Advantages of Investing in Dividend Mutual Funds

Post on: 21 Июль, 2015 No Comment

Advantages of Investing in Dividend Mutual Funds

Investing in dividend mutual funds offers you a lot of benefits. You earn a passive income, you can increase your capital through dividend reinvestment plans you preserve your asset allocation and you are fairly protected from the risks of stock market trading. For beginner investors, dividend mutual funds are probably the best investing strategy.

The first, obvious advantage of dividend mutual funds is that you are getting dividends, each trimester of the year. When you buy stocks to companies or mutual funds that don’t pay dividends, you can make money by trading those stocks. Basically, this means buying stocks when they are cheap and selling them when they go up. With dividend mutual funds, you can enjoy the same money making mechanism, but, in the same time, you benefit from regular dividend payments.

Well established, big, dividend-paying mutual funds are very safe long-term investments. The safety is due to the diversity of the mutual funds and to the professional management of the fund. When you start investing in the stock market, the first advice you get is to build a diversified portfolio, as your main tool for profitable investments. But deciding on the stocks you should buy is a difficult process. Dividend mutual funds offer you that diversity right from the start, because they are collections of stocks from various companies.

Another important advantage of dividend mutual funds is the quality of portfolio management you get. When you buy stocks one by one, it’s very hard to estimate how much success each of your investments will have, especially if you are a beginner trader. A dividend mutual fund, on the other hand, comes with the whole package a reliable, professional management of your portfolio.

Accessibility of the investments is an element that also works in favor of dividend mutual funds. When you buy participation to a lot of different companies, you have to keep track of the evolution of 20 or 30 different stocks. With dividend mutual stocks, all you have to do is follow the performances of just one stock.

Buying dividend mutual funds stocks is quite easy – it’s just like buying regular stocks from individual companies All you need is a reliable stockbroker, who can recommend you the right type of mutual funds for you. Also, when you purchase mutual funds, you don’t have to pay a commission to the stockbroker, which means you are able to invest small amounts of money, without worrying about the costs of your investment.

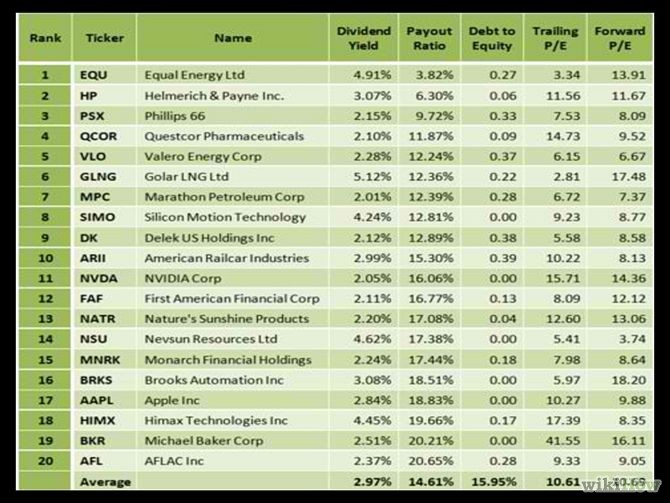

You get to decide on the level of risks you are willing to take. There are dividend mutual funds that can bring you high returns, but in the same time they are riskier investments. Other dividend mutual funds are meant to be safe long-term investments. Each mutual fund states the goals under which it operates, allowing you to make an informed investment decision. Discussing that issue with a reliable, trustworthy stockbroker will help you make the right decision. Generally, higher yield stocks carry greater risks then the rest of stocks, while well-diversified funds offer you a safer investment. Before investing in a particular mutual fund, make sure you know all the relevant information about that fond and the level of risks you’re taking.

Dividend mutual funds offer you reinvestment plans, which allow you to increase your capital on the long term. Through those plans, you are offered the option to buy stocks instead of cashing dividend money. Such plans are ideal, if you are investing your retirement money, for example, or other types of long-term investments.

If you are planning to invest your money, dividend mutual funds is an option you should definitely consider. To make sure that you are making the right decisions about your personal finances, find a reliable, trustworthy stockbroker and discuss your investment strategy thoroughly. Educating yourself about finance and investments is equally important. There are tens of information sources at your disposal: financial websites and blogs, magazines or newspapers. Take at least a few hours every week to read financial articles. This way, you’ll be able to manage your investments better and to make the right decisions to secure your family from the financial point of view.

This entry was posted on Tuesday, September 13th, 2011 at 1:52 pm and is filed under Dividend Strategy. You can follow any responses to this entry through the RSS 2.0 feed. Responses are currently closed, but you can trackback from your own site.