Beware Of The Mutual Fund Performance Trap

Post on: 19 Апрель, 2015 No Comment

Want to own a mutual fund that will double its reported return in the next six months? Chances are, you already do.

Every equity mutual fund on the planet is about to report a big jump in its five-year performance. That’s not a prediction; it’s a mathematical certainty—unless the market crashes.

The Spike in Five-Year Performance…

September 13, 2013 is the fifth anniversary of Lehman Brothers’ bankruptcy, an event that drove prices of almost every asset class except U.S. Treasuries off the cliff. For example, the Standard & Poor’s 500 Index tumbled from 1,287.83 on September 1, 2008 to 902.99 by the end of that year—and to 729.57 on March 1, 2009. The starting point for the five-year track record of equity mutual funds is about to nosedive, which means reported performance will soar.

Suppose the U.S. equity market moves sideways for the next year. A Standard & Poor’s 500 index mutual fund (or ETF ) that has a cumulative 65.7% return over five years through July 31, 2013 will see its reported five-year return jump to 87.1% by year end and to 131% by March 2014—even though nothing has changed except the starting date.

The performance spike will be fleeting, though. It will begin to unwind during the second quarter of 2014 and be over by year-end. On July 1, 2014 a flat market from July 31, 2013 will represent an 83.5% return over five years, and the number will taper off to 60.1%% at October 1 and 51.3% by December 31.

Each equity mutual fund has a unique track record, but no matter what strategy it pursues, which segment of the market it focuses on or whether it does better or worse than the Standard & Poor’s 500 index the reported results will trace a similar pattern.

It’s an Illusion…

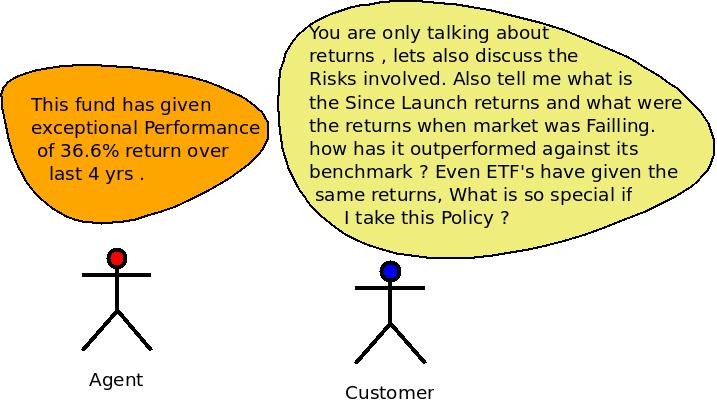

The rollercoaster ride demonstrates the danger of relying on performance alone when picking a mutual fund. Other factors that are, or should be, more important, including what investment strategy the fund pursues, manager tenure, the risk profile, assets under management and what role the fund plays in meeting an investor’s objectives.

Performance can help investors pick from a shortlist of funds that meet their other criteria, but it should be taken with a pinch of salt and in proper context. How did the fund perform relative to its benchmark? Or its peers? Is the starting point of the measurement period at a market peak or trough?

Right now, investors tracking five-year performance are like a person on the observation deck at Rockefeller Center (on the 70 th floor), who must look up another 38 stories to see the top of the Empire State Building. Relative to where the person is standing, the additional height is obvious, but comparable to any number of skyscrapers in mid-town Manhattan seen from street level. If he or she takes the elevator down and looks up from the street, the Empire State Building towers above its puny siblings. The building hasn’t changed, but the observer’s frame of reference has altered the perspective.

Investors looking at five-year performance will take that ride down over the next six months—but then get right back in the elevator and return to the 70 th floor vantage point by the end of next year.

That Could Confuse Investors…

Investors who study performance when picking mutual funds often attach more weight to longer-term results. Provided the performance was not concentrated in one or two years, a five-year record that trumps whatever benchmark the fund uses suggests the manager’s performance was not a fluke. A 10-year record will likely include both bull and bear markets, showing how the manager performs through an entire market cycle, too—but many mutual funds do not have a 10-year record, let alone under the same portfolio manager.

In the coming months, however, investors should beware of sales pitches touting funds that have “doubled over five years.” In fact, any U.S. equity fund that does not make this claim by next March, the five-year anniversary of the market bottom, will have lagged the market by a country mile.

Who Should Focus on Other Periods

While an arithmetic aberration sends five-year performance numbers to the moon and back, it will have no effect on reported performance for shorter and longer measurement periods. Investors reviewing mutual fund performance during the next year or so should pay more attention to the one-, three- and 10-year numbers and ignore—or at least downplay—the distorted five-year record.