Avoid Mutual Fund and ETF Sales Commissions and Fees

Post on: 17 Апрель, 2015 No Comment

Find VERIPLAN: Do-It-Yourself Lifetime and Retirement Financial Planning Software

Avoid mutual funds and ETFs with sales commissions and marketing fees

Summary: There is no convincing evidence that sales loads and other sales fees charged to investors result in higher mutual fund and ETF performance.

In fact, the opposite has repeatedly been proven true with mutual funds, which have a long performance history to evaluate. Paying a load just means that you are throwing your hard-earned money down a hole.

Front-end and back-end loads, 12b-1 fees, and other sales compensation charges only ensure that an advisor and his/her advisory firm will be compensated for guiding you to select funds that will pay these fees. Front-end loads reduce the amount that will be invested in the fund on your behalf. You will have less money invested and fewer assets upon which to earn a return. Back-end loads allow funds to take away a share of your future returns. Funds with front-end and back-end loads also tend to charge higher annual fees. Marketing fees sometimes known as 12b-1 fees are additional periodic sales charges that further reduce your ongoing returns. Assessed over time, 12b-1 fees pay a sales agent for periodic “servicing.”

None of these loads, higher fees, and sales charges will be applied in any attempt to improve on a fund’s investment performance.

There is zero connection between the management of the fund and the extra sales loads, higher expenses, and marketing fees that you pay. There is absolutely no reason to believe that the fund will perform any better to compensate for these charges. Because securities markets are generally efficient, superior performance is largely due to luck rather than skill and superior performance tends not to persist. On average across funds, sales loads are a deadweight loss to you due to market efficiency and the fact that the loads you pay are not even applied toward improving performance.

All a sales load will guarantee is that there will be a paid sales person to tell you that the fund that they are trying to get you to purchase is a better fund.

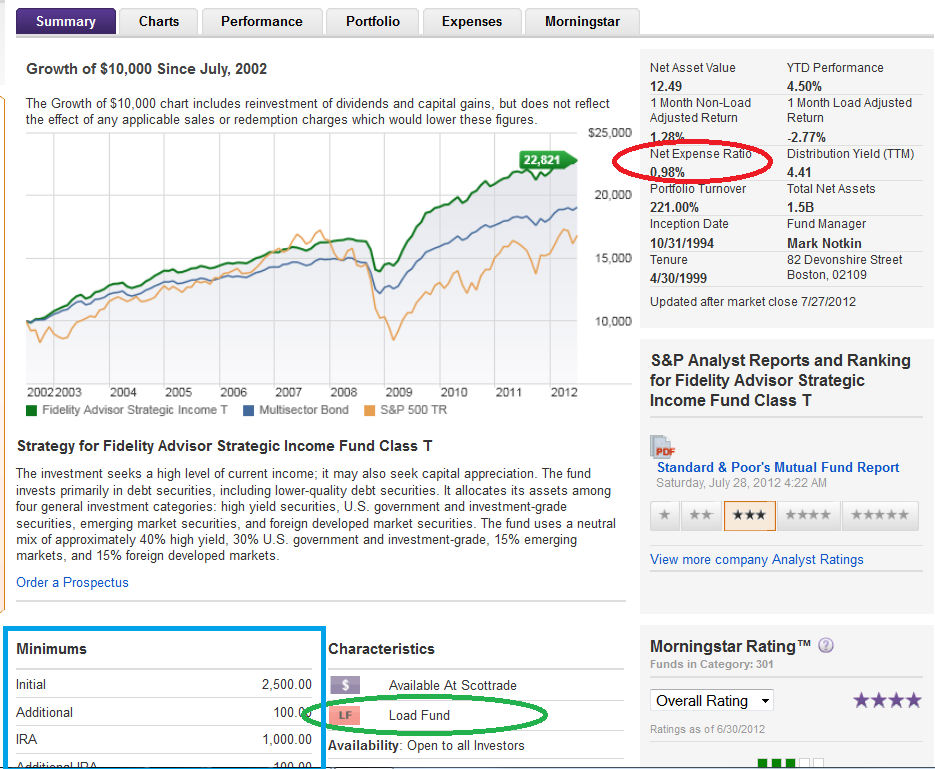

While advisors will most often be careful to avoid specific promises about future performance, they will not hesitate to provide materials that may indicate superior past performance and perhaps a 4- or 5-star Morningstar Rating. This game is easy to play, because only mutual funds and ETFs with past superior performance will be promoted by the advisor. Other funds will be conveniently ignored. When performance changes in the future, new better funds will be promoted and past better funds that did not turn out to be better will be ignored. (See: How Morningstar Ratings for mutual funds are used as a marketing tool and What might be wrong with buying a mutual fund with a 4 or 5 star Morningstar Rating? )

When you screen equity mutual funds, just eliminate all front-end loaded mutual funds from consideration.

There are thousands of fine no-load funds available. Ignore the sales pressure of any agent/advisor who pushes mutual funds with loads, marketing charges, and higher expenses.

Note that certain very limited back-end loads can sometimes be beneficial to you, but only if they expire quickly and are designed to prevent costly active trading in and out of the fund by other investors who exploit buy and hold investors. Accept only short duration back-end redemption fees that are highly unlikely to affect you (months and not years). You should be certain that you can stay invested in the fund long enough for the redemption penalty period to expire. Furthermore, ensure that all redemption proceeds from other early-exit investors will be returned the fund’s investment pool for the benefit of its longer-term shareholders.

In addition, do not ignore additional fees such as account wrap-fees charged by full-service brokers. It is unnecessary to pay these fees to purchase mutual funds and ETFs. If you have sufficient initiative to research mutual fund alternatives, then you can get a large extra financial payoff by purchasing directly from the mutual fund. Investing directly in funds that you select yourself is very straightforward.

All mutual fund families that allow direct investments have toll free customer service telephone numbers to request forms to be sent through the mail.

In addition, they have downloadable / printable forms on their websites. Filling out and mailing in the forms is only mildly tedious. However, when you do it yourself and you do not pay a commission to purchase through an advisor, you pay yourself a very high hourly wage for the relatively quick and painless process of purchasing directly from the mutual fund.

Exchange-traded funds are also very easy to acquire. Just use a discount broker to keep your transaction costs down. Furthermore, to amortize these brokerage transactions costs only buy broadly diversified, very low fee, index ETFs that you intend to hold for a long time. While somewhat different, ETFs and mutual funds share many similar characteristics. However, one disturbing trend with ETFs has been the far more frequent trading of ETFs, which drives up trading costs and taxes unnecessarily.

Also, if you want to understand the personal impact of investment expenses, take a look at VeriPlan. VeriPlans ability to project your full lifecycle investment costs can be incredibly useful to you. Your personal VeriPlan projections automatically analyze the impact of five types of investment expenses across your lifecycle: 1) purchase fees, 2) fund management fees, 3) marketing fees, 4) transactions costs, and 5) account custody fees. To analyze the lifetime impact of excessive investment costs, VeriPlan also allows you automatically to switch back and forth between projections that use your portfolios current investment costs and projections that use costs that you think are reasonable to pay. For more information, see: VeriPlan helps you to understand the full lifecycle cost to you of excessive investment expenses