Are Asia retirees missing out on a key savings tool

Post on: 17 Май, 2015 No Comment

DNY59 | E+ | Getty Images

Asia’s savers are missing out on a host of tools available in the U.S. and Europe which are designed to demystify creating a retirement savings portfolio.

The need to punch up retirement savings in Asia is acute: in Singapore and Hong Kong, more than 50 percent of people expect their savings to run out just over halfway through retirement, according to a HSBC survey. Nearly 60 percent of retirees said they only realized their savings were inadequate after retiring, the poll found.

One of the basic building blocks of many retirement portfolios in the U.S. and Europe is the ‘target date fund,’ a mutual fund holding a mix of assets which becomes more conservative as it nears a target date, usually the holders’ planned retirement.

In the U.S. it’s an approved default option, noted Art Bacci, the Hong Kong-based group head at Principal Financial, which has around $451 billion under management. Employers tend to put the target date up there because it’s proven a very simple, easy-to-understand approach to diversification.

But the funds are rare in Asia, even in Singapore and Hong Kong, which both have mandatory retirement contribution plans that would seem to be a natural fit with the auto pilot portfolio of a target date fund.

The root of the problem is remuneration, said Eugene Mak, a Hong Kong-based managing director at Natixis. an asset manager overseeing $783.3 billion. Most of the funds are sold by financial planners or bank staff in Asia. That obviously requires fees, he said.

Index and target date funds are among the most vanilla funds out there, where the fees are not that high. As a result, there’s a low interest from distributors to sell them, Mak said.

There are other institutional-side issues restraining the development of target-date funds in Asia.

The markets are so fragmented from a regional perspective. It’s not possible to launch a fund in one jurisdiction and have it launched broadly across the region, said Rahul Bhalla, managing director at Vanguard Singapore, citing the different regulatory regimes. It poses challenges from a product development perspective.

Vanguard, the world’s largest mutual fund company with around $2 trillion in assets under management, is among the largest players in the target-date space, but it doesn’t plan to offer those funds in Asia any time soon.

Lack of education

Target-date funds also face obstacles from a lack of investor education on retirement planning.

Within Asia, the idea of planning for a retirement income is relatively new, as traditionally, parents would count on their children to support them in their old age.

Singapore’s mandatory retirement contribution fund, the Central Provident Fund, or CPF, wasn’t founded until 1955, while Hong Kong’s program, the Mandatory Provident Fund, or MPF, was launched at the end of 2000.

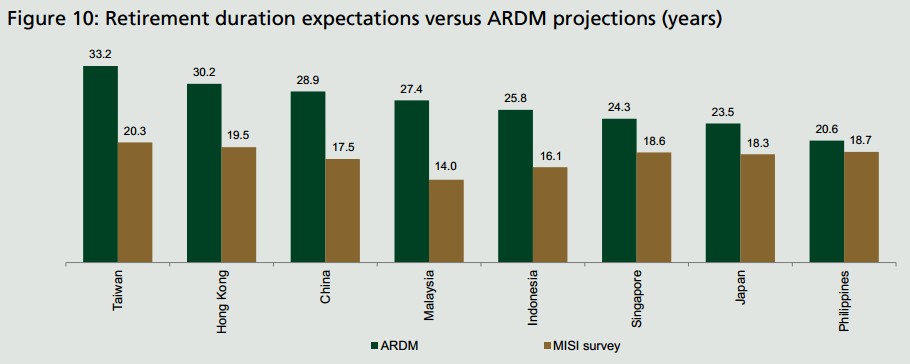

Rising life expectancies around the region have also sharply increased the number of years spent in retirement over a fairly rapid time period. For example, the average life expectancy in Singapore in 1957 was around 61 years, while in 2012, it had increased to 82.3 years, according to government data.

At the same time, the city-state’s population began having fewer babies, meaning the support of aging parents rested on a smaller pool of children.

But even as the demographics make planning for retirement more imperative, attitudes toward investment haven’t changed much.

People don’t invest in funds for a multi-year period. The average Asian probably wants to churn and shift their investments and tends to invest less in long-term products, Mak said.

It’s an observation borne out by investors handling their own accounts, noted Singapore-based Sui Jau Wong, general manager at Fundsupermart, a regional online investment marketplace. Fundsupermart’s customers often don’t pay sales charges for switching between funds, making fund-hopping easy, he said.

Balanced funds, which also hold a mix of assets but don’t usually rebalance toward a target date, are popular with his company’s customers, he noted, but younger investors tend to focus more on accumulating wealth rather than on a retirement plan.

Insufficient cash savings

Asians in general also tend to hold large portions of their portfolios in cash, noted Bacci. A recent Manulife survey found Asian investors tend to hold on average 22 months of personal income in cash; in Singapore, the figure is 35 months, the survey found.

But even as Asian portfolios hold far larger allocations to cash than most advisors would recommend, crippling investment returns, around 94 percent of survey respondents believed they are holding either the right amount or not enough cash.

At the moment, low interest rates mean the spending value of cash holdings is being eaten away by inflation. The mandatory retirement savings plans in Hong Kong and Singapore don’t always help savers seek out better returns.

In Hong Kong, the amount contributed to the MPF, is currently capped at HK$1,250, or around US$161, a month, although that will rise to HK$1,500 in June of next year.

The amount people can contribute to MPF is so small, I’m not sure it makes for a secure retirement, Bacci said, adding the small sums often either lead people to not manage it at all or to get too aggressive.

For its part, MPF said it is reviewing whether to shift the default option to life-cycle or target-date funds for members who haven’t made investment choices. Some of MPF’s employer-based plans are offering around 28 target-date funds, with some already voluntary designating those as the default.

Singapore’s CPF has cash as its default option. It is currently paying 4 percent on the retirement-designated, or special, portion of the accounts, which represent about 6 to 9.5 percent of wages, depending on the saver’s age.

The ordinary account, or the portion which can be used as a down payment to purchase a home, takes up the lion’s share of contributions; it is only paying 2.50 percent per annum. Interest is only compounded annually.

While CPF’s savers have the option to move some of their funds into mutual funds, also known as unit trusts, approved by the investment plan, only local bank UOB has put its target-date funds, marketed as GrowthPath, through the approval process.

But savers must keep at least 40,000 Singapore dollars, or around $32,000, of the Special account in the cash option and can only invest funds over that amount.

—CNBC.Com’s Leslie Shaffer; Follow her on Twitter @LeslieShaffer1