Advantages and Disadvantages of Municipal Bond Mutual Funds

Post on: 20 Июль, 2015 No Comment

The Good News

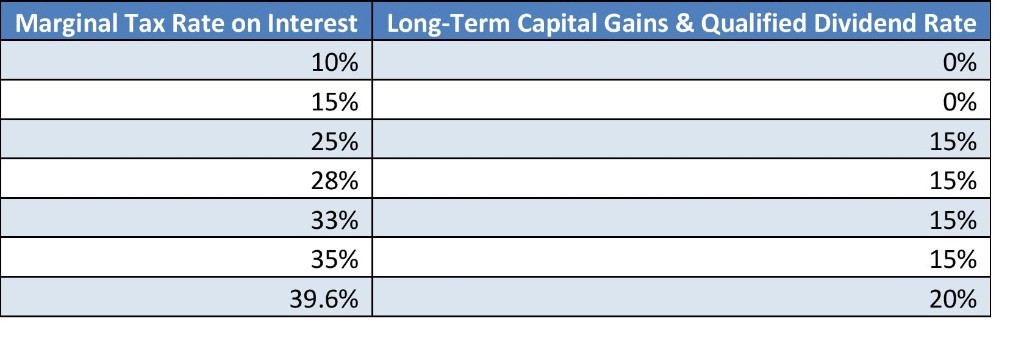

Obviously, the tax-exempt status of municipal bond mutual funds is the primary consideration for most investors. Investors in higher tax-brackets might consider municipal bonds as a way to help their portfolios weather an increased tax burden. It is important to know which bonds are tax-exempt and at what level. Federal municipal bonds are free of income taxes if you fall below the alternative minium tax bracket. There can be exposure to state taxes although many municipal bonds are free of both federal and state income tax.

The quality of the municipal bond in a bond fund depends on the rating it is given by credit agencies such as Standard & Poors, Fitch or Moodys. These rating agencies help investors determine which municipal bonds are capable of returning the principal due investors along with interest (yield). Investment grade municipal bonds tend to have a lower yield than bonds considered below investment grade (high-yield).

The Bad News

Investors looking to add this type of investment might be advised to keep them outside of a tax-deferred retirement account. The tax-exempt nature of municipal bond mutual funds are best kept where their tax treatment is most beneficial, apart from your 401(k) or IRA.

The tax-exempt nature of municipal bonds means that their overall yield can be low when compared to corporate bonds. Numerous additional factors need to be considered by investors. The bonds can be closely tied to interets rates, economic factors and how the bond issuer intends on making payments to the bondholder.

The investor needs to take the long-term performance of the municipal bond fund into consideration (five years or more), the charter of the fund (what types of bonds the fund focuses on), the maturity of the funds in the portfolio (maturity lengths can help the investor determine how often the fund turns over its holdings) and lastly, the investment grade of those holdings.

Municipal bond funds are generally more suitable for investors with higher incomes and tax brackets who are looking to gain returns without the tax implications. Lower income investors would be advised to focus their investment dollars in tax deferred accounts first before considering these types of investments.

Municipal bond funds are often low-yield, tax-free investments offered on both the federal and state level. Investment grade municipal bond funds tend to have a lower rate of return compared to municipal bond funds focused on high-yield, below investment grade bonds. These types of bond funds work better for investors concerned about high-income tax consequences.