Active Managers Vs Equal Weight Indexes

Post on: 5 Июль, 2015 No Comment

By Rachael Revesz | 13 June, 2014

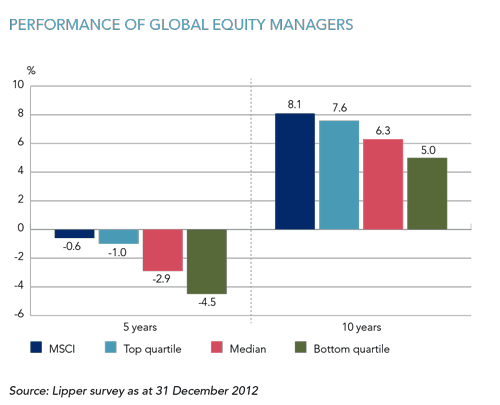

Active managers should be benchmarked against “harder to beat” equal weight indexes to test whether their performance is due to skill or luck, according to new research.

S&P Dow Jones Indices (SPDJI)’s June report, “Equal-Weight Benchmarking: Raising the Monkey Bars”, demonstrates that equal weight indexes, which rank all index constituents in the same proportion, have beaten indexes weighted by market capitalisation in the U.S. and in Europe. But most active managers fail to beat the market cap.

An equal weighted index is calculated by adding each stock’s return and dividing by the total number of stocks, and not measuring the average performance of the average invested dollar, like a market cap index.

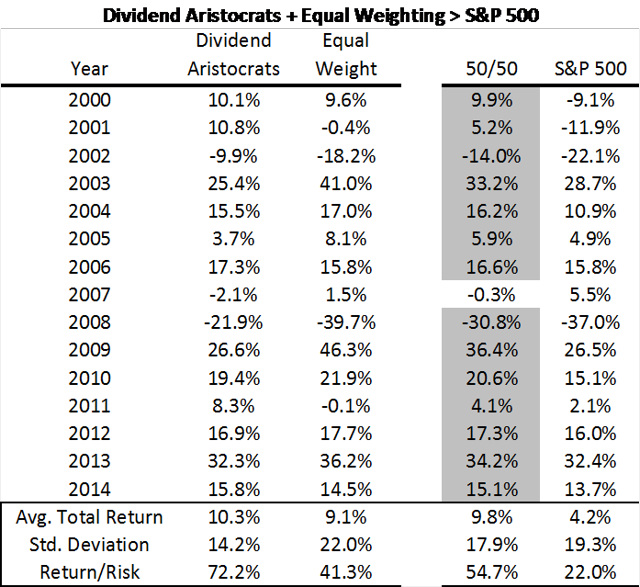

Annualised total return of the S&P Equal Weight Index between March 1999 and March 2014 was 9.1 percent, compared to the S&P market cap index’s 4.5 percent over the same period.

SPDJI data showed that out of $23.6 trillion invested in mutual funds, 87 percent of that was with active managers, yet average active fund performance was typically lower than the S&P 500 every year since 2008.

Tim Edwards, director of index investment strategy at SPDJI, said: “Equal weighting wasn’t smart in itself, but its success had the effect of making some alternatively weighted strategies look smart.”

Cass Business School was the first institution to float the idea last year that monkeys throwing darts at random stocks was more likely to beat the market than a cap-weighted index. This explains the success, to an extent, of an equal weight index, which gives no preference for one stock over the other.

Therefore investors should expect a so-called “alpha generating” strategy to beat an equal weighted index, but the S&P 500 Low Volatility Index and the S&P 500 Dividend Aristocrats indexes returned the same annualised return as the equal weight index.

Edwards said it seems as if the average active manager tilts towards equal weighting only to a small degree and charges significant fees.

However, the data did show that active stock pickers, compared to closet indexers or other styles of active management. were the only category to outperform their benchmark by an average 1.26 percent (between 1990 and 2009).

“[…] in periods when the average stock outperforms the capitalisation-weighted index, the standard comparison may be too easy,” the report noted.

“The convenience of equal weighting as a universal and “hard to beat” reference point is therefore a matter of potentially great practical importance.”