Active v—Have We Tipped Over the Tipping Point

Post on: 16 Март, 2015 No Comment

By Jay D. Franklin and Mark Hebner

Friday, August 15, 2014

Regarding this question, a recent article on Morningstar.com caught our attention. John Rekenthaler, a Vice President of Research at Morningstar, questions whether active funds have a future in light of recent cash flow data. As the chart on the left-hand side below shows, for every $3 of sales over the last twelve months, $2 went to the passive side. As Mr. Rekenthaler points out, however, the real picture is even worse for active because the active category includes target date funds which are essentially a captive audience of 401(k) participants. Also, many target date funds such as Vanguards use index funds. Once we adjust for that on the right-hand side, we see that for every $4 of sales, passive captured $3.

Actually, the real picture is even worse because Morningstar classifies the funds from Dimensional Fund Advisors (DFA) as active funds. If we consider the $25 billion in fund flows to DFA funds as passive rather than active, then the split becomes 80-20.

Mr. Rekenthaler succinctly answers his own question (whether active funds have a future?), To cut to the chase: apparently not much. The fact that statements like this are coming from Morningstar (although Rekenthalers views are not necessarily the official views of Morningstar) is very telling to us because Morningstar derives a substantial portion of its revenue from investors using its data for the purpose of manager picking. Even with the decline of actively managed funds, we believe that Morningstar still has a strong business model and has an undisputed place as a provider of information and analysis to investors of all types.

The article broke down the total cash flows into eight different Morningstar categories for mutual funds only. There were four categories for which active received higher net flows than passive. Three of those four are completely unsurprising: They are allocation funds which are primarily tactical allocation funds which we warned against here. sector funds which we deemed superfluous here. and alternative funds whose recent dismal performance we documented here. International stock was the one surprising category where active funds received higher flows than passive mutual funds. Rekenthaler notes that international active managers benefitted in the 1990s from having less of an exposure to Japan than the international index funds, but for the last ten years, the Vanguard international and emerging market index funds have soundly beaten the average actively managed fund.

Based on statements from Morningstars international research team, Rekenthaler maintains that international active managers have a higher persistence of performance compared to domestic active managers which have the same or lower persistence than we would expect from chance. Naturally, we tested this hypothesis and as the chart below shows, the persistence of the performance of international active managers is pretty much non-existent. The chart shows that of the funds that were in the top half of their peer group for 2009, a lower number than what we would expect from chance continued to stay in the top half in the subsequent four calendar years.

Coincidentally, one of our favorite authors, Charles Ellis. just came out with an article 1 in the Financial Analysts Journal which makes a compelling case that the losers game of active management is now in its endgame. According to Ellis, The costs of active investment are so high and the incremental returns so low that, for clients, the money game is no longer a game worth playing. To bolster his case, Ellis cites an interview that Eugene Fama gave to Robert Litterman at the 65 th CFA Institute Annual Conference in Chicago in 2012 in which Fama said, An investor doesnt have a prayer of picking a manager that can deliver true alpha. Even over a 20-year period, the past performance of an actively managed fund has a ton of random noise that makes it difficult, if not impossible, to distinguish luck from skill. Putting the final nail in the coffin, Ellis quotes Famas summarization of the findings of the 2010 paper he co-authored with Ken French, Luck Versus Skill in the Cross-Section of Mutual Fund Returns. as follows:

Active management in aggregate is a zero-sum gamebefore costsAfter costs, only the top 3% of managers produce a return that indicates they have sufficient skill to just cover their costs, which means that going forward, and despite extraordinary past returns, even the top performers are expected to be only about as good as a low cost passive index fund. The other 97% can be expected to do worse.

A question we are commonly asked is what would happen if everybody decided to index? Since that will never happen, we believe a better way to ask this question is what is the minimum percentage of market participants that need to be engaged in price discovery for the market to be efficient to the degree such that a dollar spent on active management is unlikely to return more than a dollar back? Of course, there is no clear cut answer, but Mr. Ellis takes a stab at it and arrives at what we think is a very reasonable answer:

Assuming that NYSE daily turnover continues at over 100% of listed shares, and index funds average 5% annual turnover, if indexing rose to represent 50% of total equity assets (from about 10% today), the trading activities of index funds would involve less than 3% of total trading. Even if 80% of assets were indexed, indexing would represent less than 5% of total trading. It is hard to believe that even this large hypothetical change would make a substantial difference to the price discovery success of active managers, who would still be doing well over 90% of the trading volume.

