ABCs of Evaluating Funds How Are Frontier Markets and Emerging Markets Different

Post on: 24 Июль, 2015 No Comment

For a long time the investment world was divided into three geographic segments: domestic market, international developed markets and emerging markets. The logic was fairly straightforward: allocate most of your funds to your home market (particularly if your home market was the US), put a decent chunk into the more stable foreign markets that could provide some low correlation benefits and a natural currency hedge, and save about 5% for more speculative return-seeking in the highly volatile emerging markets. Mutual fund families continue to clearly reflect this established taxonomy, with the larger fund families tending to offer a variety of domestic (US) styles alongside international funds where developed and emerging markets are clearly separated.

However, the world has changed and so have market definitions. Recently, a new classification has appeared on the scene: frontier markets. The MSCI database of global markets now produces separate and mutually exclusive indexes for emerging and frontier markets. Fund managers have caught on, and frontier funds have been coming online at a steady pace over the recent past. What do you need to know in being able to differentiate and evaluate frontier funds and mutual funds ?

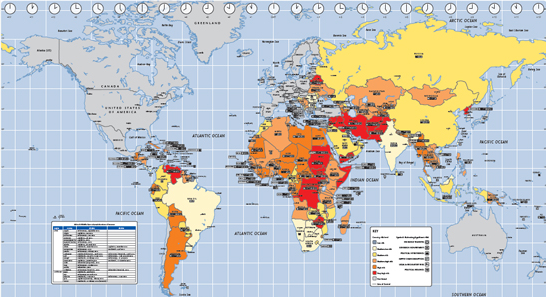

Looking at the MSCI indexes, it is pretty clear to infer some differences: the MSCI Emerging Markets Index contains the global economic growth engines of China, India and Brazil along with other countries, like Malaysia and Chile, whose risk-return patterns, if anything, look more stable than those of peripheral European countries like Greece and Portugal (more about this in a minute). On the other hand, the MSCI Frontier Markets Index is home to such markets as Ghana, Ukraine, Tunisia and Vietnam – good for a roll of the dice, you may think, but not for the frail of stomach.

Perhaps the most accurate short answer is to say that today’s frontier markets are yesterday’s emerging markets. When emerging markets first came into the sights of mainstream investment portfolios, in the late 1980s, the world was quite a different place. China was less than ten years into its experiment with capitalism after the collapse of the Cultural Revolution and the rule of the Gang of Four. The Berlin Wall was coming down and Eastern Europe earned the apt moniker of Wild, Wild East. Telecom privatizations in Southeast Asia were red hot tickets for big institutions, but highly volatile. The risk differential between US/European markets and emerging markets was usually pronounced – average volatility in developed market indexes could be in the area of 15% while the comparable figure for emerging markets was maybe 30%.

In those days, the 5% rule was a good one – in other words 5% to emerging markets and the rest to less risky prospects. Now that 5% rule is probably not a bad idea for frontier markets. These markets have some distinctive risks. Trading in local securities can be very illiquid (foreign-listed ADRs can partially address this risk), legal and political risk factors tend to be high and for the most part local enterprises have yet to establish themselves as leaders on the global stage.

What about emerging markets? Have the Chinas and Mexicos of the world changed enough to merit higher weightings than they traditionally have been accorded by portfolio managers? Opinion is split on this question; I tend to argue that the answer is yes. Emerging markets are where literally all the meaningful growth is taking place in today’s world economy. Moreover, we are seeing best-in-class competitors in these markets in a variety of sectors from specialty chemicals to building materials, from solar power to generic drug manufacturing. Investment portfolios ideally should reflect the actual distribution of global wealth, and increasingly that is tilting towards emerging markets.

And that brings me back to the likes of Greece and Portugal – so-called developed markets that currently seem to be anything but. A look at volatility patterns over the last 2-3 years reveals that emerging markets have actually evolved to relative parity with developed non-US markets by risk comparison. For example the MSCI EAFE index of developed international markets (Europe, Asia and Far East) has actually been more volatile over the past twelve months than the MSCI Emerging Markets Index.

How much you actually allocate to each of these categories depends on many things, primarily your own appetite for risk. But a reasonable benchmark for a diversified, growth-oriented equities portfolio might look something like this: 40% domestic US exposure, 30% international developed markets, 25% international emerging markets, and 5% frontier markets. The main thing to remember is that these definitions are not static. They evolve, and portfolios have to evolve with them.

Post a comment and share your thoughts and tips on emerging and frontier markets.

For a free, easy and objective way to find the best investments for you, visit Jemstep.com .