Annuity v Market Account

Post on: 3 Июнь, 2015 No Comment

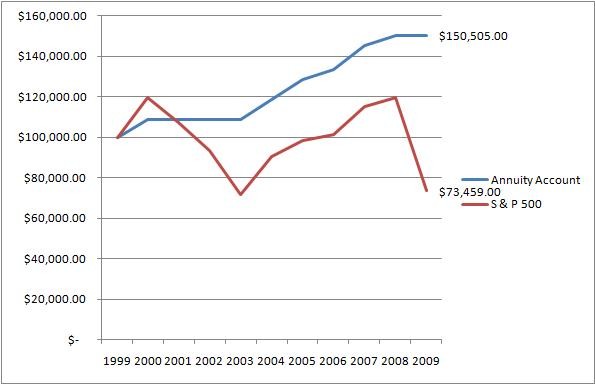

Annuities and money market accounts are two of the safer places to put your savings.

Comstock Images/Comstock/Getty Images

What Is an Annuity?

An annuity is savings vehicle that guarantees income upon retirement. An investor pays into the plan, which is often offered by an insurance company. After time passes the invested money are given back in installments. For instance, an investor can ask that after the annuity matures they receive a check every month or quarter or possibly in one lump sum. The money invested also grows over time based on the type of annuity chosen. An investor usually can’t access the annuity until they are 59 1/2 years old.

Types of Annuities

Annuities are generally either fixed or variable. As you might have guessed, a fixed product allows the investor to know exactly what theyll receive when the annuity pays out. The investor would pay into a CD-like product with set payments to for the life of the annuity. A variable annuity functions more like a mutual fund. The money is invested in a variety of mutual funds offered by an insurance agency and the investor’s money is subject to stock market gains or losses. These mutual fund offerings are considered more stable in that they are professionally managed accounts with the comfort of stock diversity built-in.

What Is a Money Market Account?

A money market account is considered the boring approach to investing savings. Basically, the account set up at a bank, which offers a fixed rate of return that is usually higher than the standard interest rate of a savings account. The future retiree just needs to maintain a minimum balance — $10,000 or whatever the bank limit is — and can only use the account sparingly, say write four checks a month on the account. These criteria are necessary for the bank offer the higher interest rate. MMAs are considered the halfway point between the higher-yielding yet illiquid certificate of deposits and a standard savings account.

The Pros and Cons of a MMA

MMAs allow investors to earn interest on money available to them now. Earnings usually fall in the single-digit percentages. But the money is safe from the volatility of the stock market. There are fees involved in MMAs, which can take a bite of your interest-based earnings. For instance, if an investor sinks $5,000 into an account with a 3 percent return than they can expect earnings of $150 a year. However, the fees could be about $30 or about 20 percent of the earnings.