Active ETF Center

Post on: 10 Апрель, 2015 No Comment

Published on by Michael Johnston on June 3, 2011 | Updated September 11, 2014

Welcome to the ETF Database Active ETF Center, a special section of ETFdb.com dedicated to providing information on actively-managed exchange-traded funds (ETFs). Active ETFs have become increasingly popular in recent years, as investors have embraced these vehicles as a means of combining the talents of experienced and professional management teams with the benefits of the exchange-traded structure, including intraday liquidity, unparalleled transparency, and potential tax efficiencies.

As active ETFs have grown, there has been some confusion over both the potential limitations and advantages of these securities. The content below is designed to educate investors on the nuances of active ETFs, from relatively simple concepts to the more in-depth underpinnings:

Active ETF FAQs

Actively-managed ETFs are the subject of a fair amount of confusion, as many advisors and investors are confused over various aspects of these securities related to management, disclosure requirements, and differences relative to traditional mutual funds.

While many perceive active ETFs as somewhat complex mechanisms that introduce additional risk factors and structural underpinnings, in reality they are rather simple instruments that can offer exposure to attractive active management strategies along with all the benefits of the exchange-traded structure available through passively-indexed products. This piece addresses several of the most commonly asked questions surrounding active ETFs, from disclosure risks to myths about expenses.

Bond ETF Breakdowns: Case For Active Management In Fixed Income Portfolios

Bond ETFs have become increasingly popular in recent years, as more and more advisors have embraced the exchange-traded structure as a means of establishing fixed income exposure within client portfolios. This movement is part of a larger trend, as investors have embraced a vehicle that features low expense ratios and potential tax efficiencies across a variety of asset classes.

While the combination of fixed income exposure and ETFs yields some significant advantages, this marriage also has the potential to expose assets to certain biases and return drags that may ultimately result in a less-than-optimal investing experience. In this article, we dive into some of the ramifications of achieving fixed income exposure through a passively-indexed product, highlighting the potential pitfalls of passive bond ETFs.

Active ETFs vs. Mutual Funds: Highlighting Critical Differences

When discussing various options for achieving exposure to an asset class, some investors show a lack of understanding by comparing ETFs vs. active management or the merits of mutual funds vs. passive indexing strategies. While active ETFs are seen often viewed as securities that are similar to traditional mutual funds, the reality is that there are significant structural differences between the two that often have a major impact on risk, return, and investor experience.

This articles compares active ETFs with traditional mutual funds, highlighting the few similarities and many differences, and discussing the ramifications of these distinctions on a portfolios bottom line.

Active ETF Investing: 3 Things To Consider

While the bread-and-butter of the ETF industry has been index-tracking products, active ETFs are quickly growing in popularity as several funds have gained critical mass with investors. There are now more than 55 different active ETFs. More importantly, these funds have allowed retail investors to apply professional management to a variety of asset classes and strategies

In this piece we highlight three crucial factors potential active ETF investors need to consider.

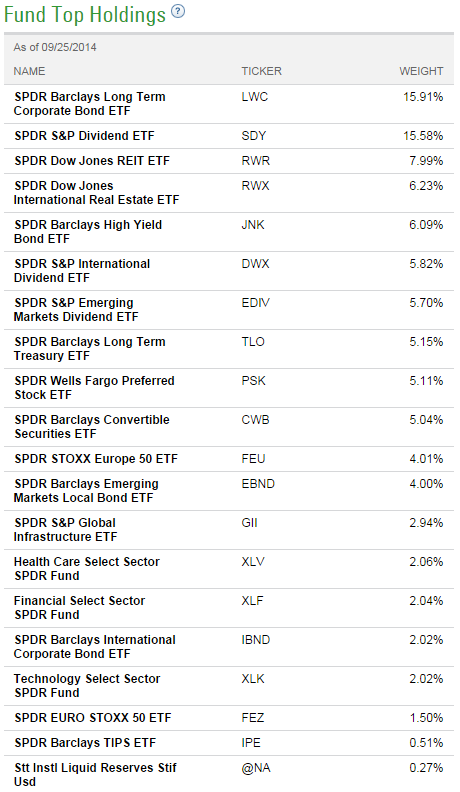

Under the Hood of the 5 Largest Actively Managed ETFs

Over the years, the ETF industry has expanded rapidly, allowing investors to gain access to not only every asset class, but also to various investment strategies. Actively-managed funds, in particular, have become more popular among investors looking for a more cost effective way of tapping into the expertise of management professionals.

In this piece, we’ll go under the hood of the five largest actively managed ETFs, highlighting each fund’s expenses, investment strategy, portfolio, performance, and management.