BestPerforming Funds Over the Past 20 Years

Post on: 6 Апрель, 2015 No Comment

Exclusive FREE Report: Jim Cramer’s Best Stocks for 2015.

Oct. 19, 1987, Black Monday produced the largest one-day percentage decline in stock market history. But for many buy-and-hold mutual fund investors, it proved to be little more than a relatively brief, albeit painful, bump along a path of long-term, annualized double-digit returns.

The mutual fund world was a different place two decades ago. Of the 7,256 open-end mutual funds currently tracked by TheStreet.com Ratings, only 914 were around at the end of September 1987. Back then, corporate America was only starting to migrate employees from traditional, defined-benefit pension plans into defined-contribution 401(k) plans.

For this and other reasons, funds tended to have fewer share classes than they do today. Of 20,536 current fund share classes, fewer than 10%, or 1,990, existed in September 1987.

Most of the open-end equity funds available 20 years ago were relatively vanilla products. Leveraged funds, inverse funds and emerging markets funds had yet to dominate the lists of winners and losers.

But there were some relatively concentrated funds that focused on a single sector. As the table below shows, making a correct call on an industry sector in the days just before Black Monday would prove a winning strategy over the intervening 20 years.

Of the 20 leaders for the past two decades, 11 turned out to be sector-specific funds.

The prospect of increased medical expenditures of the Baby Boom generation combined with advances in technology and genetics propelled three health/biotechnology funds into the roster of top performers. The fund with the best return for the period, the (VGHCH ) Vanguard Health Care Fund (VGHCH), rewarded its holders with a compound annual return of 16.84% for the past 20 years.

The Vanguard Health Care Fund’s top holdings are Schering-Plough (SGP ) and Eli Lilly (LLY — Get Report ).

Even with the market implosion of 2000 to 2002 that followed the 1990s tech bubble, three tech/telecom funds made it to the top 20. Perhaps most surprising, the financial services sector, not considered very glamorous, placed four funds in the top 20.

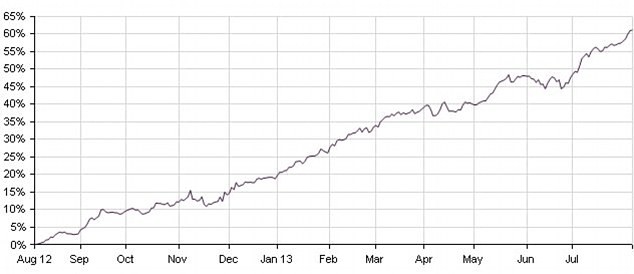

Patience proved a virtue for holders of the top performing funds. Although the longevity of their returns merited marathon status, their paces generally picked up over the past half decade. For 16 of the 20 winners, returns for the past five years exceeded their impressive overall returns for the 20-year stretch.

Precious metals proved disappointing. Respective annual returns of more than 30% over the past five years weren’t enough to pull a pair of precious metals funds off the list of the 10 worst-performing open-end equities of the past 20 years. One was among four stock funds to share the dubious distinction of burdening holders with negative average annual returns for the period.

While funds with international focus — and especially emerging market offerings — have dominating the performance lists in recent years, only a single fund with a totally international prospective investment objective appears on the table. It combines what many thought were sure winners at the time: Japan and small stocks.

A dominant international investing theme throughout the 1980s was the charging locomotive of Japan. The Nikkei Average seemed unstoppable as it roared to a crest in the 39000 range at the end of 1989. Now, almost 18 years later, the index seems mired close to 60% below its apex. The lone Japanese fund on the list has barely moved from its level of 20 years ago.

Black Monday Veterans

The 20 leader and laggard equity funds over the past 20 years (through Sept. 30)