A Primer on FinanceLed Capitalism and Its Crisis

Post on: 8 Апрель, 2015 No Comment

Résumés

Cette contribution au débat sur le capitalisme financiarisé cherche à identifier les changements structurels principaux dans la nature de la finance depuis les années 80. Après avoir analysé la dynamique d’innovation financière, l’accent est mis sur le processus de titrisation comme moteur d’une nouvelle forme du capital financier, le capital fictif, qui nourrit les bulles spéculatives. L’éclatement de la dernière bulle, centré sur le marché immobilier américain, a déclenché la crise financière la plus sérieuse depuis des décennies. L’article se conclut sur une discussion des implications possibles de cette crise systémique.

Plan

Texte intégral

1 Ever since we responded to the worldwide stagflation crisis of the 1970s and early 1980s by deregulating banks and letting them reshape the workings of our economy, we have lived in a system dominated by finance. Representing a new accumulation regime in the sense developed first by the originators of the French Regulation School (Aglietta, 1976 ; Boyer & Saillard, 1995), finance-led capitalism (FLC) has spread its relentless logic of free-market regulation and shareholder value maximization across all corners of the world. Over the last quarter of a century its propagation has helped the integration of half of the planet’s human race into our private market economy, financed a new technological revolution, and pushed along the globalization process at a rapid clip. By organizing new ways to fund debt we have been able to smoothen out the business cycle and accommodate much larger external imbalances between countries, major achievements in our perennial stabilization efforts.

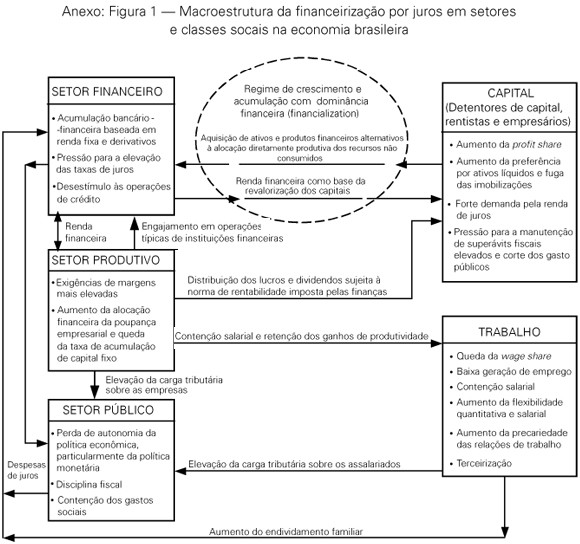

3 Regulationists and other heterodox economists have in recent years recognized the arrival of a qualitatively different type of capitalism, one termed alternately “patrimonial capitalism” (Aglietta, 1998), “finance-led growth regime” (Boyer, 2000), or “finance-dominated accumulation regime” (Stockhammer, 2007). No matter what name it gets referred to, the new regime is driven by finance (Tabb, 2007). Its central attribute is a process widely referred to as financialization which Epstein (2005, p. 3) has defined as “ the increasing role of financial motives, financial markets, financial actors and financial institutions in the operations of the domestic and international economies.” When looking at it in the concrete, financialization is a complex process comprising many different facets 1.

1.1. Shareholder Value Maximization

4 On the level of the firm, financialization refers above all to the dominance of shareholder value maximization among corporate objectives. This change came about with the emergence of different types of funds – pension funds, mutual funds, more recently also hedge funds – which pool together smaller investors for the benefits of scale (better diversification, more information, lower transaction costs, etc.). The rapid growth of these so-called institutional investors over the last quarter of a century has turned them into the principal shareholders of large firms across the globe. They often use their ownership rights to impose a financial logic rooted in quarterly per-share earnings as defining measure of performance, a logic pervading corporate boardrooms and governance rules (Aglietta & Rebérioux, 2004). Thus subject to intense market pressure, managers prioritize short-term results over long-term activities which would be far more productive for growth – research and development, renewal of plant and equipment, skill formation of its work-force, nourishment of long-term relations with suppliers. Mergers and acquisitions are preferred as method for growth over investment in new, additional production capacity. Facing now suddenly a much more active market for corporate control, underperforming corporations have to worry about shareholder revolts, takeover bids by competitors, leveraged buy-outs by private-equity funds wishing to take them private and/or break them up, and pressure from well-funded corporate raiders. The share price is thus the key variable around which corporate management organizes its action, prompting frequent stock buy-backs, use of shares as currency, stretching of accounting rules, and manipulation of financial statements.

