Ascending Triangle Chart Pattern

Post on: 16 Март, 2015 No Comment

The descending triangle is a bearsih continuation pattern. The pattern is formed by two converging lines. The first is a downward slant that which is resistance and the other is a horizontal support. To confirm the descending triangle. there must have oscillation between the two lines. Each line must be touched at least twice for validation.

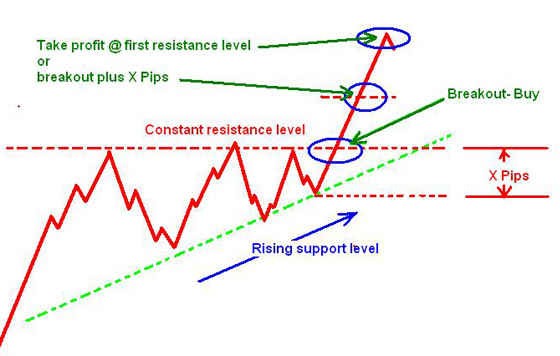

Here is a graphic representation of an descending triangle :

The target price of the pattern is determined by its height from the base of the triangle that we carry over the breakpoint. Another technique is to draw a parallel to the support line of the descending triangle from the first contact point with the support

This pattern is difficult to classify. Indeed, the exit is bearish just over half the time. So this is a continuation pattern but may also be a reversal pattern symbolizing a buying accumulation zone. Bullish movements are also more important than downward movements.

Statistiques

Here are some statistics about the descending triangle :

- In 54% of cases, there is a bearish breakout

- In 54% of cases, the target price is reached when the support is broken. However, when the bearish slant is broken, the percentage up to 84%.

- In 64% of cases, a pullback occur on the support

- More than half the time, when a breakout occurs from the bottom, the exit will be made by the top However, false breakouts by the top are rare with only 6%.

Notes

- The exit often occurs at the 2/3 of the pattern. This is the output level that offers the best performance

- The target price of the pattern is normally reached before the end of the triangle

- False breaks give no indication on the true side of the exit.

- Avoid taking a position if the breakout occurs before the 2 / 3 of the pattern

- Pullbacks are harmful for the performance of the pattern

Trading Strategies

The classic strategy (1):

Entry: Take a short position at the breakout of the support

Stop: The stop is placed above the last highest

Target: Theoretical target of the pattern

Advantage: The target price is often reached (75% of cases)

Disadvantage: There is a lot of false breakouts

The classic strategy (2):

Entry: Take a long position at the breakout of the resistance