Active ETF Investing 3 Things To Consider

Post on: 25 Апрель, 2015 No Comment

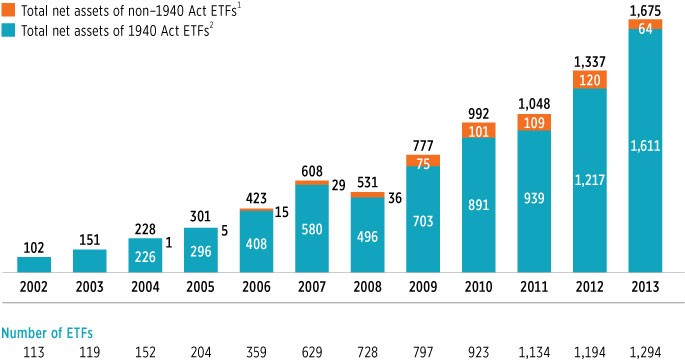

While the bread-and-butter of the ETF industry has been index-tracking products, active ETFs are quickly growing in popularity as several funds have gained critical mass with investors. There are now more than 55 different active ETFs with a combined $13 billion and counting in total assets under management. More importantly, these funds have allowed retail investors to apply professional management to a variety of asset classes and strategies [see 10 Questions About ETFs You’ve Been Too Afraid To Ask ].

Whats the Appeal?

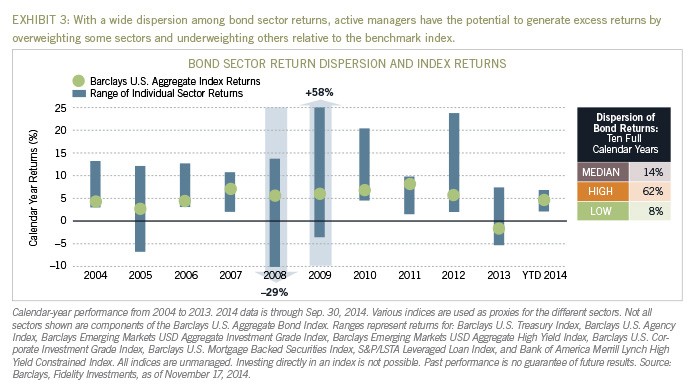

For investors, there’s a lot to like about active ETFs. First, given the markets heavy volatility over the last few years, active ETFs because they are managed by a professionalhave the ability to shift allocations and positions according to the economic environment. Recent studies have shown that managers with high “active shares”or the percentage of a funds weight-adjusted portfolio that differs from its benchmarkcan produce extra returns for portfolios. Typically, active ETFs have an alpha-seeking objective and are designed to “beat the market.” Those extra returns can mean a great deal when the market is moving sideways.

Secondly, active ETFs make a great substitute for mutual funds. Active ETF fees are often less expensive than mutual funds in the same Morningstar (MORN) category. This cheapness extends to esoteric asset classes normally reserved for high net worth individuals, which are only accessed through separate managed accounts [see our Mutual Fund To ETF Converter ].

Finally, like index ETFs, investors can gain access to superstar managers with lower initial investments. For example, Bond King Bill Gross’s and PIMCO’s flagship Total Return Fund requires an initial investment of $1,000 or more depending on the share class. The PIMCOs Total Return ETF (BOND, B+ )also managed by Bill Gross in a similar stylecan be purchased for around $110. This lower initial investment makes it more widely available to smaller investors.

How Much Will It Cost?

Though active ETFs are typically more expensive than passive index ETFs- some broad market trackers are basically free at this pointthey are still considerably cheaper than active managed mutual funds. According to the latest Investment Company Institute (ICI) report, the average mutual fund investorincluding index fundspaid 1.07% in expenses last year. That doesn’t even include the average 5.73% sales load [see Actively-Managed ETF Portfolio ].

For active ETF investors, these costs are much lower. For example, both the Guggenheim Enhanced Core Bond (GIY ) and Guggenheim Enhanced Short Duration Bond ETF (GSY ) can be had for only 0.27% in expenses. Below are the cheapest active ETFs in their respective asset class categories.