Asset Allocation and Diversification Planning & Retirement

Post on: 14 Сентябрь, 2015 No Comment

One of the oldest and wisest maxims in investing, but one that is sometimes ignored, is: Dont put all your eggs in one basket.

The image, of course, is that if the basket falls, all your eggs will crack and break. If your life savings are all in the stock of the company that employs you, an economic slump could bankrupt your employer, thus leaving you broke. Then, again, if you put every dollar in an FDIC-guaranteed bank account, those savings will hardly grow and your dollars may fall victim to inflation.

The solution is what investment professionals call asset allocation a plan for spreading your savings among different types of investments. The key word is plan, because many investors bounce along without a plan, plunging into stocks or speculative investments based on hot trends and emotional reactions. Too many have learned the hard way that putting all your money into tech stocks or commodities or even housing can lead to financial disaster.

Planning your own mix

Asset allocation is a long-term strategy to divide your savings among asset classes such as stocks, bonds and cash. There is no one size fits all solution. You are unique, with your own life goals and circumstances, so the mix of assets in your portfolio should be tailored to you.

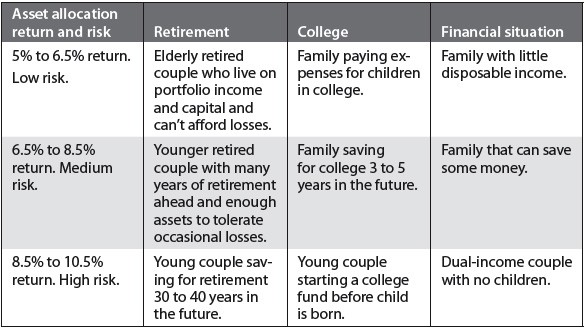

Some example scenarios of asset mixes include:

- A young investor saving for retirement might allocate 80 percent to stocks, the highest-return asset class but also one that fluctuates the most, and 10 percent each to bonds and cash.

- A middle-aged investor might allocate 60 percent in stocks for growth, with 30 percent in bonds and 10 percent in cash for safety.

- A couple entering retirement might shift to a more conservative allocation of 60 percent bonds, 30 percent stocks and 10 percent cash.

Creating an asset allocation plan involves math and some complexity. You need to consider your current financial position, time horizons for your goals and your tolerance for risk. Investment advisors can help you find the right asset allocation mix to fit your needs.

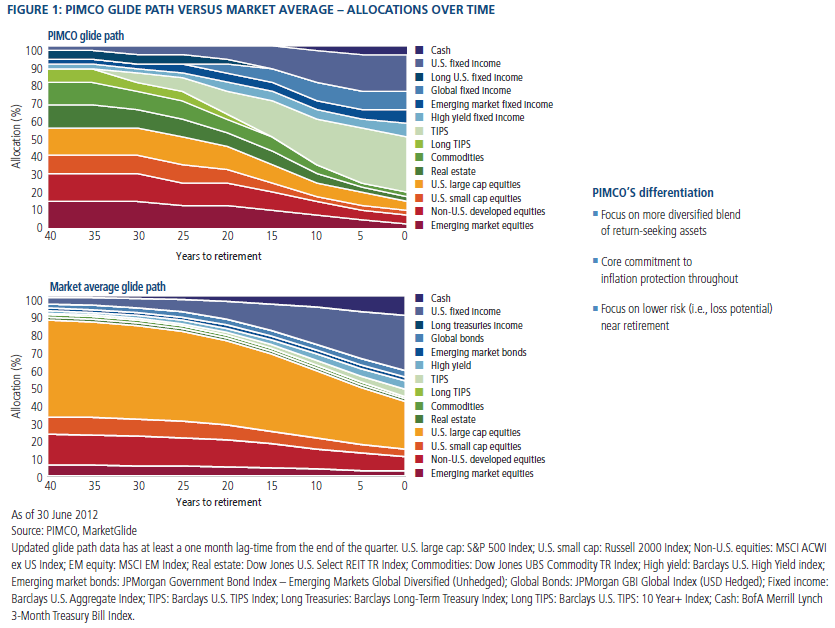

Some investors and advisors subdivide the basic stocks/bonds/cash list of asset classes like

- U.S. stocks vs. international

- Large cap vs. small cap stocks

- Treasury, corporate or high-yield bond

Some investors add asset classes such as real estate or commodities to the mix as well. You can find mutual funds to focus on each broad asset class or narrower ones, or you can assemble your own portfolio within each class. However, studies have shown that the benefits of proper asset allocation are clear.

Asset Allocation:

- Limits your risk through diversification

- Improves your long-term returns

- Enforces discipline in your investing

Diversification limits your risk

A core principle of investing is diversification, i.e. putting your eggs into different baskets. In one sense, asset allocation is a defensive approach to guard against setbacks. It works because markets for diverse asset classes move in different ways and at different times.

If your goals are long-term like building a college fund for young children or creating a nest egg for retirement, advisors would probably suggest you own stocks or stock mutual funds for the growth in value. Putting everything into a safe, low-interest money-market account (in the cash asset class) will not produce enough growth to achieve your goals. But if you invest everything in stocks and the market suddenly drops 40 percent in a bear market, your savings may be in a hole that makes it hard for you to reach your goals.

Asset allocation mitigates the risk by investing some money in stocks and some in asset classes that are expected to stay the same, or even rise in value, when stocks decline. The appropriate investments to use and the percentages to allocate depend on your individual circumstances.

Allocation improves returns

Sound allocation of assets not only a cushion against severe losses but also improves your returns over the long term.

The principle of modern portfolio theory states that you can analyze the risk and expected returns of your portfolio as a whole, beyond the individual parts of it, and by doing so you can arrive at an ideal mix to provide the best return for your personal risk tolerance.

Studies of actual portfolio returns have concluded that roughly 90 percent of your returns are determined by how you allocate assets among asset classes such as stocks, bonds and cash. So developing an overall portfolio plan to properly balance risk and returns is crucial.

An investor throwing money into a mishmash of assets that may individually look attractive, without an asset allocation plan, is likely to take on too much risk and gain too little in return or to do the reverse by taking too little risk to garner enough return to achieve long-term goals.

Discipline gets the job done

An asset allocation plan gives you a discipline to follow. It is a long-term guideline that specifies how much money you will keep in each asset class.

Too many investors jump from one fad to another. They may be hopping into a hot mutual fund today, then chasing a high yield in a bond next month. Or selling stocks when the market retreats, then buying again after a bull market calms their fears. The effect, unfortunately, is that individuals often buy high, sell low and lose money.

With an asset allocation plan, you do not change allocations because of market hiccups. If your plan is to invest 60 percent in stocks, you are not going to plunge all in because the stock market gets exciting or sell out because it has some scary days.

In fact, over time, rebalancing your portfolio to maintain your asset allocation has the benefit that you will sell some asset classes after they go up in value and buy in the asset classes that have gone down in their market cycles buying low, selling high.

When circumstances in your life change marriage or divorce, children, retirement outlook you can adjust your allocation percentages. In between, it is best to review your portfolio on a regular basis, but you do not want to tinker frequently. The Mutual Fund Store suggests investors perform personal quarterly reviews of their portfolio and visit with their investment advisors at least twice a year.