Avoid ETFs With These Traits (SPY DIA)

Post on: 17 Апрель, 2015 No Comment

Exchange-traded funds (ETFs) have become extremely popular with investors and with good reason – they track a wide range of assets, generally have lower management fees than do mutual funds, and are usually very liquid. But all ETFs are not created equal, and deciding which ones to avoid in an extremely crowded field can be as important an investment decision as deciding in which ones to invest. Here are six attributes that reduce the investment appeal of ETFs:

(For a great primer on ETFs, see Investopedia’s tutorial, Top ETFs and What They Track .)

- Leverage . A number of ETFs offer double and triple leverage. While this may appeal to investors with substantial risk appetite, these ETFs do not offer twice or thrice the return generated by the underlying index; rather, their returns are based on daily changes in the underlying index. Thus, the return offered by a triple-leveraged ETF whose underlying index has gained 10% over one year is likely to be nowhere close to 30%, especially if the index has been quite volatile during that period.

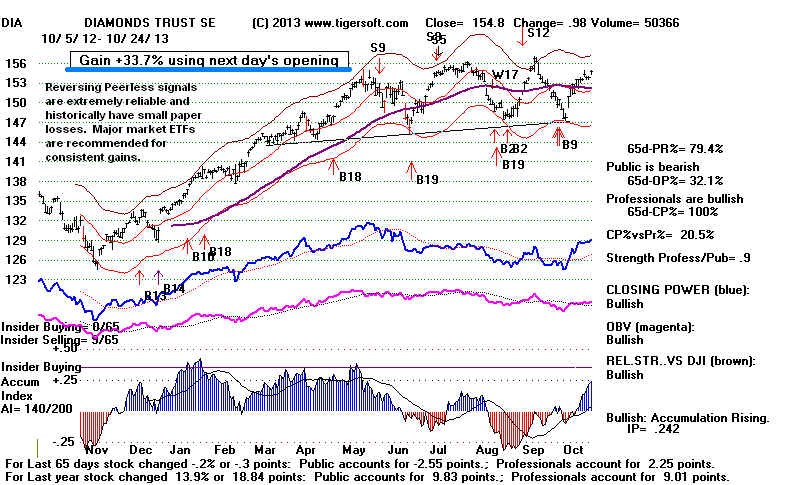

- Narrow or obscure index . An ETF that tracks a narrow index or one that is based on an index that is not well-known should be eschewed in favor of an ETF that is based on a broad, well-known index. Thus, for investing in U.S. blue chips, it may be vastly more preferable to use the SPDR S&P 500 ETF (SPY ) or the Dow Jones Industrial Average ETF (DIA ) than an ETF based on a proprietary, non-transparent index.

- Low asset level . An ETF with a low level of assets will have limited trading volume and liquidity, and wide bid-ask spreads, putting the investor at a trading disadvantage. An ETF may also be at risk of being liquidated or delisted if its asset base declines so much that its continued existence is no longer economically viable.

- Volatile index or asset class . An ETF that is based on a volatile index or asset class – like commodity futures or junk bonds – is not likely to be less riskier than the underlying asset just because it is an ETF. If you think emerging market junk bonds are too risky for you, there’s little reason to invest in an ETF whose main holdings are such bonds.

- High expense ratios . Inordinately high expense ratios will erode the total returns generated by such ETFs, which can have a cumulative negative effect on the returns from your investment portfolio over time.

- Tracking error . While some degree of tracking error is to be expected over time due to the impact of fund management fees – as well as other reasons such as hedging costs, slow deployment of cash by the ETF manager etc. – avoid an ETF that has an inexplicably high tracking error, as it can eat into ETF returns over the long run. For example, given the choice between two country ETFs that track similar indices, an ETF with a tracking error of 2% may be a better choice than the one with a tracking error of 5%.

Avoiding ETFs which possess some or all of these attributes may be good for the overall health of one’s investment portfolio.

Disclosure: The author did not own any of the securities mentioned in this article at the time of publication.