Best Sectors for 2014

Post on: 9 Июль, 2015 No Comment

The Best Sector Mutual Funds and ETFs for a Diversified Portfolio

You can opt-out at any time.

When choosing the best sectors for 2014, you will begin the process the same as you would before you build a portfolio — with your investment objective. In other words, make sure that sector investing is a good fit for your financial goals and your tolerance for risk. Also, you are wise to consider sector funds as enhancements to your portfolio or as diversification tools, not as a means to beat the market.

Which Sectors Will Perform Best in 2014? Balancing Returns With Diversification

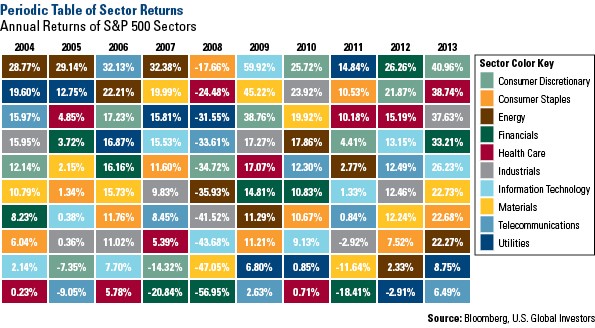

Again, performance should not be your first consideration but you do want to think of adding exposure to areas that may perform better but also perform differently than a broad market benchmark, such as the S&P 500. For example, what if the broader stock market begins to decline? The right sector can help buffer your portfolio against steeper declines.

I also like to frame my own sector selections around a contrarian investing mindset, which is to think of areas of the market that have done poorly in recent years that may be due for a correction in the positive direction. A few areas that come to mind in this regard include consumer staples and commodities. A third idea that can be smart in any environment is healthcare.

- Consumer Staples (also called consumer non-discretionary or consumer defensive or non-cyclical stocks) include products or services that people need on a daily basis or those that they may still buy, regardless of the economy. For example, a recession won’t stop people from buying groceries and it probably won’t stop them from consuming tobacco products and alcohol. Therefore consumer staples can be a wise sector choice when you believe consumer spending will slow as the economy matures and draws closer to recession. From a contrarian perspective, stocks within this sector have lost to consumer cyclical stocks (also called consumer discretionary stocks) for two consecutive years. In different words, consumers have spent money on things they don’t necessarily need, such as entertainment and automobiles, in recent years but will they continue to place leisure ahead of necessity in 2014? If you think consumers will cut back on luxury items, Consumer Staples can be a smart choice.

- Commodities are not really an industrial sector but can be categorized as an asset class. Gold is probably the first commodity investors think of but others include sugar, corn, and oil. Commodities have suffered in the past several months and year, especially because of Gold’s dramatic fall in price, but they could be due for a positive bounce in 2014. Also, commodities can work as hedge against inflation because commodity prices tend to rise in that environment. Commodities also tend to have a low correlation with stocks, which means their prices do not move in unison. This makes for a good diversification tool.

Best Sector Funds and ETFs in 2014

Index funds and ETFs can be good choices for sector investing because it is smart to buy a low-cost, broad basket of stocks, especially when investing in a concentrated or focused area, such as a sector or narrow asset class.

Consumer Staples fund ideas include Vanguard Consumer Staples Index Adm (VCSAX ) and Vanguard Consumer Staples ETF (VDC ). Note: VCSAX has a $100,000 minimum purchase for non-IRAs but there is no minimum purchase for IRAs.

Commodities are a complex asset class. For this reason, I only like to use funds that track the commodity index closely and the Powershares Commodity Index Tracking Fund (DBC ), which is an ETF, is one of the few choices that tracks the index well. For more information on using commodities now, see my blog post, Why 2014 Could Be Good for Commodities .

Healthcare sector fund ideas include T. Rowe Price Health Sciences (PRHSX ) and Healthcare Select SPDR ETF (XLV ) .

How Much Should You Invest in Sectors?

Investors with smaller portfolios, such as $50,000 or less, may not benefit by sector investing as much as those with larger portfolios. This is partially due to the cost of trading. For example, if you are allocating 5% to one sector and you have a $20,000 portfolio, a $1,000 purchase at $10 or $15 per trade can be counterproductive due to the expense versus the benefit (return).

As for allocation percentage, I like to follow the 5 percent rule of asset allocation. which suggests no more than 5% invested in one particular stock or focused sector.

Disclaimer: The information on this site is provided for discussion purposes only, and should not be misconstrued as investment advice. Under no circumstances does this information represent a recommendation to buy or sell securities.