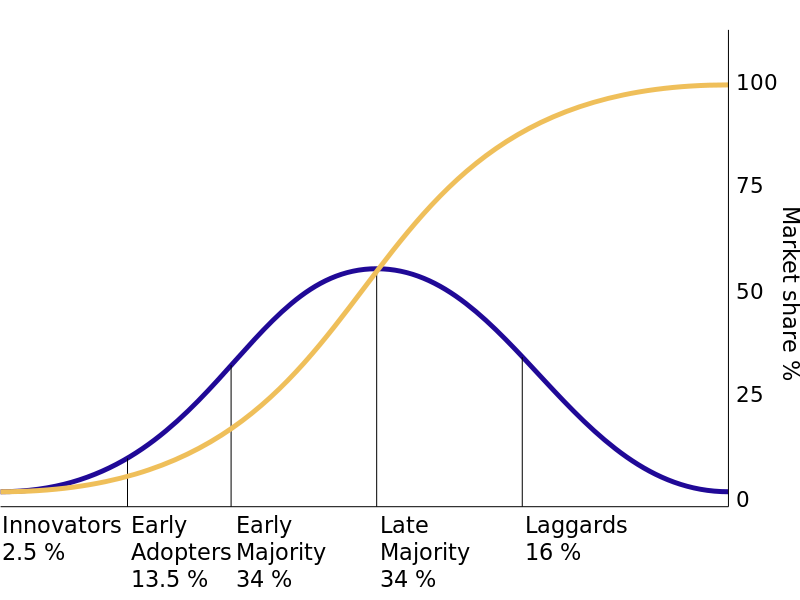

In other words, we have a long way to go before the rise of indexing causes the market to become inefficient enough to make active management a worthwhile endeavor. To answer the question asked in the title of this article, it appears that we may have indeed gone over the tipping point. We at Index Fund Advisors would like to think that we played a role in bringing this about. As John Bogle said when he endorsed Mark Hebner’s book, Index Funds, in 2007, We must be near a tipping point of passive over active. Perhaps Hebners book will mark the moment.

The company founded by Mr. Bogle, Vanguard, is the single largest provider of index funds, and every year, they have faithfully a study called The Case for Indexing which successfully argues that:

1) The average actively managed fund has underperformed benchmarks that properly reflect the risks undertaken.

2) Reported performance statistics can deteriorate markedly once survivorship bias is accounted for (that is, once the results of funds that were removed from the public record are included). This does not even consider incubator bias .

3) Persistence of performance among past winners is no more predictable than a flip of a coin (which is what we saw above with international funds).

Oddly, despite making such a strong case for indexing, Vanguard continues to offer actively managed funds, with a substantial percentage of their investors invested in them.

While we are elated to witness the continued migration from active to passive, we know that more is needed for investors to have a truly successful investment experience. Even with passive funds, it is still possible (and perhaphs even easier) for investors to engage in destructive behaviors such as market timing and style picking (tactical asset allocation ). This was recently documented by some German researchers in The Dark Side of ETFs . Specifically, they showed that investors obtained worse performance when they started using low-cost exchange-traded funds, and this deterioration was directly attributable to poor market timing. Indeed, when we look across several studies of investor performance versus investment performance, we see a substantial behavior gap .

We at Index Fund Advisors strive to close the behavior gap by advising our clients to buy and hold a risk-appropriate portfolio and rebalance. tax loss harvest and glide path the portfolio when warranted. The other ways that IFA adds value for our clients is include asset allocation. asset location. performance reporting. cash management. wealth management. the selection and monitoring of investments. and many other aspects of acting as a fiduciary for our clients. If you would like to learn more about IFA’s approach to investing and providing fiduciary wealth advice, please give us a call at 888-643-3133.

1 Ellis, Charles D. 2014. The Rise and Fall of Performance Investing , Financial Analysts Journal, vol. 70, no. 4 (july/August):14-23.