Basics of Hedge Accounting

Post on: 17 Май, 2015 No Comment

Volatility

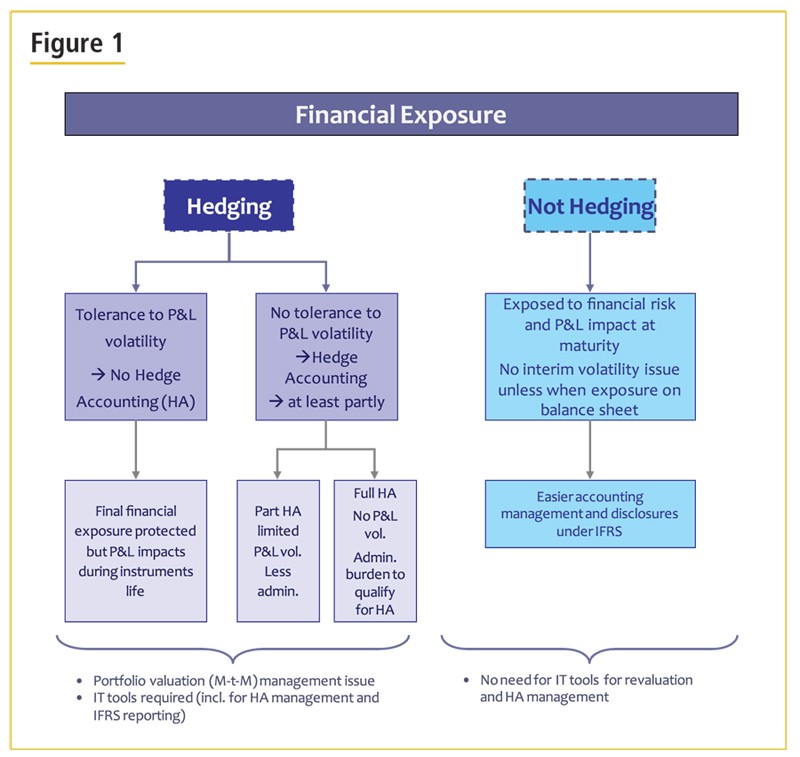

Volatility is a key aspect of hedge accounting. Essentially, certain types of investments are subject directly to an investment market. Investment markets are volatile depending on risk, regulation and the attitudes of investors throughout the economy. This leads to frequent changes, sometimes drastic ones, which in turn quickly change the value of investments. This creates a problem for accountants, who must adjust the values of their accounts based on the always-changing market.

Account Combination

When accountants deal with derivative instruments, they must account for the value of the derivative instrument, the primary security on which it depends, and the changes of the market that can constantly alter them both. To simplify matters, accountants are allowed to — in the books — combine the two accounts and treat them as one, allowing market fluctuations to only change on accounts that include derivative and primary instruments. This downplays the sharp rises and falls of investment accounts.

Requirements

References

More Like This

Fund Accounting Training

How to Account for Inventory Hedges

What Is a Hedge Fund Accountant?

You May Also Like

Basics of a Hedge Fund. Similar to mutual funds, hedge fund investors combine or pool their money together to make a collective.

Accounting 101 Basics. Accounting 101 or basic accounting deals with the basic concept of bookkeeping or recording transactions that occur on a.

Accounting Practice Books. If you are interested in learning more about accounting or just need to practice what you already learned, there.

Hedge fund accountants are a key member of a hedge fund's staff. Their goal is to value the fund's assets, measure ongoing.

Because of past problems with derivatives and hedge funds that led to large investor losses and market volatility, the popular opinion of.

Business owners often lack the education and experience to handle all of their business accounting needs. Hiring an accounting practice to assist.

An investment fund is a company that collects assets, such as cash and property, from clients and engages in financial market activities.

Foreign exchange (FX) hedging refers to strategies that are put in place in order to manage foreign exchange risk. Foreign exchange risk.

A fund accounting training program helps a participant understand the latest changes in fund accounting principles, and how they apply to a.

How to Choose a Hedge Fund. Part of the series: Investment Basics. A hedge fund is a hedge against a stock or.