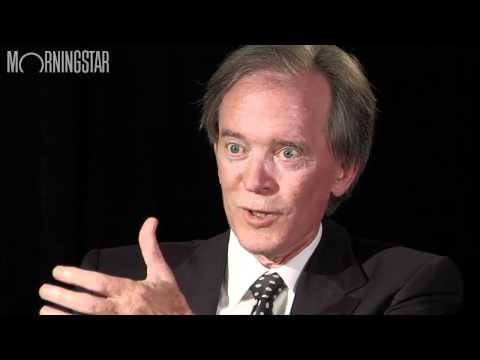

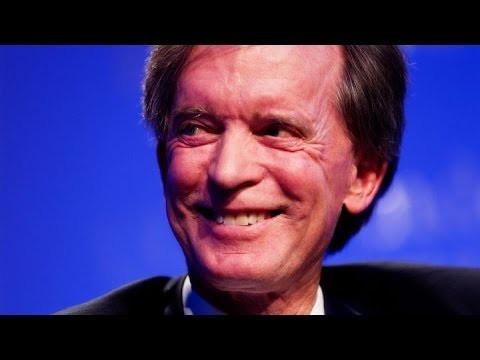

Bill Gross is the Most Underpaid Money Manager in the World

Post on: 28 Июнь, 2015 No Comment

(August 1st, 2012) A recent article in New York Times by Geraldine Fabrikant put the salary of Bill Gross, the legendary manager of PIMCO Total Return Fund, at $200 million per year. The number two most recognizable name at PIMCO, Mohamed El-Erian, was reported to make $100 Million. The source for these numbers was not disclosed, and has come under criticism for being too high by Felix Salmon who writes for Reuters. I believe there is a strong argument to be made that even if Bill Gross made $1 billion per year that he would be undercompensated by several measures.

The New York Times article quotes Bill Gross as saying, “We all earn too much, but I can sleep because of the multiples we have provided for our clients over the years.”

Poll: How much should Bill Gross of PIMCO earn per year?

How Much Bill Gross Makes Shouldnt Really Matter To Investors

Before I tell you why I think that Bill Gross is undercompensated, I would like to spend a moment on why this discussion is not relevant from the standpoint of investing in PIMCO funds. The compensation for Bill Gross and Mohamed El-Erian is paid via the fee revenue generated by the funds. If Bill Gross made $3 million dollars vs. $300 million dollars, the fees charged to investors would probably not be any different. The amount of Bill Gross’ salary has much more impact on the profits of investors of the parent company of PIMCO, Allianz SE, than on the investors in its bond mutual funds and ETFs.

An argument could potentially be made that PIMCO’s funds would have lower fees, if they did not have to pay big salaries to its top two managers. If Bill Gross and Mohamed El-Erian both worked for free and the savings were passed along to PIMCO’s clients in the form of lower annual expenses, how much lower would fees be? Assuming that they make a combined $300 Million and PIMCO manages $1.8 billion, the annual expense ratio would be reduced .015%. To put this in context, the PIMCO Total Return Fund charges its class A shareholders an annual expense ratio of 0.85%, so the potential impact on fees of this fantasy scenario is less than 2%. In other words, the salaries of Bill Gross and El-Erian have little impact on PIMCO’s management fees.

Is Bill Gross Under Compensated?

In my view, Bill Gross has two distinct but related jobs. There is Bill Gross, a very good, perhaps extraordinary portfolio manager, whose primary job is to deliver superior investment returns. But there is also Bill Gross the celebrity pitchman / marketer for PIMCO who is a permanent fixture on CNBC, and whose job it is to bring more assets into PIMCO’s funds. It’s hard to separate these roles, as Bill Gross would not be a successful pitchman if he did not have the reputation for being the “bond king”. However, for the purposes of figuring out compensation we will pretend that these are different roles.