Before You Invest in a Bond Mutual Fund

Post on: 16 Март, 2015 No Comment

You can opt-out at any time.

Please refer to our privacy policy for contact information.

Bonds are among the safest investments available. And as a general rule, bond funds are the safest way to invest in bonds. But that doesn’t mean you should jump right in.

Here are a few items to consider before you buy a bond mutual fund.

Know Your Objectives; Know a Fund’s Objective

Understand what you want your bond fund to accomplish. Not all funds serve the same purpose.

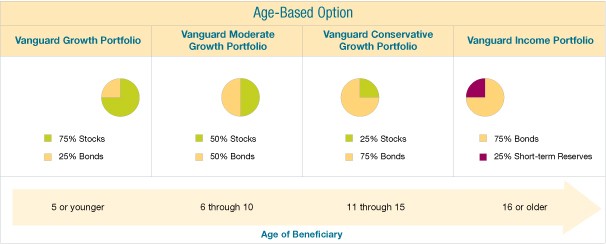

Are you looking to generate income? Trying to reduce your tax bills? Maybe you’re saving for your child’s college education.

Once you know your objectives, you can search for a fund that has a similar objective, whether it be maximizing return, protecting principal or something in between.

Consider Your Tax Status: Tax-Free Muni Bond Funds Don’t Make Sense for Everyone

Sure, it sounds like a good idea — a fund where you don’t pay taxes on what you earn. But muni bonds aren’t for everyone.

Unless you’re in the right tax bracket, owning municipal bonds or municipal bond funds can be a very bad move. And even if you’re in a high enough tax bracket to justify a muni bond fund, choosing the right muni fund depends on your state of residence.

What’s Your Time Frame? How Liquid Must Your Fund Be?

When will you need your principal back?

With a bond fund, unlike with individual bonds, you can sell your shares at any time (although there’s no guarantee that you’ll make money on the deal.

But as liquid as the bond fund market is, be cautious about locking yourself in to fund for longer than needed. If you’re working with a short timeframe, i.e. you’re looking to park some cash for a few weeks or months before using it for a large expense like buying a home, look no further than a money market fund.

If you’ve got more time to play, you can choose from a wider variety of funds with much longer investment horizons.

Think About the Fees. There are Loads of No-Load Funds Available

Nothing will eat away at the gains in your bond fund like fees. Never invest in a fund until you understand what the fees are and how they compare with industry averages.

It’s worth remembering that there are thousands of no-load funds available.

Also, as you’d expect, managed funds (where someone actually makes decisions about what bonds to buy and sell) charge higher fees than index funds (which simply duplicate the investments in an index.)

Decide If You’re Interested in ETFs and UITs

When considering a bond fund, you may want to take a look at two newer forms of fixed-income investment.

Exchange-traded funds are bought and sold on an exchange. Management fees for ETFs are negligible (although you will pay a brokerage fee when you buy or sell.)

Unit-investment trusts are also worth a look. A UIT is made up of a collection of bonds, just like a bond mutual fund. But a UIT holds the investments in the trust until maturity. Fees are low compared with mutual funds. But you’ll likely pay a brokerage fee to buy a UIT of up to 3%.