Best MLP Funds For Risk Adjusted Return Vs S&P 500

Post on: 14 Апрель, 2015 No Comment

Summary

- Actively managed mutual funds generally outperformed ETFs, CEFs and ETNs on a risk adjusted basis versus the S&P 500 on a 3-year basis.

- Close-end KED outperformed the S&P 500 on a risk adjusted basis for 3 and 5 years, and is way out front year-to-date.

- Popular ETFs and ETNs underperformed KED over the last 3 years.

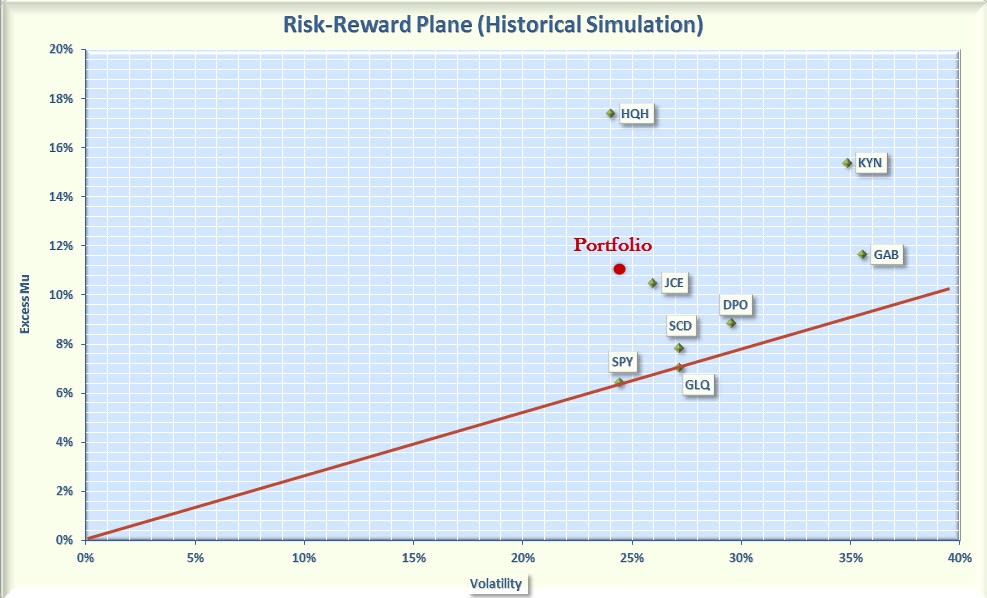

In our prior article. we analyzed the relative risk adjusted return of individual MLPs. In this article, we analyze the relative risk adjusted return of MLP investment vehicles.

Including multiple share classes, we found 112 MLP focused investment vehicles (ETFs, CEFs, ETNs and Mutual Funds). After discarding those with less than 3 years of history, and discarding different share classes of mutual funds representing the same underlying portfolio, we had 29 MLP investment vehicles to consider.

Tortoise Energy Capital Common

The mutual funds are noted by the lack of a hyperlink. The linked vehicles are either ETFs, CEFs or ETNs.

To arrive at a relative risk adjusted return, we divided the standard deviation of the S&P 500 by the standard deviation of the investment vehicle, and then multiplied that ratio times the total return of the investment vehicle.

The effect is to show a lower relative risk adjusted return than the nominal return for those vehicles with a higher volatility than the S&P 500, and to show a higher risk adjusted return for those with a lower volatility than the S&P 500.

Here are the rankings:

(click to enlarge)

The tan shaded symbols are ETFs, ETNs or CEFs. The unshaded symbols are mutual funds.

There is one non-mutual fund that outperformed the S&P 500 on a risk adjusted basis (and also on a nominal return basis). That is KED (Kayne Anderson Energy Development Company).

They also outperformed on a relative risk adjusted level and a nominal level over 5 years. They were formed in 2006, so there is no 10 year data.

Tortoise Energy Infrastructure is the only one with 10 year of history. It outperformed the S&P 500 nominally over 5 and 10 years, but not on a relative risk adjusted basis. They fell short of nominal outperformance over 3 years, and did yet worse of a relative risk adjusted basis.

The popular AMJ outperformed over 5 years, but not over 3 years.

The popular AMLP also underperformed over 3 years.

KED uses some leverage, but AMJ and AMLP do not. KED is thinly traded, but AMJ and AMLP are not. None of the 3 generate K-1 tax reports.

We have not invested in KED due to the size of our trades versus the average trading volume, and the prospect of less than average liquidity in a crisis. It is tempting, however, and we might sometime nibble on the edges. We prefer individual MLPs, and thus watching their portfolio choices is of great interest to us.

