Best mutual funds in India The rankings Money Today

Post on: 20 Июнь, 2015 No Comment

After a dismal 2011-12, during which benchmark equity indices, Nifty and Sensex, fell 8.5% and 10%, respectively, 2012-13 saw equity markets recovering their previous year’s losses. Bond prices also went up due to calibrated cut in interest rates. Both favoured mutual funds as they mostly invest in these two asset classes. Our mutual fund scorecard gives you a comprehensive view of their performance during the year.

With over 850 schemes investing in different assets (equity, debt and gold), and divided into different categorise, finding your scheme could be an onerous task. Keeping this in mind, we have divided each category (equity, debt and hybrid) into sub-categories so that you can easily spot your fund.

However, it is important that you are able to make sense of the data given with your fund and use it in a meaningful way.

Here is a brief guide to help you interpret data that we have compiled with the help of our knowledge partner, Value Research.

FUND SCHEME

Fund schemes in different categories and sub-categories are listed in alphabetical order. The three broad categories are equity, hybrid and debt. These have been divided into sub-categories such as large-cap, mid- and small-cap, tax planning, etc. The names are followed by the rating assigned to them by Value Research and the risk grade of the fund.

BASICS

The next three columns give details of the scheme, such as the size of the fund, the year it was launched, and the period for which the current fund manager has been at the helm. It is important to know the duration for which the fund manager has been around. The longer his tenure, the more stable the fund’s return. The assets (AUM) of the funds are as on 31 March 2013.

PERFORMANCE

One of the best yardsticks for an equity mutual fund is its long-term performance. The longer the period, the more reliable the result. This is why, besides five-year, three-year and one-year returns, we have given 10-year returns for equity and hybrid funds. For debt funds, the period is shorter.

Quartile ranking: Returns vary over time and should be judged in relation to schemes with similar objectives. A fund that has delivered consistent returns is better than one that delivers high returns when the market is up but wipes out your investment when they crash. So, a relative assessment is needed to get a true picture of the fund’s performance. This is given in quartile rankings for the past five years. The quartile ranking is simply a division of a particular category of funds into four parts. The top 25% fall in the first quartile, the next 25% in the second quartile, and so on. A fund that has consistently remained in the top quartile is obviously a good choice.

Bear market returns: The 2008 equity market collapse remains one of the worst bear phases in recent past. The broader equity markets dropped almost 50% between 8 January 2008 and 9 March 2009. You can check how your equity funds performed during those 14 months. This is an important piece of information because only good funds will be able to minimise your losses when markets are falling.

PRICE AND COST

If you are investing in a mutual fund for a longer period of 5-10 years, it is pertinent to know how much you are being charged every year.

Expense ratio: This is what a fund charges you in a year for managing your money.

Minimum initial investment: This is the minimum amount that you can invest in a fund. For equity funds, this may vary from Rs 500 to Rs 5,000. For debt funds it could be up to Rs 25,000 for retail investors.

*EQUITY FUNDS*

Equity funds had a good 2012-13 with 72 out of 385 schemes across categories giving more than 10% returns on an average as against 7.31% rise in Nifty and 8.23% in Sensex.

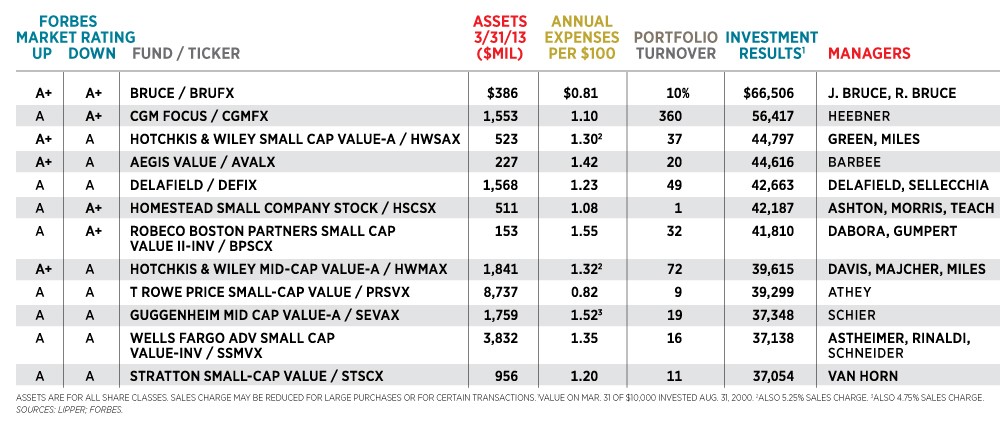

Click image to see how your mutual fund has performed