Active v Money Management Mindset Wealth Mindset Wealth

Post on: 9 Апрель, 2015 No Comment

By Robert Mulrooney

June 12, 2014

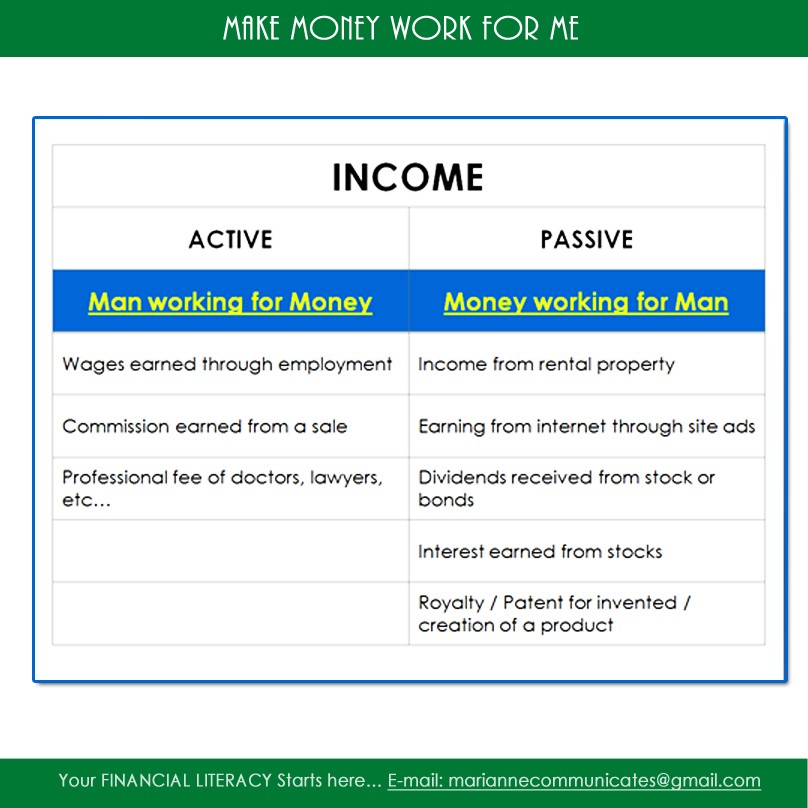

Active money management, which generally involves an investment professional, aims to outperform a specific benchmark to provide above-market returns. Passive management, which includes vehicles like exchange-traded funds (ETFs), strives to replicate the performance of indexes; passive management maintains market exposure, but doesn’t offer the potential for above-market returns.

Three years ago, there was a definite “passive management” push toward ETFs and index funds. When the inflows from these passive investments started to become impressive, you couldn’t watch the Business Network without seeing an ad for a company selling ETFs. The prevailing trend was to leave mutual funds for low-cost indexes.

When it comes to investing, however, there’s much to be said for going against the grain. Three years ago, for example, if you had put your money in the Cundill Canadian Security Fund, one of the Canadian equity funds we use, you would have outperformed the S&P/TSX Composite Index. While an investable ETF would have underperformed due to fees and transaction costs, our fund investors were rewarded with superior returns.

I don’t dispute that ETFs have their benefits (primarily low fees), but they are passive investment vehicles and therefore carry a different set of risks, one of which is known as “tracking error.” Exchange-traded funds replicate major indexes to the extent possible, but they can’t follow every up and down; when an ETF falls short, the result is called a tracking error.

Three-year chart showing the performance of the Cundill Canadian Security Fund vs. the S&P/TSX Composite Index. Note that an investable ETF would underperform even the index due to fees and transaction costs. Source: Mackenzie Investments.

Clear as mud? Lets look at an example from DundeeWealths February 2012 ETF report: The year-to-date performance of the MSCI World Index Fund was 10.64 per cent. The return on Ishares XWD, an ETF that tracks shares of that fund, was 6.3 per cent resulting in a lag of 3.91 per cent.

When you consider both the tracking errors and the fees associated with ETFs and index funds, I’m confident that many of the fund managers we partner with will match or outperform their benchmark indexes. If you’d like to read DundeeWealths report on ETFs, or see other examples of funds we use, please dont hesitate to call our office.