Alternative investments are no longer all that alternative

Post on: 11 Апрель, 2015 No Comment

April 4, 2013

This post originally appeared at the Amazon Money & Markets blog. Last months post looked at the pursuit of mediocrity or the high cost of active management. Thanks for reading.

-

Please accept my resignation. I don’t care to belong to any club that will have me as a member. Groucho Marx (Wikiquote )

The same could be said for alternative investments these days. The pitch for alternative investments has been that they generate high returns with lower correlation to the broader stock market and economy. Throw in the hope and exclusivity of these strategies and you have a potent pitch. So-called alternative assets include a wide range of assets and strategies including most prominently private equity and hedge funds. These funds are now finding ways to open their doors to smaller, more retail investors.

Why is that? Many of the biggest private equity investors have come public and have transformed themselves into broadly diversified asset managers. The raison detre of publicly traded asset managers is to grow assets under management, hence earnings. The retail-ization of alternative investments represents a big part of this strategy. For example at least one private equity manager is trying to get their funds included in a 401(k) plan .

The behemoth Carlyle Group recently announced a plan to make their buyout funds available to individual investors with a minimum investment of $50,000. While for many that still seems high, it is a far cry from the multimillion minimums institutional investors face. Then again the very act of lowering its minimums may be a not altogether positive sign. It will be interesting to see if retail private equity funds become a mainstream alternative.

In their favor, investors are desperate to generate returns in a zero-interest rate environment. Buyout funds seem to many like a way to boost portfolio performance, albeit at a high price. As well, many mass-affluent investors who have to-date been shut out of these funds could find the prospect of investing with the best and brightest an intriguing possibility. Before proceeding investors considering an investment in private equity funds, or any other alternative investment, should keep in mind these four Cs.

The best argument against alternative investments in general, and more specifically retail-focused products is costs. Inevitably these products have higher fees. This is due to the fact that most managers have structured their fees to include both an investment management fee and performance fees. These fees reduce investor returns on a one-for-one basis. So returns have to generate excess returns in order to offset these fees. Thankfully fees are one area individual investors have a high degree of control.

Private equity funds are a very different animal than the open-end mutual funds and ETFs most investors are familiar with. In addition to the higher, multi-layered fees and leverage, it is difficult to value their holdings on an ongoing basis. Not until a holding is sold, goes public (or goes bankrupt) do you know its value with certainty. A recent study showed that private equity firms have historically overvalued their holdings to help aid fundraising.

It is hard to argue that private equity is undiscovered. Historically the best returns for alternative investments has come before the crowd discovers them. A common mistake investors, even professional investors, make is to chase returns. For example the returns to private equity and venture on a dollar-weighted basis are worse than on a headline basis. This is because money rushes into an asset class after the best returns have already been generated. Not surprisingly future returns cant keep pace.

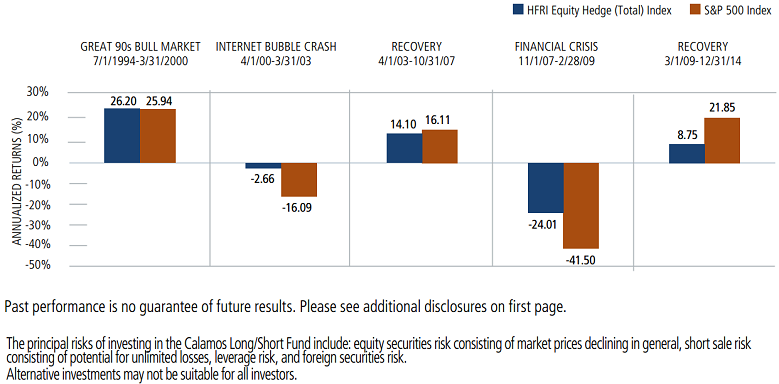

Correlations

The other side of the crowding coin is increased correlations. Post-financial crisis private equity can no longer be considered an asset uncorrelated with equities. The same could be said for any number of asset classes as well. As high performing asset classes become recognized they attract capital and almost inevitably become ever more correlated with the broader markets. There are number of reasons for this but one reason is that the best returns were generated when few were willing (or able) to invest. That sounds a lot like the situation with private equity.

All of that being said, private equity plays a vital role in our economy by helping grease the wheels of capitalism. As I wrote in my book, Abnormal Returns: Winning Strategies from the Frontlines of the Investment Blogosphere :

The firms engaged in private equity and venture capital play a key role in the functioning of the market economy. It would be hard to imagine the markets without them. In a very real sense, all investors benefit from the work of private equity professionals and venture capitalists. The challenge for average investors is that they don’t have easy, inexpensive access to these asset classes. Whatever access they do have is mediated with layers of fees upon fees. As with most alternative investments, the allure of private investments is less than meets the eye.

The bottom line is that there is no magic investment that consistently generates high returns and low correlations. So when considering any alternative investments keep in mind Grouchos words. If not Groucho, how about William Bernstein as quoted by Jason Zweig at WSJ ?

Think of it like this, he [Bernstein] says: The first person to the buffet table gets the lobster. The people who come a little later get the hamburger. And the ones who come at the end get whatever happens to be stuck to the tablecloth.

The danger today is that investors plunging into alternatives are the last ones in the proverbial buffet line getting the stuff stuck to the tablecloth. The vast majority of investors can safely ignore alternatives (and other active strategies). Focusing on those things over which investors have some genuine control like their savings rate, fund costs, turnover and taxes is a far better use of their limited time and energy.

Further reading :

The New Tycoons: Inside the Trillion Dollar Private Equity Industry That Owns Everything . Jason Kelly

Unconventional Success: A Fundamental Approach to Portfolio Management . David Swensen

The Ivy Portfolio: How to Invest Like the Top Endowment Funds and Avoid Bear Markets by Mebane Faber and Eric Richardson

The Behavior Gap: Simple Ways to Stop Doing Stupid Things with Money . Carl Richards

Skating to Where the Puck Was: The Correlation Game in a Flat World . William Bernstein