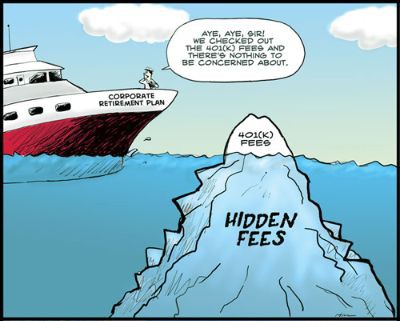

As a Fiduciary You Are Required to Understand the Hidden Fees and Expenses Associated with Your

Post on: 28 Март, 2015 No Comment

Fact: Plan fiduciaries responsibility includes identifying, understanding, and evaluating fees and expenses associated with plan investments, investment options and services. Fiduciaries should also monitor any revenue sharing (hidden fees) made indirectly by third parties and determine if they are fair and reasonable. Monitoring fees and expenses is an ongoing fiduciary responsibility and an increasing level of fee litigation is currently occurring across the country.

Types of Hidden Fees:

- Revenue Sharing Arrangements:

- This is the practice by mutual funds or other investment providers of paying other plan service providers (i.e. third party administrator, record keeper) for performing services that the mutual fund might otherwise be required to perform

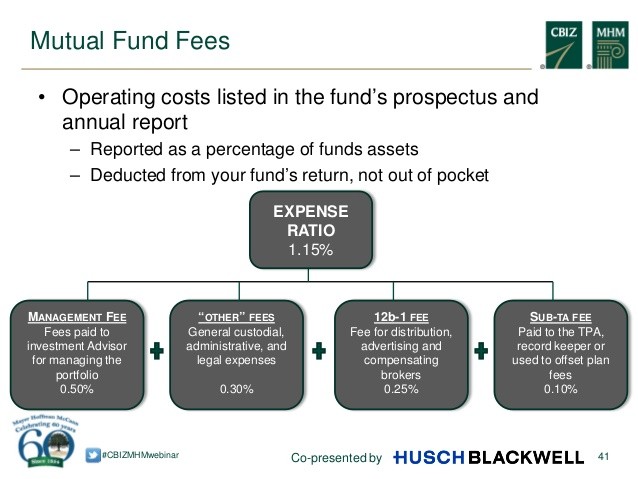

- Bottom-line: The mutual fund has typically built into the cost of their fund charges for services they may not ultimately perform (i.e. annual expense ratio which includes the Sub-Transfer Agent Fee and 12b-1 fee) and these revenues will be shared with the actual third party service provider involved with delivery of such services.

You are required to understand any revenue sharing arrangements and assess the reasonableness of these fees and how they impact your plan

You are required to understand what 12b-1 fees are and how they impact your plan

- Sub-transfer Agent Fees:

- Fees paid to record keeper by the mutual funds available on their platform in order to reimburse for participant/sponsor level services which are provided by the record keeper.

- Bottom-line: The payment arrangement of these fees is acceptable, the issues are whether they are being disclosed (you are required to understand who is being paid what and assess the reasonableness of those fees) and whether the fees being received are offsetting plan costs (i.e. is the record keeper receiving Sub-transfer agent fees AND billing the plan/assets for its services, double-dipping)

You are required to understand what Sub-transfer Agent fees are and how they impact your plan

You are required to understand the total plan asset charges involved in a variable annuity platform and how those charges impact your plan

- SEC Rule 28(e) Soft Dollars:

- Brokerage firms may charge extra an extra fee/commission considered to be a Rule 28(e) Soft Dollar charge. This potential extra charge can be used to purchase services (i.e. investment research).

- Bottom-line: If these fees are applicable and are deemed to be unreasonable it would be in violation of ERISA.

You are required to know whether your plan is being charged Rule 28(e) fees and if so, are these fees fair and reasonable for services rendered

- Investment Management Fees:

- These fees are for managing investment assets and are usually deducted directly from the investment return (as part of the annual expense ratio associated with the particular mutual fund)

- Bottom-line: The Investment Management Fee can vary greatly from fund to fund and since it has a direct relationship to the net return should be benchmarked against other funds with similar objectives.

You are required to demonstrate a process of benchmarking fees and expenses which impact your plan