Beware of High Mutual Fund Expenses

Post on: 18 Апрель, 2015 No Comment

Written by: Chuck Epstein

Comments are closed

When the average investor buys $10,000 of Class A shares in a load mutual fund, how much of that money actually gets invested in the market?

If you thought it would be $10,000, you are not even close.

The way load mutual funds operate, by the time the average investor puts down $10,000 and leaves the investment adviser’s office, only $9,450 will be invested in the market. The other $550 gets eaten up by sales charges, which go to the selling broker-dealer and the fund distributor. In addition, another $50 typically is paid as an underwriting commission to the fund distributor.

That’s just for starters. Every year, the shareholder pays about 25 basis points (bps), or one-quarter of 1%, in 12b-1 fees, a management fee of about 90 bps, plus a $20 administrative fee to the fund distributor.

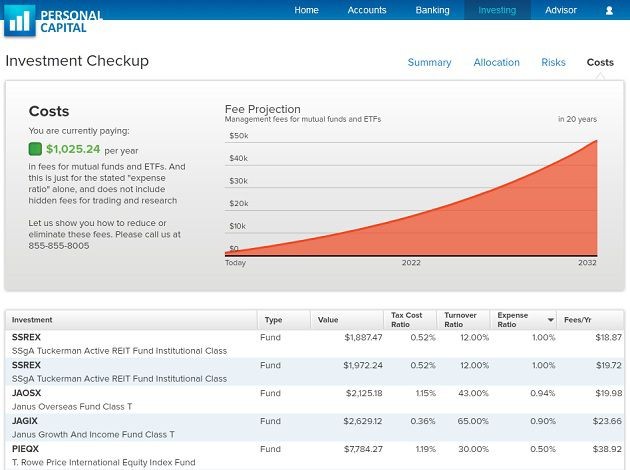

Many mutual funds are so laden with fees that the U.S. Department of Labor has identified 17 distinct fees which can be charged to shareholders. While some costs are well-known (administrative fees, for example), there are also hidden costs, such as trading expenses, which add up to 50% to shareholders’ costs. Finance professor Burton Malkiel estimates that over time, fees of just 3% can devour up to 50% of an investor’s investment returns.

Key Things to Remember

The key thing for shareholders to remember is that the 12b-1 fees are charged annually to shareholders by the fund distributor to primary pay for the mutual fund company’s sales and marketing efforts.

The original stated goal of 12b-1 fees, which was presented to regulators in the mid-1970s, was to increase the level of shareholder communications and boost fund assets which, in turn, would lower fund expenses. That was the idealized version.

But today, most fund companies, especially load companies, charge the 12b-1 fees to subsidize sales and marketing efforts, yet they rarely reduce shareholder expenses.

While this may seem complicated, the bottom line is that 12b-1 fees contribute to a fund’s total expense ratio. But the arithmetic of mutual funds shows that the higher the expense ratio, the lower an investor’s return.

As fund returns become more volatile and erratic, one of the few things investors can control is costs. You have to choose funds with low expenses.

ETFs have become more popular than mutual funds because they have more specific focuses, but also because they have very low costs. Invetsment professionals do not recommend them because they do not pay revenue sharing to advisors. Despite this, ETFs have become the instrument of choice for more knowledgeable investors who want to build their own portfolios.

But the bottom line is that costs, especially over time, can deliver significantly more money into a shareholder’s account. It is also the only investment variable an individual can control.