AQR Investing With Style in Corporate Bonds

Post on: 8 Июнь, 2015 No Comment

Contributors:

Ronen Israel. Johnny Kang, Scott A. Richardson

Topic:

Fixed Income

In a comprehensive analysis of the cross-sectional determinants of corporate bond excess returns, the authors find evidence of positive risk-adjusted returns associated with four investment characteristics, or styles carry, defensive, momentum and value. These returns are diversifying with respect to both known sources of market risk (e.g. equity risk premium, credit risk premium and term premium) and style returns that have been documented in equity markets (e.g. size, value and momentum).

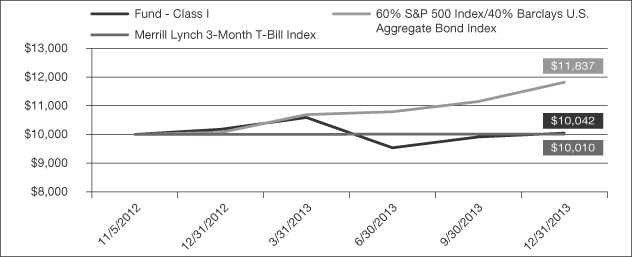

The authors add that realistic long-only portfolios can be constructed to achieve maximal exposure to these styles. Based on a broad sample of U.S. corporate bonds from January 1997 through November 2013, they found that an active long-only portfolio annually earned 1% in excess of a value-weighted benchmark of all corporate bonds in the BAML dataset, with an Information Ratio of 0.60. This long-only portfolio is aware of transaction costs, trading limits and position constraints, suggesting it is possible to build meaningful corporate-bond portfolios with styles exposures.

The analysis examines the exposures of actively managed credit hedge funds and actively managed credit mutual funds and finds that both have significant exposure to beta, primarily through exposure to credit risk premium, as well as minimal exposure to our documented styles with the exception of carry. Thus, despite evidence of a robust relation between styles and corporate bond excess returns individual credit funds are underexposed to styles.

The information contained herein is only as current as of the date indicated, and may be superseded by subsequent market events or for other reasons. The views and opinions expressed herein are those of the author and do not necessarily reflect the views of AQR Capital Management, LLC, its affiliates or its employees.

This information is not intended to, and does not relate specifically to any investment strategy or product that AQR offers. It is being provided merely to provide a framework to assist in the implementation of an investors own analysis and an investors own view on the topic discussed herein. Past performance is not a guarantee of future results.

Hypothetical performance results (e.g. quantitative backtests) have many inherent limitations, some of which, but not all, are described herein. No representation is being made that any investment strategy will or is likely to achieve profits or losses similar to those shown herein. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently realized by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. Hypothetical performance results are presented for illustrative purposes only.

Broad-based securities indices are unmanaged and are not subject to fees and expenses typically associated with managed accounts or investment funds. Investments cannot be made directly in an index.