Alternative Mutual Funds May Disappoint MoneyBeat

Post on: 30 Март, 2015 No Comment

So-called alternative mutual funds that aim to replicate popular hedge-fund strategies for retail investors have never been hotter. But a new report this week suggests that performance in some of the more popular vehicles could be disappointing.

In the study, authors Andrew Beer of Beachhead Capital Management and Prof. Michael Weinberg of Columbia University compared the performance of a basket of retail-focused, alternative multi-manager funds with that of institutional multimanager funds measured by research firm HFR.

They found that last year the new mutual fund vehicles returned about 4.2 percentage points less on average than equivalent vehicles open only to wealthy investors. Among the reasons: Mostly subpar hedge funds will agree to jump through the hoops required to invest money in a retail format, and even high quality hedge funds that sign up may avoid cannibalizing their main businesses by using their best ideas for common investors.

The multi-manager mutual funds returned 4.75% while the hedge-fund equivalent returned 8.95%

Traditionally, hedge funds are secretive private placements that hold onto investor cash for months or years at a time. The new retail products are structured as public mutual funds, must provide daily liquidity to redemption requests and come with vastly lower minimum investments.

“The evidence suggests that the performance drag will be higher than many investors realize and that the (real) advantages of greater liquidity, lower minimums and reporting simplicity are likely to come at the cost of diminished returns,” Messrs. Beer and Weinberg wrote.

Both this type of mutual fund entries and their hedge-fund equivalents, also known as funds of funds, parcel out money to a group of underlying hedge-fund managers they hope will deliver superior returns.

As The Wall Street Journal noted last month in a Weekend Investor cover story . hedge-fund-like retail funds have been rapidly gaining popularity among investors looking for returns that purport to be less correlated to global equity markets.

Firms such as Goldman Sachs and Morgan Stanley have been launching new products in the space, in addition to well-known hedge funds like Avenue Capital.

The authors wrote that they were surprised at the wide performance gap, given the relatively low-fee nature of the products compared to traditional hedge-fund vehicles.

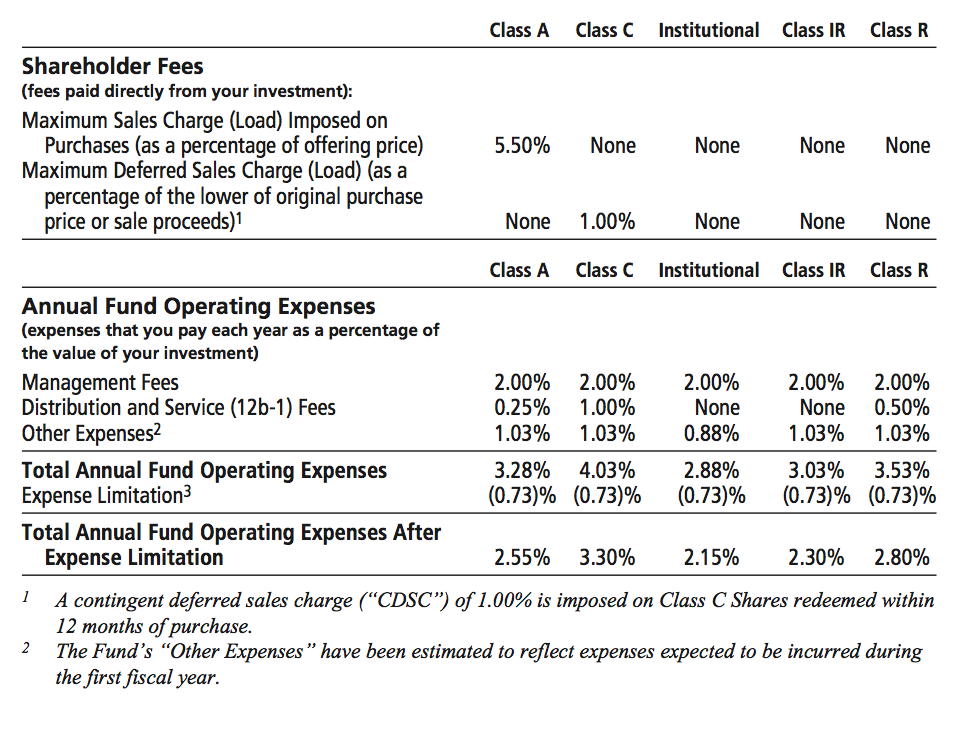

Annual fees for alternative mutual funds average 1.87%, while funds of hedge funds traditionally charge a 1% management fee and 10% performance charge on top of the traditional two-and-twenty of their underlying hedge fund managers.

Alternative mutual funds, a designation that spans a variety of strategies, managed a combined $286 billion at year-end, compared with $41 billion at the end of 2008, according to fund tracker Lipper.

Beachhead runs an advisory business for deep-pocketed investors to help them select hedge funds.