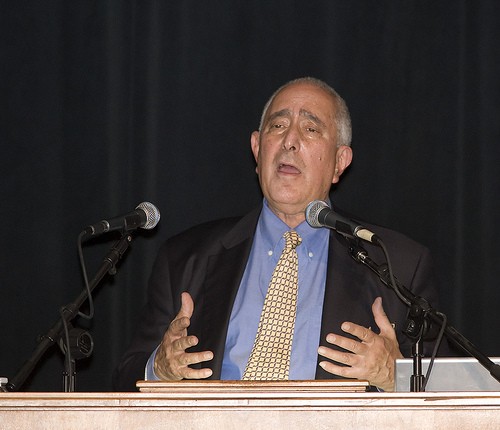

Ben Stein Invest or Pay Off Mortgage

Post on: 16 Март, 2015 No Comment

This is an age-old question. Does it make more financial sense to pay off your mortgage quicker by increasing or adding payments, or to use that extra money and invest in an index fund in the stock market? The simple answer is to choose the option that leaves you with the most money down the road, and with low mortgage rates. the better choice is investing for the long term.

But thats a simple answer to a complex question. There is a psychological aspect of money that differs for each person. Money isnt all about math for most individuals. Some are good at separating emotion from money and treating their finances as a business with little emotional attachment, but thats not common in my experience. For some people, eliminating debt is preferred over maximizing money. For one, less or no debt can reduce stress, which improves your health.

Generally speaking, if you have a very low mortgage rate, it is better to invest the money than to pay off your mortgage. Its an interesting fact the rate of return on your mortgage is the interest youre paying on it. If you have a 6 percent mortgage and youre paying it off, youre earning 6 percent. If you can earn more than 6 percent in the stock market, you should probably put it in the stock market. But, on the other hand, pay it off in an expeditious way. Its good to have it paid off, or at least mostly paid off, by retirement time.

This simplified answer doesnt take into account the emotional side of money. Perhaps it shouldnt, because facts are facts (unless theyre statistics). But it also doesnt mention tax benefits of a mortgage for those who itemize their deductions (the home mortgage interest tax deduction ) and it doesnt take into account variations in stock market returns depending on your chosen investments and on market cycles.

His last point is the important one, I think. Once you retire and income presumably drops, you dont want to have that much of a mortgage payment preventing you from using your money for other living or enjoyment expenses.

Updated January 12, 2012 and originally published June 18, 2007. If you enjoyed this article, subscribe to the RSS feed or receive daily emails. Follow @ConsumerismComm on Twitter and visit our Facebook page for more updates.

3A%2F%2Fwww.consumerismcommentary.com%2Fimages%2Fgravatar.png&r=G /%