Best Mutual funds to invest in 2014

Post on: 18 Май, 2015 No Comment

In my post published in Money control.com I have discussed about various parameters while selecting best mutual funds to invest in. Let me summarize those here:

1. Performance ranking Quartile ranking

As per these rankings Mutual funds are divided in 4 quartiles based on the returns they have generated. Quartile 1 carries top 25% of funds and Quartile 4 carries 25% of funds given least return.

2. Ratio analysis – Alpha. Standard deviation

Alpha denotes the extra return that the fund manager has generated as compared to benchmark. Standard deviation denotes how risky or volatile the fund is.

3. Fund manager tenure and experience

Fund manager tenure tells us that since how long the fund is being managed by same fund manager. Recent change in the fund manager should make the investor wary about the future of the fund.

4. Expense ratio and Scheme Asset size.

High expenses means less returns, but expense ratio is the factor of scheme asset size. SEBI has put restrictions on the Expense ratio which depends on the funds asset size. Higher the asset size lower will be the expenses. Though we can look out for a minimum expected scheme asset size but if the fund is consistently performing and fund manager is experienced and generating Alpha, so many time expense ratio does not matter. But higher the Asset size is always better.

So based on above mentioned parameters, to find out best mutual funds to invest in 2014,we have filtered out the funds which should fall into Quartile 1 ranking for 1 and 3 year performance, Should have generated Positive Alpha in last 1 and 3 year and fund manager tenure should be at least of 1 year.

Before going ahead, I would like to reiterate that consider the below list of funds as something you should look at after understanding your risk profile, and decided on a suitable asset allocation. Zeroing onto specific funds in your particular case might require understanding of funds Risk parameters too. Also keep in mind the standard disclaimer that fund houses give :

“Mutual funds investments are subject to market risks, read all scheme related documents carefully before investing”

Best Mutual funds to invest in 2014 – Large Caps

Best Mutual funds to invest in 2014 – Large Caps (Performance)

Best Mutual funds to invest in 2014 – Large and Midcap

Best Mutual funds to invest in 2014 – Large and Midcap (Performance)

Best Mutual funds to invest in 2014 – Mid and Small Cap

Best Mutual funds to invest in 2014 – Mid and Small Cap (Performance)

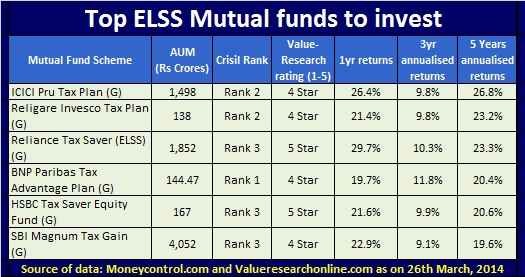

Best Mutual funds to invest in 2014 – ELSS

Best Mutual funds to invest in 2014 – ELSS (Performance)

I have included Franklin India Tax shield in the performance comparison, since few months back when i did the same filtering on Tax saving funds, Franklin India tax shield came out as clear winner (Tax saving mutual funds for 2013). Just wanted to figure out what went wrong now.

Best Mutual funds to invest in 2014 – Multi Cap

As theres nothing much to show on Multi cap funds, so i have not made any performance comparison of these funds

Best Mutual funds to invest in 2014 – Equity Oriented hybrid

Best Mutual funds to invest in 2014 – Equity oriented Hybrid (performance)

Data Source: the complete data above has been generated from FE analytics as on 31/12/2013

Every new year brings another opportunity to review the things and take corrective actions as and when required. So this post on Best Mutual funds to invest in 2014 will help you in making an opinion on your Mutual funds portfolio.

I have covered only equity and equity oriented hybrid funds in the article. As selecting parameters of debt mutual funds are bit different so that will be covered in a separate article.

Do share, how did you like the article above.