These charts show the year-to-date relative return of all of the ETFs, CEFs and ETNs versus SPY (the S&P 500 proxy) — KED is way out front.

Here is a bit of information about KED.

This is their investment policy as rendered by Morningstar:

The Fund intends to pay quarterly dividends to their stockholders. As a business development company, the Fund has elected to be treated as a RIC under Subchapter M of the Code. To qualify as a RIC and maintain their RIC status, they must distribute at least 90% of their investment company taxable income and net tax-exempt interest out of the assets legally available for distribution. A portion of the cash distributions they receive from their investments will be treated as a return of capital and therefore generally would not be treated as investment company taxable income. While the Fund anticipates that they would distribute some or all of such return of capital, they are not required to do so in order to maintain their RIC status. In order to avoid certain excise taxes imposed on RICs, they must distribute during each calendar year an amount at least equal to the sum of (1) 98% of their ordinary income for the calendar year, (2) 98% of their capital gains in excess of their capital losses for the one-year period ending on November 30, the last day of their taxable year, and (3) any ordinary income and net capital gains for preceding years that were not distributed during such years. The Fund currently intends on making sufficient distributions to satisfy the annual distribution requirement and to avoid the excise taxes. In connection with this offering, the Fund has established an opt out Dividend Reinvestment Plan for their common stockholders. As a result, if they declare a dividend, then stockholders cash dividends will generally be automatically reinvested in additional shares of the Funds common stock, unless they specifically opt out of the dividend reinvestment plan and elect to receive cash dividends.

This is a price chart that shows the low trading volume and high performance.

Next, you see a chart of the premium or discount to NAV over time.

This chart shows the dividend and the yield over time.

This table shows the top 30 holdings from the most recent portfolio report.

This table gives some basic contact information.

Importantly, here is profile information about the portfolio managers, also through Morningstar.

J.C. Frey (since 09/21/2006) is a Senior Managing Director of Kayne Anderson. Mr. Frey serves as portfolio manager of Kayne Anderson’s funds investing in MLP securities, including service as a co-portfolio manager, Executive Vice President, Assistant Secretary and Assistant Treasurer of Kayne Anderson MLP Investment Company, Kayne Anderson Energy Total Return Fund Inc. Kayne Anderson Energy Development Company and Kayne Anderson Midstream/Energy Fund, Inc. Mr. Frey began investing in MLPs on behalf of Kayne Anderson in 1998 and has served as portfolio manager of Kayne Anderson’s MLP funds since their inception in 2000. Prior to joining Kayne Anderson in 1997, Mr. Frey was a CPA and audit manager in KPMG Peat Marwick’s financial services group, specializing in banking and finance clients, and loan securitizations. Mr. Frey graduated from Loyola Marymount University with a BS degree in Accounting in 1990. In 1991, he received a Master’s degree in Taxation from the University of Southern California.

Kevin S. McCarthy (since 09/21/2006) is Chief Executive Officer and he has served as the Chief Executive Officer and co-portfolio manager of Kayne Anderson Energy Total Return Fund Inc. since May 2005, of Kayne Anderson Energy Development Company since September 2006 and of Kayne Anderson Midstream/Energy Fund, Inc. since August 2010. Mr. McCarthy has served as a Senior Managing Director at KACALP since June 2004 and of KAFA since 2006. Prior to that, Mr. McCarthy was global head of energy at UBS Securities LLC. In this role, Mr. McCarthy had senior responsibility for all of UBS’ energy investment banking activities. Mr. McCarthy was with UBS Securities from 2000 to 2004. From 1995 to 2000, Mr. McCarthy led the energy investment banking activities of Dean Witter Reynolds and then PaineWebber Incorporated. Mr. McCarthy began his investment banking career in 1984. Mr. McCarthy earned a BA degree in Economics and Geology from Amherst College in 1981, and an MBA degree in Finance from the University of Pennsylvania’s Wharton School in 1984.

Disclosure: QVM has positions in AMJ as of the creation date of this article (May 8, 2014). We certify that except as cited herein, this is our work product. We received no compensation or other inducement from any party to produce this article, but are compensated retroactively by Seeking Alpha based on readership of this specific article.

General Disclaimer: This article provides opinions and information, but does not contain recommendations or personal investment advice to any specific person for any particular purpose. Do your own research or obtain suitable personal advice. You are responsible for your own investment decisions. This article is presented subject to our full disclaimer found on the QVM site available here .