Active Share A Measure of Active Management Financial Web

Post on: 9 Апрель, 2015 No Comment

Evaluating active management can be a good way to help you differentiate between mutual funds. Active Share is a system that was developed to help you easily compare the active management of one fund against the other. Here are the basics of active share and how it can help you as an investor.

History

Active Share is a relatively new form of comparison for mutual funds. It was invented in 2006 by Martijn Cremers and Antti Petajisto of the Yale School of Management. They conducted a detailed study that led to some interesting findings that dealt with choosing a mutual fund based upon how actively it was managed. A good deal of technical analysis and experience went into formulating the system. Since that time, it has become a common method of comparison for mutual funds. However, the ability to calculate active share is not readily available to the public. Therefore, this is most commonly used by institutional investors who have access to the study.

What Is Active Share?

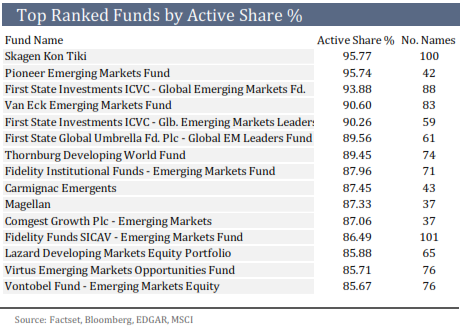

Understanding what Active Share is can help you make better investment decisions when it comes to mutual funds. Active Share is a method that is used to evaluate how actively managed a portfolio is. Mutual funds are gauged against a particular financial index to determine whether they are doing their job. The active share concept determines how different a mutual fund’s holdings are from the particular index against which it is being compared. The most interesting findings from the study indicate that the fund managers that actively managed their portfolios more than others also had the best odds to outperform their particular benchmark index. Therefore, they discovered that this system was a very useful method to use when choosing mutual funds.

In fact, they found that the funds that were ranked above 80 percent in the Active Share category outperformed their benchmark index by as much as 2.71 percent. This was determined after looking at mutual funds from 1980 to 2003, a very large statistical sampling. This indicates that if you want to choose a fund that outperforms the benchmark index, you ought to choose one with a very active fund manager.

The study also found that the majority of mutual funds tended to have a low rate of active management. As time went on, more and more mutual funds started to get away from active management. Part of this can be explained by the rise in index funds in the market; however, many mutual funds have been much less actively managed over the last few years.

Problems with Active Share

The results of the Active Share study show that one can choose mutual funds that have a good chance of beating their benchmark index. However, the problem with this method of comparison is that it is not readily available to the public. This is not a common tool that is used in the marketplace yet. Finding a fund that has displayed Active Share can thus be very difficult. Investors will have to perform their own calculations, which takes a substantial amount of time and the knowledge. Therefore, it may be difficult to find Active Share information about funds at times.

$7 Online Trading. Fast executions. Only at Scottrade