Beware of large and hidden mutual fund costs Personal Investment Management Cost Control and

Post on: 27 Июль, 2015 No Comment

Find VERIPLAN: Do-It-Yourself Lifetime and Retirement Financial Planning Software

Beware of large and hidden mutual fund costs

Summary: In pursuit of better returns, many investors sensibly seek out no load mutual funds with low annual expense ratios. However, loads and published expense ratios are only part of the mutual fund cost story. Other costs for individual investors to consider concern hidden mutual fund expenses that directly reduce the net asset value of the fund. These hidden expenses include trading commissions that a fund pays to brokers and the cost or market impact of fund trading.

While hidden trading expenses are not directly visible to individual investors, a mutual funds turnover ratio gives a strong indication of the trading expenses that a fund incurs. A lower turnover ratio is better. The scientific investment literature indicates that the average fund managers who trades actively will not recoup his higher expenses through superior returns.

The Skilled Investor has summarized the Karceski, Livingston, and ONeal 2004 study in a related article. 1 This study provides important insights into hidden mutual fund trading expenses and the costs of fund portfolio turnover. (See this related article: How much do hidden mutual fund trading expenses cost you? )

The hidden trading costs investigated by Professors Karceski, Livingston, and ONeal come right out of the pockets of individual investors each and every year. These costs are deducted from a mutual funds net asset value. They are not included in other reported expense categories, such as the annual expense ratio. The widely reported mutual fund expense ratio only covers management costs related to stock selection and to legal, accounting, and other administrative expenses. Sales, marketing, and advertising costs charged in the form of front-end loads, back-end loads, and 12b-1 fees are additional costs borne by investors through separate charges.

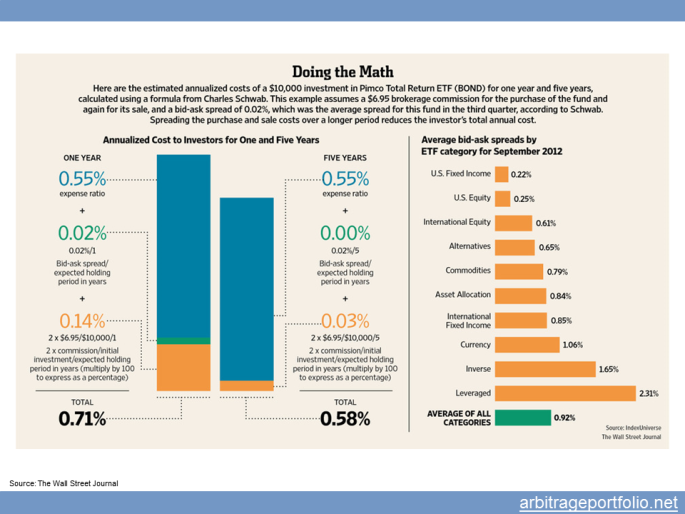

It would seem that it should be straightforward to measure mutual fund brokerage commissions, but mutual funds are not required to specify clearly their commission expenses and/or bid/ask spread trading costs. Mutual fund brokerage commissions are reported to the U.S. Securities and Exchange Commission in documents that are not easily accessed or understood by individual investors. Furthermore, when reporting commissions, mutual fund families are allowed to group together their funds. This makes it impossible to track the trading costs of each fund separately.

In their study, Professors Karceski, Livingston, and ONeal used a U.S. Securities and Exchange Commission study to estimate the average trading cost to investors of the bid/ask spreads that mutual funds pay when trading. However, the market impact across individual mutual funds can be much more variable than a funds low or high portfolio turnover rate might indicate. A major issue faced by mutual funds is the real market impact of that particular funds trading activities. This is not just a question of paying some or all of the bid/ask spread. Additional costs can be incurred when a fund trades large positions poorly. Trading too much too quickly will increase or move the bid/ask spread to the detriment of the funds shareholders.

If a fund tries to buy or sell large positions in individual stocks over short periods, they will adversely affect the market price of that security. When large mutual funds buy or sell large postions, there must be enough other investors who hold a contrary opinion of a companys prospects. Cost-efficient trading requires willing investors to take the other side of the transaction at the current market price. If not, the market price must adjust to encourage others to trade. These trading induced changes in securities prices drag down the net returns of mutual funds that trade larger positions. Market impact is one reason why a variety of electronic exchanges has arisen to facilitate large block trading.

In addition, hidden mutual fund commission trading costs also include the widespread and legal industry practice of using soft dollar compensation arrangements to encourage mutual funds to trade through specific brokerage firms. In exchange for directing their mutual fund trading activity through particular brokers, these mutual funds may receive a wide variety of free research, services, computers, etc. Without soft dollars, mutual funds and/or their service providers would have had to pay directly for these freebies or not use them.

Unless you believe that the brokerage houses have become charitable organizations, such soft dollar arrangements could indicate that lower commission rates might otherwise be available. Products and services obtained through soft dollars would otherwise have to be purchased by the fund and then presumably would be part of a funds published expense ratio. Currently, reported mutual fund expense ratios do not include these additional, hidden soft dollar management expenses. In reality, this means that management expenses for funds with soft dollar arrangements are really higher than reported. The expense just gets hidden in lower returns due to higher brokerage commissions and/or less than best price trade execution.

In summary, mutual fund shareholders need to understand that avoiding loads and seeking low expense ratio funds is only part of the expense story. Hidden trading costs can be very significant added expenses. Such costs are increasingly incurred the more actively a fund decides to manage or turn over its portfolio. You may have already wondered whether the higher expense ratios of actively managed funds are worth paying. Given that investing across the entire market is a zero sum game, these additional hidden trading costs make the case for passive, low cost index investing even more compelling.

See these related articles:

www.zeroalphagroup.com/news/hiddenstudy111704.cfm