All About Mutual Funds Actively Managed Mutual Funds Index Funds ETFs

Post on: 10 Апрель, 2015 No Comment

One of the ways that many people add diversity to their portfolios is with the help of various funds. Funds essentially represent the ability to invest in shares from multiple investments at once. This can add instant diversity to a portfolio, as well as spread the risk around so that if one investment tanks, there are other investments to make up for it.

However, before you invest, its a good idea to get a basic idea of what your options are in terms of the available funds, and how they work.

Actively Managed Mutual Funds

A mutual fund is a collection of assets. Investors pool their funds and the money is used to purchase shares in companies, or bonds or other investments. Money managers operate the funds, investing the capital, with the hope of earning a return for the investors. Mutual funds usually have a stated objective, and the managers job is to make sure that the investments included in the fund help meet the objective, whether thats providing socially conscious investments, promoting growth, or providing income.

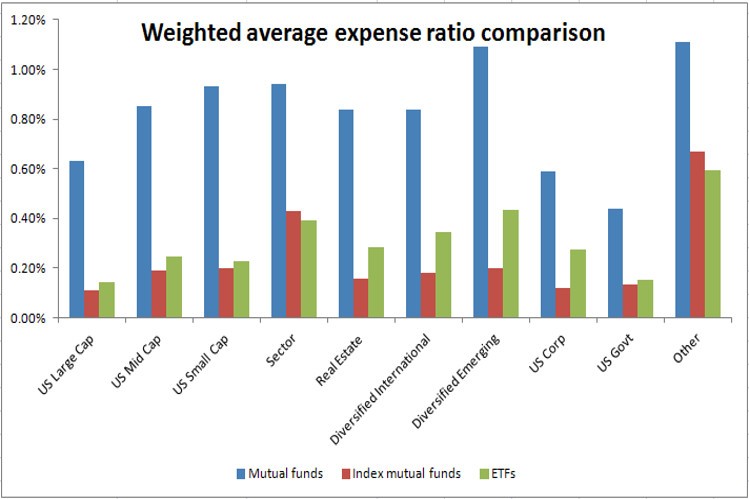

Managers of these funds insist that their expertise can lead to better returns than what you can get investing yourself, or using other means. Research shows that these claims may not be true. Many actively managed mutual funds feature higher fees, since the money managers have to be paid for their active management of the fund, and there may be other operating expenses.

Index Funds

Like actively managed mutual funds, index funds represent a collection of investments. However, rather than being chosen by a manager to meet a specific goal, index funds track a specific index, such as the Dow or the S&P. Index funds may also track bond indexes, or other asset indexes. You can find indexes that follow small businesses, or alternative energy, or any number of other assets.

Because managers arent exactly picking investments to go in the fund (just making sure the fund tracks the index), the costs are usually much lower with an index fund. You spend less money in fees, so your earnings arent eroded as much with an index fund as with an actively managed fund. Plus, your returns reflect how well the index has done; if you invest in an all-market index fund, your returns will be close to the same as the market (minus the fees associated with the index fund).

Exchange-Traded Funds (ETFs)

ETFs are similar to mutual funds in that they represent a collection of assets, lumped together as one. However, unlike mutual funds, ETFs can be traded on the stock market as a security. This means that you can buy and sell ETF shares as you would a stock. However, its important to note that you will still have expense fees (although they are usually much lower than a mutual fund fee), and you will have to pay the regular transaction fees that you would pay for trading a stock.

Many investors are gravitating toward ETFs because they are easy to trade, offer diversity, and have relatively low fees (especially if you trade them with a discount brokerage account ). However, there are still those who prefer actively managed mutual funds or index funds. No matter what you choose, though, its important to do your research and decide what is likely to work best for you.