1.2. The Decoupling of Profits and Investment

5 The dominance of shareholder interests, reinforced by the prevalence of stock options and profit-based performance bonuses as major components of management pay, is suspected to be the major culprit behind the sluggish investment performance relative to historically high levels of corporate profitability during the last couple of decades (Stockhammer, 2004 ; 2006). Investment involves immediate cost outlays and delayed benefits, thus tends to reduce profits at first before boosting them later…not something undertaken lightly when the primary focus has become quarterly profit. There is, of course, the often cheaper alternative of buying already-existing production capacity in the (stock) market of corporate control through mergers or acquisitions. Such fusions have the added advantage, from the point of view of the sector as a whole, of avoiding capacity expansion and thereby forestalling global overproduction problems which, in light of the extremely rapid industrialization of emerging-market economies in parts of Asia, Eastern Europe, Latin America, and Africa is nowadays always a threat. The global merger booms of the 1990s and 2000s, good business for yet another financial institution at the center of the financialization process, the investment banks. show up as a rise in financial assets rather than as productive investment. And we have indeed seen huge increases in the financial asset portfolios of non-financial corporations during that period, with financial income (interest, dividends, capital gains) becoming correspondingly more important. Part of this trend may also reflect a changing conception of leading firms as orchestrators of global production networks whose capacity for decentralization of production depends on centralizing collection of cash flows and investing them in liquid assets for easier redeployment of capital. As this trend unfolds, it will become increasingly difficult to capture the entire investment dynamic of American or European corporations just by looking at their home country’s investment data.

1.3. The Redistribution of Income

6 The third facet of financialization is an extension of the second to the extent that the relatively high profits of recent years have had to be shared with a larger number of investors taking their cut from the pie. We have seen a steady decline of the share of profits retained for re-investment and a concomitant increase in the share of profits paid out to shareholders as dividends. Creditors get their interest payments, and financial intermediaries their fees and commissions. Add in capital gains, and you can begin to see that financial income has risen steadily as a share of the total, forcing industrialists to push for higher profits at the expense of stagnant, often even falling wage shares. This redistribution of functional income shares from wages via industrial profit to financial income is tied to a parallel shift in personal income distribution in favor of the richest among whom most of the financial assets are concentrated, as well as even more unequal distribution of wealth – a general trend among most industrial nations (Power, Epstein, and Abrena, 2003 ; Wolff, 2004). Of course, the declining wage share has during the last quarter of century been compensated for by falling personal saving rates and rising levels of consumer debt, another important aspect of the growth dynamic in finance-led capitalism (Guttmann & Plihon, 2008).

1.4. Biased Growth Dynamic

7 Different heterodox approaches have tried to link financialization to economic growth, aiming to figure out how best to model the connection between the two. The regulationist approach (Boyer, 2000) analyzes how the dominance of financial capital has impacted on the main institutional forms of an accumulation regime (i.e. competition, the wage relation, and economic policy). Post-Keynesian stock-flow (Lavoie, 2007) or growth-distribution (Hein & Van Treer, 2007) models try to shed light on the macro-economic embeddedness of variables related to finance (dividend payout ratios versus investment spending, interest rates linked to exchange rates, etc.). Economists grouped around the Union of Radical Political Economists (Tabb, 2007) analyze finance as a cyclical engine of growth within the social-structure-of-accumulation approach which in many ways resembles the French regulation approach.

8 Even though all three approaches contain many valuable insights concerning the growth dynamics of finance-led capitalism, the constraint of modelisation necessitates a typically very simplified, easily quantifiable proxy measure for financialization (e.g. dividend pay-out ratio) which treats the whole complexity of the phenomenon in far too compressed a fashion. We propose here to add two dimensions for further analysis which may help us understand financialization in more complete fashion. The first looks at changes in the modus operandi of finance over the last couple of decades. And the second pertains to financial globalization remaking the world economy into something more than just the sum of its parts. Finance-led capitalism is crucially shaped by both of these forces.

