Alternative mutual funds Hot and hiring

Post on: 13 Май, 2015 No Comment

Corporate banking: hot in Asia

Hedge funds may be providing sanctuary for a lucky few investment banking traders looking for a way out of the bulge brackets, but it’s hedge funds-lite – or alternative mutual funds – that are fast becoming the hot place to work.

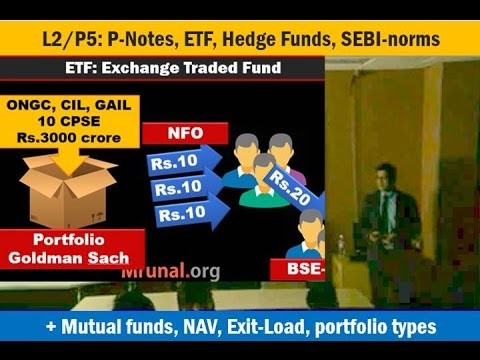

Alternative mutual funds act a lot like hedge funds, shorting with a range of asset classes from derivatives to ETFs and gold, but there are a few important differences. The first being that they’re available to the man-on-the-street – rather than accredited investors, as is the case with hedge funds – they also have limits on leverage and don’t charge the inflated 2 and 20 fee structure that so many hedge fund investors complain about.

The number of alternative mutual funds has been growing – from 112 in 2007 to 357 last year, according to figures from Morningstar – but it’s only in the past couple of weeks that they’ve looked like hitting the mainstream. Morgan Stanley’s Alternative Investment Partners launched its first mutual fund, the AIP Dynamic Alternative Strategies Fund earlier this month while Goldman Sachs Asset Management unveiled its Multi-Manager Alternatives Fund that “offers exposure to a range of alternative and non-traditional investment strategies within the convenient structure of a mutual fund”.

A recent report by Citigroup, which predicted that retail assets in these alternative mutual fund vehicles would more than triple to $940bn over the next four years, has only added to the buzz. Headhunters working in the asset management sector are understandably excited, but say it takes a different sort of beast to work for an alternative mutual fund than a hedge fund.

Michael Castine, chairman, investment management at Korn/Ferry International, said: “It’s predominantly cultural – getting to grips with a working in a mutual fund targeting long-term returns for retail investors is a decidedly different proposition to that of an alternative shop. A more conservative approach is required.”

AQR is by far the biggest hedge fund player in the mutual fund space, managing 20 funds with $9.2bn in assets under management. Other firms, such as Aurora Investments and Arden Asset Management are offering mutual fund products through traditional money managers – Natixis Global Asset Management and Fidelity Investments respectively.

However, many believe that household names will dominate the alternative mutual fund arena because of their ability to attract retail investors. Kolhberg Kravis Roberts has recently entered the retail market, with Scott Nuttall, global head of capital and asset management revealing that it had built a new team specifically to attract investors during its conference call this month.

“Weve built a direct high net worth team at KKR and so we are calling actively on high net worth individuals and family offices and that has actually worked quite nicely in that we have found we can build relationships with those individuals that will bring us deal flow,” he said.

The managers responsible for Morgan Stanley’s new fund don’t have a typical hedge fund background. Ryan Meredith, a managing director, has been working for the bank’s AIP since 2007, having previously been at Citigroup’s alternatives arm. However, he also has a background working as an actuary at Towers Perrin in London. Rui De Figueiredo, who leads the division, and Patrick Reid, and executive director, both have wealth management experience at Morgan Stanley.

Michael Martinolich, partner at hedge fund focused search firm Caldwell Partners, said: Hedge funds have a myriad sales professionals who can sell to all types of institutional investors, but bridging that retail gap requires a different approach, methodology, and niche skill-set. There are real opportunities for asset raisers who can reach retail and related platform investors.