Beware the pitch for indexed annuities

Post on: 31 Май, 2015 No Comment

Analysis & Opinion

n>Nov 8 (Reuters) — Wouldn’t it be nice to earn competitive returns without getting slammed by the stock market?

That appealing prospect helps explain the growing popularity of indexed annuities. By offering a portion of the stock market’s gains, along with a low minimum guaranteed rate, they attempt to fill the gap between puny certificate of deposit yields and potentially higher, but more volatile stock market returns.

But these complex products have also attracted critics; they were the subject of a 2010 Financial Industry Regulatory Authority (FINRA) alert (see) and have also been the subject of lawsuits claiming sales people glossed over their terms and complexities.

If you haven’t heard about indexed annuities, also called fixed index annuities or equity indexed annuities, there’s a good chance you will soon. Last year, buyers committed a record $33 billion to them and sales are on track to at least match that amount in 2011, according to Beacon Research. While independent insurance agents have been responsible for most sales thus far, brokerage firms are now the fastest-growing sales channels for these insurance products.

What brings out the critics is their view that any safety net these annuities may offer is vastly overshadowed by high costs and complex terms.

I understand the theoretical case for principal-protected products such as indexed annuities, but that doesn’t make me a fan of the actual products in the marketplace, says Glenn Daily a fee-only insurance consultant in New York City. High commissions, high surrender charges, and a lack of transparency — is that the best that insurers can do?

FINRA’s alert, which is a must-read for anyone considering these products, warns: Although one insurance company at one time included the word ‘simple’ in the name of its product, EIAs (equity-indexed annuities) are anything but easy to understand. (The Illinois Department of Insurance also has some helpful guidelines in its on-line buyer’s guide at)

Other complaints include:

— Hidden fees and commissions. Commissions typically run between 5 percent and 10 percent of the contract amount, but can sometimes be more. These and other expenses are taken out of returns, so it’s hard for buyers to determine exactly how much they’re paying.

— Complex formulas and changing terms. The formulas used to determine how much annuity owners earn are so complex that even sales people have a hard time understanding them, and they can change during the life of the contract.

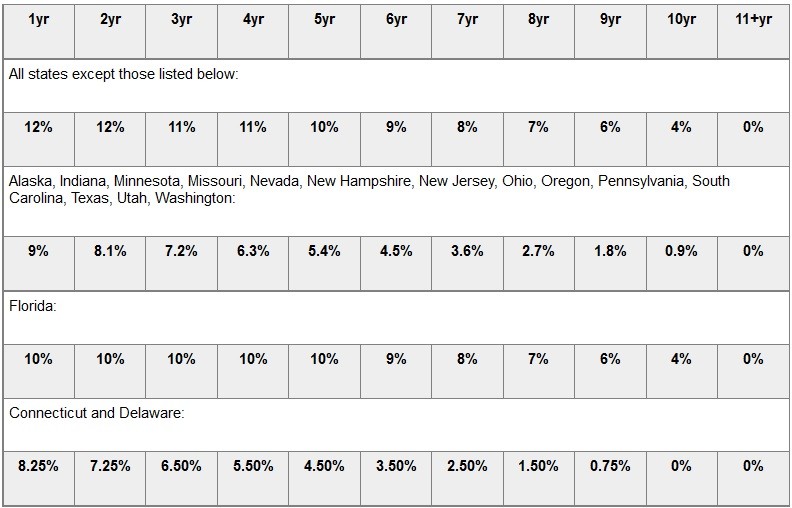

— Limited access to funds. Buyers who try to cash out early will incur a surrender charge that typically starts at 10 percent and decreases gradually each year until it stops after a decade or more.

— Limited upside. An annuity’s participation rate specifies how much of the increase in the index is counted for index-linked interest. For example, if the change in the index is 8 percent, an annuity with a 70 percent participation rate could earn 5.6 percent. However, many annuities place upside caps on the index-linked interest, which limits returns in strong bull markets. If the market rose 15 percent, for example, an annuity with a cap rate of 6 percent would only be credited with that amount.

CASE IN POINT

In some cases, seniors were encouraged them to ditch their old variable annuities at significant expense to fund purchases of indexed annuities.

An 2008 investigation by the Illinois secretary of state’s office of Thomas and Susan Cooper and their firm, Pinnacle Investment Advisors, looked at a dozen indexed annuity sales that were funded with liquidated variable annuity or IRA money. It found that clients, whose average age was 73, incurred a total of $122,630 in variable annuity surrender charges when they cashed out of their old policies early.

Most of them would be well into their 80s before the surrender charges on their new indexed annuities expired. Pinnacle earned $80,134 in commissions on the subsequent indexed annuity sales, according to the investigation’s records

In an order revoking the firm’s investment advisor registration in May of this year, the state noted that the transactions were both unsuitable and not in the best interests of the clients due to the clients’ age, as well as no derivation of additional tax benefits and the surrender penalties incurred due to the early liquidation of existing annuities and IRAs.

Attempts to reach Thomas Kelty, the Springfield, Illinois attorney who handled the Coopers’ case, were unsuccessful.

Judith Hasenauer, partner at Blazzard & Hasenauer in Southwest Ranches, Florida, says that insurers and brokerage firms are working to improve sales force training to address those kinds of problems.

Of course there are always going to be complaints about indexed annuities, as there are with mutual funds and other investments, says Hasenauer, whose firm does consulting for insurers and brokerage firms. But a lot of the more aggressive sales practices have been reined in.

Despite criticism, proponents point out that indexed annuities have fulfilled their mission to produce competitive returns and reduce stock market risk.

Eric Thomes, senior vice-president of sales at Allianz, the largest writer of indexed annuities, says the firm’s products have historically produced average annual returns of around 4 percent to 6 percent, which includes expenses but not surrender charges. My father-in-law bought one in 2006 and so far it’s had average annual returns of close to 5 percent, he says. If he’d been heavily invested in the stock market he wouldn’t have done as well.

He adds they aren’t trying to compete with variable annuities or other investments that offer a shot at higher investment returns, but can be much more volatile. These are for someone who’s looking for safety and is happy with the potential to get a slightly higher return than a fixed annuity or a bank CD, he says.

Jerry Miccolis, chief investment officer at Brinton Eaton Wealth Advisors in Madison, New Jersey, believes there are more flexible, less complicated ways to get decent returns and keep portfolio volatility in check.

For most people, even those who are already retired, a diversified portfolio is still the best way to stay ahead of inflation and generate income, he says. And if market volatility is a concern you can smooth the ride out by tilting your portfolio more toward bonds.