9 Finance has been profoundly transformed by a combination of deregulation, globalization, and computerization (Guttmann, 1996 ; Plihon, 2008). This triple push has changed our financial system from one that was tightly controlled, nationally organized, and centered on commercial banking (taking deposits, making loans) to one that is self-regulated, global in reach, and centered on investment banking (brokerage, dealing, and underwriting of securities). The preference for financial markets over indirect finance using commercial banks has been greatly facilitated by the emergence of funds – pension funds, mutual funds, more recently also hedge funds and private-equity funds – as key buyers in those markets. These structural changes of our credit system have been very much shaped by financial innovation on a massive scale. Key innovations, while making the overall credit system more flexible and responsive to the needs of both creditors and debtors, have also encouraged asset bubbles, underestimation of risks, and excessive leverage. Now that these destabilizing tendencies have combined into what may arguably be the most serious financial crisis since the Great Depression of the 1930s, we need to trace back how we got here before we can claim to know how we can go forward.

2.1. The Transformation of Finance

10 The post-war regulatory regime for money and banking, best characterized as a system of nationally administered credit-money based on low interest rates, fixed exchange rates, tight regulation of banking activities, and bank loans as engine of money creation, came undone when its international framework, the dollar-based Bretton Woods system (1945-1971), fell apart in a series of speculative attacks against an overvalued dollar. Those attacks were catapulted to an unprecedented scale by the Eurocurrency market. That major innovation emerged during the early 1960s when excess injections of dollars into international circulation via steadily growing U.S. balance-of-payments deficits looked for a new absorption circuit. Consisting of bank deposits and loans in key currencies located outside of their country of original issue (e.g. $-denominated deposits in Paris, €-denominated loan originating in London), this global banking network bypassed the reach of central banks. With the help of two computer networks (SWIFT, CHIPS) the Eurocurrency market made it easy to move funds in and out of countries and currencies as a conduit for currency speculation2. It also enabled banks and their clients to circumvent many domestic regulations like America’s controls on capital outflows and interest-rate ceilings. Add to this a deepening clash after 1969 between intensifying stagflation, a new form of structural crisis, and the post-war regime’s pillars of low interest rates and fixed exchange rates. The Eurocurrency market exploded this contradiction in spectacular flights out of the dollar (March 1968, July 1971, February 1973) which led to the dismantling of fixed exchange rates in March 1973, two oil-price shocks calibrated by sharp declines of the dollar (October 1973, March 1979), and finally the end of America’s low-interest policy in October 1979.

11 All this occurred before the conservative counter-revolution of Reagan and Thatcher, which in the 1980s pushed the free-market doctrine across the world to make privatization and deregulation politically viable elsewhere. Deregulation of banking spread from the United States to continental Europe (via the Single European Act of 1987 and the Second Banking Directive of 1989), to many developing countries forced to reform their banking sectors in the aftermath of the LDC debt crisis of 1982-87, finally to emerging market economies (Russia, Asian “tigers” of Pacific Rim from Thailand to Korea) in the wake of their currency and banking crises of the late 1990s. This global process included an IMF push for worldwide liberalization of capital movements during the 1980s and early 1990s (Eichengreen and Mussa, 1998), a global “reciprocal access” accord in 1997 on financial services under the auspices of the World Trade Organization, and – still being pushed by the United States, but heavily resisted elsewhere – a multilateral accord on investments.

12 U.S. banks, in the meantime, faced the new world of deregulated money prices by investing heavily in foreign-exchange trading and having to compete for funds with higher deposit rates. Resuming price competition for the first time since the Great Depression, they sought to compensate for costlier funds by seeking higher-yielding assets and pushing into fee-generating activities that would leave them less exposed to interest-rate risk and less dependent on interest income. They were greatly helped in this diversification push by ambiguities and loopholes resulting from a rather chaotic regulatory structure in the United States3. Long-standing barriers to the geographic reach and range of permissible activities were hence gradually undermined while policy-makers spent a decade arguing about what new structure to give the American financial-services industry. That debate was resolved in 1999 with passage of the Financial Services Modernization Act, which repealed the banking-activity restrictions of the Depression-era Glass-Steagall Act.

