All you need to know about investing in exchangetraded funds Money Today

Post on: 11 Апрель, 2015 No Comment

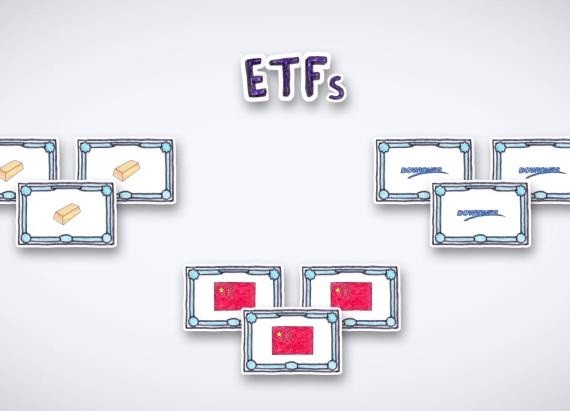

Exchange-traded funds (ETFs), which offer flexibility of a stock and protection of a fund. are catching on big time with Indian investors.

ETFs, which invest in stocks comprising an index, trade on exchanges. Financial planners are increasingly recommending ETFs to investors who have long-term goals and want to invest in equity without taking too much risk. This is reflected in average assets under management in the retail ETF category, which have risen from Rs 59 crore in March 2009 to Rs 394 crore in March 2012, according to the Association of Mutual Funds in India.

However, equity ETF volumes, unlike that of gold ETFs. are very small compared to the mutual fund industry’s total assets. ETFs became popular with gold ETFs, even though gold ETFs came much later than equity ETFs, says Lakshmi Iyer, head of products and fixed income, Kotak Mutual Fund.

An ETF invests in stocks that comprise an index. The proportion in which it will allocate money may be the same as individual stocks’ weight in the index or differ. For example, a Nifty ETF will invest in 50 stocks comprising the Nifty, most likely in accordance with the weight of individual stocks in the index.

The investor can buy/sell on the exchange without approaching the fund house. Such trades attract a brokerage.

Unlike a regular fund, where investors can buy a fraction of the unit, ETFs are available in multiples of one. Big investors can directly approach the fund house for sale/purchase if the lot size is big and the units are not available in the market. The lot size is determined by the fund house. Usually, it is more than Rs 15-20 lakh.

INDICATIVE NAV

Just like a mutual fund, ETFs have a net asset value (NAV), the price of each unit at the end of the day. But as ETFs trade in real time, funds provide an indicative NAV, or iNAV, which is the real-time NAV of an ETF. iNAV may be different from the market price.

Remember that buying or selling an ETF involves brokerage.

ADVANTAGE INSTITUTIONS

ETF prices depend on demand and supply on exchanges. When there is more demand than the units on sale, the market price may be 25-50 basis points more than the iNAV. If there are more sellers than buyers, the price may be 25-50 basis points less, says Rajnish Rastogi, senior fund manager and co-head, equities, Motilal Oswal AMC.

Fund houses display iNAVs on their websites. iNAVs may be lower or higher than the market prices. So, there is a possibility of arbitrage. However, institutional or big investors move in fast to plug any price difference, putting small investors at a disadvantage.

Another thing to be kept in mind is that an investor can buy on an exchange and sell to the asset management company, or AMC, or sell on an exchange after buying from an AMC to gain from arbitrage

The arbitrage opportunity may be there only if the difference between the market price and the iNAV is above 50-75 basis points. If not, no party will make money due to brokerage, securities transaction tax and inventory-carrying costs, says Rastogi.

However, a retail investor may not be able gain from arbitrage due to the difference between the iNAV and the market price. This is because AMCs buy in lot sizes. So, he will have to approach a marketmaker

LIQUIDITY ISSUES

Though ETFs are gaining popularity, they face liquidity issues.

Unlike a regular mutual fund, AMCs do not deal directly with small investors. If there is not much liquidity in a product you want to buy or sell, you can ask the AMC to give you details of the authorised participant or the market-maker who gives buy/sell quotes. A market-maker is a broker-dealer firm that accepts the risk of holding particular securities to facilitate trading in those securities.

In such a case, there are chances that the quote offered may be less than the market price. So, one must negotiate hard. The market-maker may be willing to oblige as the fund house usually buys/sells units on a large scale. The market-maker accumulates units from retail investors and after reaching a sizeable amount sells to the fund house.

Recently, we found that an ETF which our client wanted to buy was not available in the market in the required quantity. He had to pay a 3 per cent premium to the market price to acquire it, says a financial planner

However, some fund houses take steps to protect investors’ interest.

For three of the ETFs we have launched, in case the market price is at a discount of more than 3 per cent over a period, we open the ETF for direct redemption by retail investors in multiples of one unit. As a result, during such time, the ETF becomes an open-ended fund for redemption by retail investors. This protects retail investors, says Rastogi of Motilal AMC. This means if the market price of an ETF is at a discount to its iNAV by over 3 per cent, you can directly contact the AMC for redemption rather than going to the market-maker.

GOING FOR IT

Investors often compare ETFs with mutual funds. It’s like comparing a stock with a mutual fund. Every investment is different and caters to the different needs of investors. If you are a first-time investor and not accustomed to the market, I would introduce you to the passive route, that is, ETFs, says Iyer.

One of the main advantages of investing in an index ETF is that you can sell and buy at real-time prices rather than waiting for the closing of the day to determine the price. Also, one can get access to the equity market but with limited risk. Moreover, the risk of the fund manager’s discretion is eliminated.