Activelymanaged Index Funds offer advantages

Post on: 9 Апрель, 2015 No Comment

Index fund are aimed at producing a rate of return that closely matches the index (e.g. S&P 500 Index)

You likely know that a mutual fund is an investment option offered by a company which pools money from investors and invests it using a predefined strategy involving certain stocks, bonds and other assets. Each investor in the fund owns shares representing some fraction of the collective holdings of stocks, bonds or other assets.

You may not be fully aware of the differences between actively-managed and index funds (those which are usually passively managed), but you should understand the differences in how theyre managed as they relate to your chances for increasing the value of your assets.

Portfolios in actively-managed funds are managed on a day-to-day basis by a team of professionalsusually under the direction of one or two managerswhich makes buy, hold and sell decisions with the goal of maximizing shareholder return. Actively-managed funds offer an advantage over index funds in that managers are not compelled to own shares of any specific company. Portfolio choices are made based on an expectation for performance, not on the basis of a list of companies which comprise an index.

Every year, some actively-managed funds outperform various broad market indices and other more defined stock market indices.

Some funds have a demonstrated history of solid performance for extended time periods.

Many investment advisors offer advice and asset management based on their belief they can regularly identify those fund managers who have long-term track records of increasing the value of their shareholders assets. While companies strive to offer funds which offer a higher rate of return than one available through an investment in an index fund, their funds may also generate a return lower than one produced by an investment in an index fund.

The portfolio in an index fundand its performanceis designed to mimic that of a specific market index (e.g. S&P 500 Index). Professional management efforts for an index fund are aimed at producing a rate of return that closely matches the index by ensuring that the allocation of assets in the fund portfolio is in alignment with that of the index at various times throughout the year.

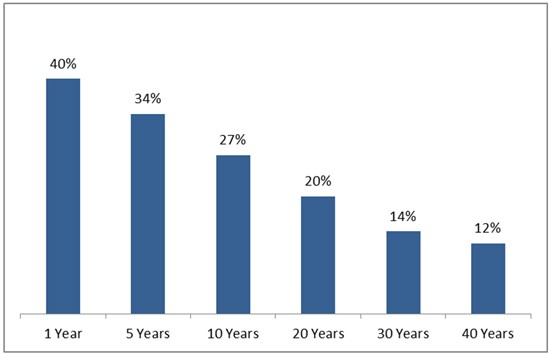

One argument for index funds is that they annually outperform a majority of actively-managed mutual funds.

Thats true. However, they also annually underperform a number of fund managers. If you invest in an index fund, youre giving up the chance to match the performance of the markets top-performing fund managers.

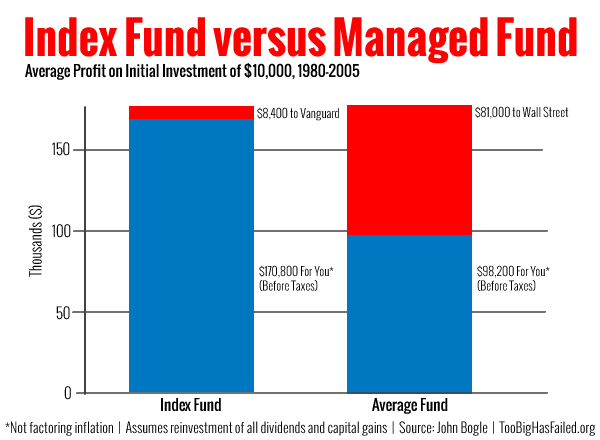

Another argument for the use of index funds is that investors normally pay lower operating expenses. Proponents of actively-managed funds counter by saying funds which generate above-market returns for shareholders can offset the added expenses through performance.

Companies have offered another form of funds in recent years. Unlike open-ended actively-managed or index funds, ETFs (exchange-traded funds) are traded throughout the day like shares of stock. ETFs often correlate directly to a specific market index, while a small number of recent ETF offerings offer active management of securities. Those products are new enough that long term track records for performance have not yet been established.