A Safer Money Market With Rule 2a7

Post on: 8 Апрель, 2015 No Comment

Money market mutual funds (MMMFs) are a type of mutual fund, regulated in the U.S. under the Investment Company Act of 1940 MMMFs provide valuable and diverse sources of short-term funding for key sectors in the economy including state and local governments, commercial paper, banks and the Federal government. Moreover, these funds give attractive options to short-term investors by providing professional money management and diversification at a low cost.

MMMFs attempt to maintain a net asset value (NAV) of $1/share, only the yield goes up and down. As a result, these funds have relatively low-risks compared to other mutual funds and pay dividends that generally reflect short-term interest rates. Therefore, MMMFs provide investors with a safe place to invest easily accessible cash-equivalent assets, usually for a year or less. MMMFs are important providers of liquidity to financial intermediaries (institutions that acts as a middleman between investors and those raising funds) and play an important role in our economy.

Money markets are able to stay constant because they do not invest in products that produce capital gains or losses. Should the NAV fall below $1/share, it is said to have broke the buck. Prior to September, 2008, investor losses in money markets were almost unheard of. However, that changed when Lehman Brothers Holdings Inc. filed for bankruptcy. On Tuesday, September 16, 2008, Reserve Primary Fund, broke the buck when its shares fell to 97 cents, after writing off debt issued by Lehman. There was concern that investor anxiety triggered by this incident would cause a run on money market funds. In response, the Department of Treasury established the Exchange Stabilization fund to insure the holdings of covered MMMFs; if a MMMF were to break the buck it will be restored to $1 NAV.

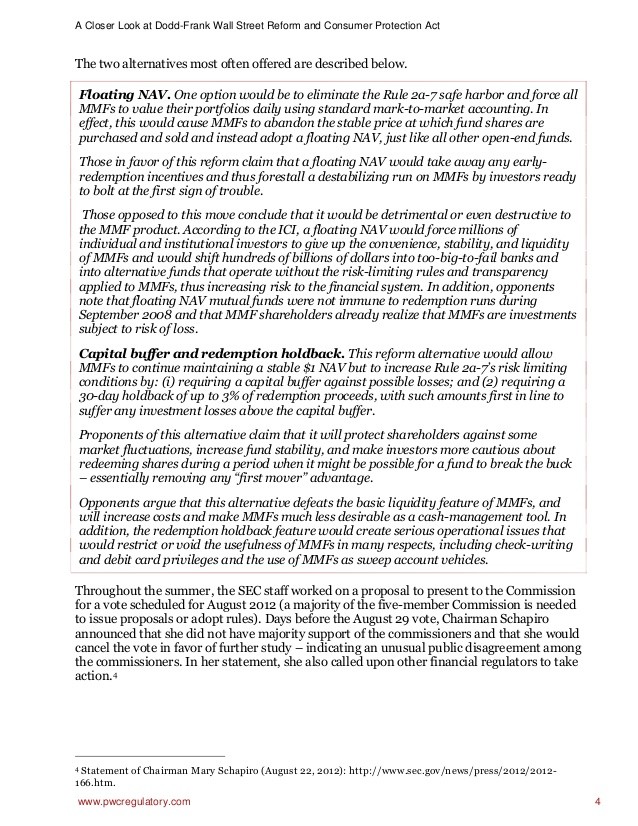

To mitigate the risks to MMMFs, in 2010, the Securities and Exchange Commission (SEC) made significant changes to Rule 2a-7 which, among other things, established stricter quality and liquidity requirements, as well as, shortened average maturities.  In November 2012, FSOC exercised its authority under Section 120 of the Dodd-Frank Act to propose further MMMF reform recommendations to the SEC.  The SEC, drawing from some of FSOC’s recommendations, proposed amendments in June 2013.  The SEC’s proposed reforms would consist of either or both of the following:

- Require a floating net asset value (NAV) for money market funds other than U.S. Government money market funds and retail money market funds (as defined in the Proposed Rules). The requirement would apply to all prime money market funds, as well as, certain tax-exempt money market funds (referred to in this letter as municipal money market funds), unless such funds constitute retail MMMFs.

- Impose two provisions that apply when the 5-day liquidity of a fund (other than a U.S. Government money market fund) drops below 15% of the funds’ total assets.  If so, the fund would be required to impose a liquidity fee of 2% on redemptions made after the fee is imposed, unless the board finds that: (i) either the fee is not in the best interest of the fund or, (ii) a lower fee is in the best interest of the fund. In addition, the board would have authority to temporarily suspend redemptions if the board finds that such suspension is in the best interest of the fund. Note: U.S. Government money market funds could voluntarily (but are not obligated to) implement either of these fundamental reforms.

Lastly, in March 2014, SEC’s Division of Economic and Risk Analysis issued analyses on the cost of liquidity during crisis periods and municipal MMMFs exposure to parents of guarantors.  These studies were intended to  further inform the June 2013 proposed amendments.

Position

As regulators continue to consider major structural changes to money market mutual fund reform regulation, SIFMA AMG remains concerned that certain of the SEC’s June 2013 proposed reforms would either obstruct the operation of MMMFs or, alter their indispensable characteristics and, thereby harm investors who rely on them as a cash management tool and, issuers who depend on them as an important source of financing. SIFMA AMG recommends several modifications of the proposed reforms with an eye towards strengthening the resilience of MMMFs in the face of market turmoil.

- Floating NAV vs. Fees and Gates Proposals. SEC should not to impose both the floating NAV and the liquidity fee and redemption gate proposals together on any type of MMMF.

- Municipal MMFs. Municipal MMFs, like government funds, should be explicitly exempted from further changes, as these funds have not shown susceptibility to destabilizing runs and are held primarily by retail investors.  Additionally, MMFs should continue to have a 25% basket for non-diversified credit support (the SEC has proposed eliminating this basket and their study seems to indicate they will do so).

- Retail Money Market Funds. We believe that retail money market funds should not be required to adopt a floating NAV.  We oppose defining retail funds by reference to a $1 million redemption limit.  We support an alternative of referencing social security # vs. taxpayer ID #s to identify retail funds.

- Liquidity Fee. If the SEC adopts a liquidity fee, the default level of the fee should be reduced from 2% (proposed) to 1%.  Data in the SEC’s Liquidity Cost Memorandum support that position.

- Implementation. The SEC should extend the implementation period if any of the proposed reforms are adopted: at least 3 years for floating NAV and at least 2 years for redemption fee and/or gate or, other reforms.