Bessemer Trust Hires Principal in New York Wealth Manager

Post on: 22 Апрель, 2015 No Comment

By Thomas Coyle

Charles Bryceland

Multifamily office Bessemer Trust has hired former Fieldpoint Private Bank & Trust executive Charles Bryceland to bring in new business for its New York office.

He reports to Eric Gies, head of Bessemers northeastern U.S. region.

Prior to supervising Greenwich, Conn.-based Fieldpoint Privates wealth-management business, Bryceland ran his own consulting firm for ultra high-net-worth clients. Before that, he was in charge of Bank of America Corp.s private banking in the U.S. Northeast and its private-client brokerage on the East Coast.

While at Bank of America, Brycelands name got entangled with the mutual-fund scandal of 2003though his role in the affair may have been confined to the fact that he supervised the broker who introduced the hedge fund Canary Capital Partners LLC to Bank of America.

In September 2003, then-New York Attorney General Eliot Spitzer said the Charlotte-based bank let Canary conduct improper after-hours trades in its mutual funds.

Canary quickly settled the matter with a $40 million fine, while neither admitting nor denying guilt.

Bryceland was named in media reports of the scandal and cited by the new Attorney Generals office as the source of an email in which the deal with Canary was described as a tremendous example of leveraging the franchise. He subsequently resigned from Bank of America. By early 2005, all civil charges filed against him in class-action suits had been withdrawn or dismissed.

Bryceland was never charged with wrongdoing by the Securities and Exchange Commission, the National Association of Securities dealers (now the Financial Industry Regulatory Authority) or the New York State Attorney Generals office.

Bryceland wasnt available for comment, but a senior manager at Bessemer said the trust company was fully aware of the Bank of America matter and was confident that Bryceland had been inadvertently caught up in the mutual-fund timing scandal.

In a press release, Gies said that Bryceland comes to Bessemer with wide-ranging experience in wealth management, investment advisory and business development along with a keen understanding of client needs.

New York-based Bessemer supervises assets worth more than $55 billion for about 2,000 individuals, families and related entities. It started more than 100 years ago as the private family office of Henry Phipps, a partner of Andrew Carnegie. It became a multifamily office in the mid 1970s.

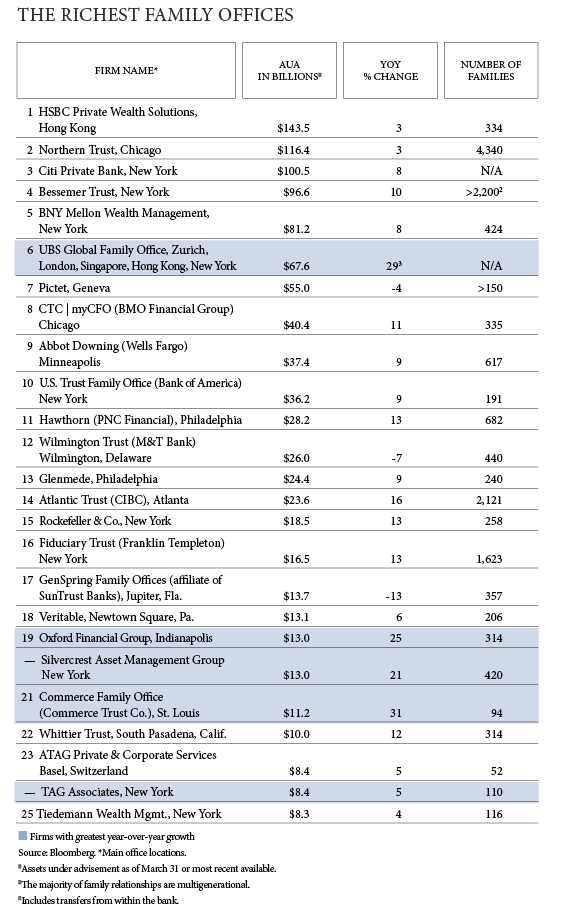

Multifamily offices are commercial entitiesusually investment advisory firms or trust companiesthat provide wealth-management services to high-net-worth families. Like Bessemer Trust, they frequently stem from private single-family offices.

VOICES: Jeff Kostis, On Acting When the Time is Right Next

Whats Going On with Dendreon Stock?