Arthur Saving 401(k)s With ETFs

Post on: 1 Апрель, 2015 No Comment

Managed ETF solutions could save the 401(k) market from its own shortcomings.

This is part of a regular series of thought-leadership pieces from some of the more influential ETF strategists in the money management industry. Today’s article is co-authored by Kim Arthur, chief executive officer and founding partner of San Francisco-based Main Management, and Hafeez Esmail, Main’s director of marketing.

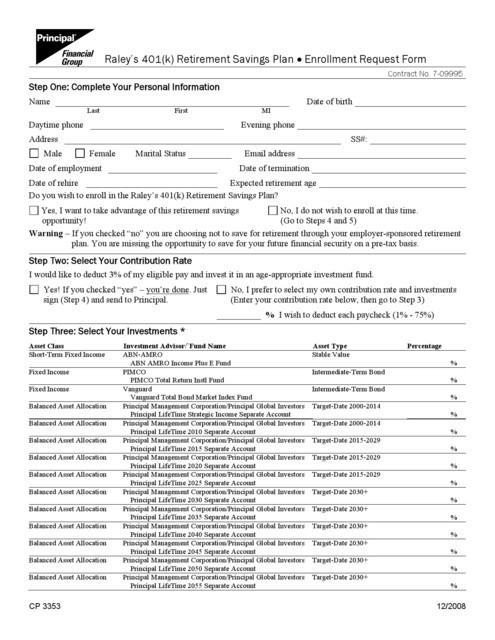

It’s that time of year again—open enrollment season where employees have the option to join employer-sponsored retirement plans.

However, for most retirement plans, it’s the same old ineffective structure that has failed the current crop of retirees. To be blunt, defined contribution (DC) retirement plans have proven to be a disaster for the vast majority of plan participants.

Dalbar, the financial industry research firm, estimates that the average DC participant has underperformed the S&P 500 Index by almost 4 percent per year over the past 20 years. That return differential may amount to the difference between a comfortable retirement and one that’s far less appealing.

It’s our view at Main Management that ETFs are going to be—in fact, already are—part of the solution. More specifically, we’re talking about so-called managed ETF solutions involving advisors playing the role of portfolio manager and fiduciary on behalf of retirement investors.

About $5.2 trillion, or a quarter of the nearly $21 trillion in U.S. retirement assets, are in defined contribution plans, and the vast majority of those DC assets are in relatively expensive open end mutual funds. Comparatively, DC assets in the managed ETF solutions universe remain miniscule, though they are clearly growing.

Below, we’ll get into how much less investors are likely to pay and how much better their portfolios are likely to perform with their DC retirement assets integrated into a managed ETF platform solutions platform. That is, after all, what’s at stake.

But first, a bit more on the defined contribution train wreck unfolding before us now.

An Accident In The Making

About 30 years ago, prior to defined contribution plans, the retirement landscape was dominated by defined benefit (DB) plans. The problem was that companies tended to use the DB plan as a private piggy bank during more difficult stretches, something that would dramatically affect the ability of the DB plan to meet its obligations.

Accordingly, DC plans were a positive step forward because each plan participant had a distinct, separate account in his or her name. It was an idea that offered promise, but had a key shortcoming.

DB plans had a professional money manager investing the entire retirement pool. By contrast, DC plans placed the choice of investments in the hands of the plan participant. Although well intended, it actually imposed the obligation on the plan participant of becoming the portfolio manager for his or her retirement assets.

Given that 80 percent of plan participants have never logged onto their online retirement accounts, they are effectively managing their retirement in absentia. Is it any surprise that the outcome of this experiment has been so poor so far?

Perhaps a bigger surprise is that the failing status quo has prevailed for so long?

It’s time for retirement plan participants to recognize that the allocation decisions they make are the most important component of their investment returns. Furthermore, it’s important to acknowledge that most plan participants lack the time or resources to actively manage or sufficiently diversify their retirement assets.

Accordingly, it makes sense to examine a return to placing allocation decisions back in the hands of a professional asset manager.