for long-term Treasury bonds, but investors should prepare themselves for ongoing shifts.

Bloomberg: – ETF, the sequel: Now in a portfolio near you. – Many sequel ETFs have lived up to the promise of the original, and then some. Here’s a look at five of the best-performing examples of the past few years. These ETFs adhered to the formula, the structure and even the ticker of the original but added a new twist that appealed to investors.

About.com: – Despite an ugly 2013, Actively managed bond fund have outperformed over time. – Its a widely held belief that index funds outperform actively managed funds over the long term, and thats certainly been the case when it comes to stock funds. In the bond world, however, managers have added meaningful value in recent years.

The 2s5s10s fly is up nearly 25bps in the last week & is just under 5yr+ resistance levels

— David Schawel (@DavidSchawel) March 25, 2014

2-Year went all the way yesterday on RP. Set to open today at -1.00/-1.50 — Ed Bradford (@Fullcarry) March 25, 2014

If you think Detroit is bad, wait until they insert themselves into Puerto Ricos inevitable restructuring.

— Bond Girl (@munilass) March 25, 2014