Beware Of The Fees And Costs That Affect Mutual Funds

Post on: 27 Июль, 2015 No Comment

When it comes to mutual funds, it is not just about the money that you put in those matters. There are a lot of things to take into consideration since you are dealing with company or bank to manage your shares. That being said, the most important aspect of your investment strategy is to be aware of the costs that you have to pay. There are standard costs and fees that are your responsibilities. Fulfilling them can cost you a considerable amount of money. To make it easier, we identify these costs as shareholder costs, and operating costs.

Shareholder costs are the ones that you have to pay when you make transactions with the company. These are costs that you pay for the actions that you require the company to do in terms of marketing or distributing the shares.

- The sales charge on purchase is the cost that you pay when you make a purchase of shares in the fund. This is the fee that is paid to the fund broker who sold the shares. This cost has a direct impact on your investment since it could reduce its amount. If you want to invest on a mutual fund with a front end load of five percent, if have a thousand dollars, you pay $50 and so you only invest $950. The good news is that these costs are regulated and based on FINRA; such fees cannot be higher than 8.5%.

- Another one is the purchase fee. Some funds will require this fee to their investors if they buy shares. This amount though goes into the fund and it aims to offset some of the costs that are associated to the purchase.

- There is also the deferred sales fee that you pay if you intend to sell the shares. The opposite of the sales charge on purchase, the amount that you pay for this fee is dependent on the extent the investor has kept the shares. Normally, the amount will decrease to zero if the shares had been held for quite a long time.

- The exchange fee is the amount applied to the transfer of shares from one fund to another.

- Finally, the Account fee is applied per investor based on account management purposes.

The operating costs for mutual funds are paid for by investors for the maintenance and other processes that the management does for the investors. These are normally applied to all investors.

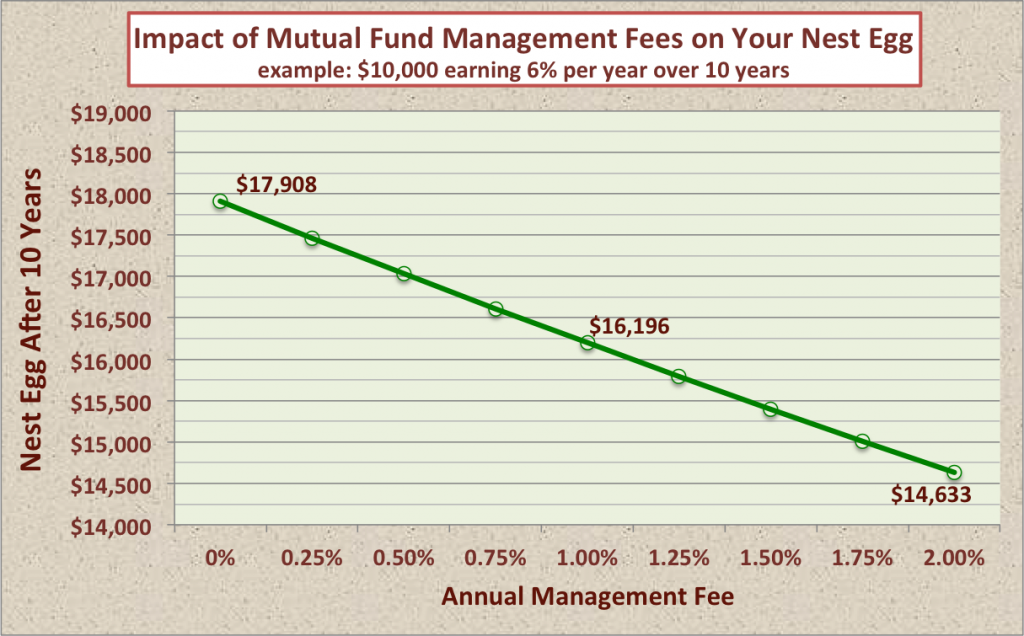

- First is the management fee. This is paid to the manager of the funds who is handling the mutual fund for the clients. Any amount that is payable to the adviser and will be included here.

- The service fees are also called distribution costs. These are paid by the fund from the assets in order to pay the cost incurred through the marketing and selling the shares. These fees compensate the brokers and the ones who do the dirty work of advertising, making the necessary publicity, sending prospectus to the interested investors and other necessary costs.

Factor in the class of fund

Class A funds normally impose the front end of the sales load. They have lower costs in terms of fees and annual expenses but beware; some funds can reduce this as your investment rises. It is important to check the break points if you want to get this.

Class B funds do not have front end sales but they have deferred sales load. The shares can convert instantly to the class with lower fees if you hold on to them long enough.

Class C funds can have either back or front end sales loads, annual costs and fees but these costs tend to be lower compared to the prior 2 classes.

Factor in the tax concerns

You have to pay income tax each year on the money that you get from the mutual funds. If you sell your shares and make a profit, you have to pay a tax for capital gains. Also, in terms of taxation, mutual funds different from each other. If you hold on to your shares, you will have to pay the necessary taxes within the year you got or reinvested them. You might also be liable to pay taxes for the funds capital gains since the law states to distribute the capital gains to the shareholders whenever they make a sale on the securities for a profit that losses cannot offset.