13 Deregulation has enabled banks to expand into new geographic areas as well as widen the range of their services. While there remain many specialized niche players across the entire spectrum of financial services, the world’s leading financial institutions have all become huge conglomerates keen on integrating different types of services, instruments, and markets. Typically they combine several financial functions – commercial banking, investment banking, fund management, private wealth management, and insurance – under one roof, hoping to enjoy significant scope and network economies in the process. There are perhaps four-hundred or so of those “do-it-all” financial groups. and their trans-national organization is what makes finance a truly global industry. Their multi-product approach to finance has also accelerated a certain convergence of once-diverse national financial structures, as concerns the relative importance of financial markets, the interaction between banks and those markets, and the degree of concentration in the provision of banking services (see Plihon et alii 2006 ; Pastré et alii. 2007).

14 Apart from the world-wide market presence of the leading trans-national banks, financial globalization also includes globally diversified portfolios of (mutual, pension, and hedge) funds, cross-border hook-ups of securities exchanges (e.g. NYSE and Euronext), the emergence of truly international capital markets like Euromarket notes, bonds, and shares (Cartapanis, 2004), and phenomenal increases in international capital flows following their widespread liberalization during the 1990s. Thanks to technology it has become much easier to organize financial markets via electronic trading platforms connecting a worldwide community of investors and issuers seeking their funds. The era of electronic money and banking is upon us (Guttmann, 2003). The thrust of this technological progress, centered on much-improved information-processing and communication capacity within planetary networks (the internet, SWIFT, CHIPS, etc.), lends itself to webs of financial transactions and money transfers beyond national boundaries. Given money’s inherent mobility, the cross-border push of finance has spearheaded the broader globalization process.

2.2. Financial Innovation

15 The computerization of finance has dramatically improved the system’s ability to innovate. In contrast to the creation of tangibles in industrial innovation, financial innovation concerns mostly implementation of contractual arrangements, which meet the funding and/or portfolio-management needs of borrowers, lenders, and the financial intermediaries bringing those two sides together. That kind of activity is much more easily implemented than industrial innovation, but also more readily copied and devoid of protection by intellectual property rights, hence endowed with a much shorter life cycle. This fact explains the frantic pace of financial innovation as well as its tendency towards complexity and customization both of which make the end result more difficult to imitate.

16 Another key aspect of financial innovation is its relationship to regulation. Key innovations over the last three decades circumvented prevailing regulatory restrictions, which in the process ended up weakened to the point of no longer performing as intended. Such successful demolition of existing regulations occurred already early on, during the 1960s, when U.S. banks introduced a series of new money-market instruments (e.g. Federal funds, commercial paper, negotiable certificates of deposit, bankers’ acceptances), which they used to fund credit expansion beyond their Fed-controlled deposit base. One such so-called borrowed liability (“passif emprunté”) then coming into vogue were the Eurodollar deposits which U.S. banks used to help their corporate clients escape the Fed’s interest-rate ceilings on domestic deposits or controls on capital outflows4. Another important example of regulation-evading innovation was the use of securitization and credit-default swaps by banks to readjust their loan portfolios in response to the 1988 Basel Accord’s capital requirements by selling off low-risk loans and insuring high-risk loans they wanted to keep.

17 That last example points to an even more complex relationship between innovation and regulation, described by Kane (1981) accurately as regulatory dialectic. The aforementioned Basel Accord of 1988 was itself the result of a global effort, under the auspices of the Bank for International Settlements (BIS), to regulate the hitherto unregulated Eurocurrency market after it had triggered the LDC debt crisis of 1982-87. And to the extent that banks used securitization and credit default swaps to thwart that accord, they forced a reform of the latter, now known as “Basel II.” Banks use innovation to undermine existing regulations only to drive their new-found freedom too far, create conditions of crisis, and so invite re-regulation in response.

18 The most important financial innovations in this regard are those creating new networks of financial intermediation, which have moved our credit system beyond the confines of traditional commercial banking. We have so far had four of those, each one playing a crucial role in the emergence of finance-led capitalism.

The introduction in the 1960s of money-market instruments, so-called borrowed liabilities, which freed banks to pursue much more aggressive lending than had been the case when they depended just on deposit liabilities as source of funds.

One borrowed liability in particular, the Eurodollars, has given rise to a truly supra-national commercial banking network beyond the jurisdiction of any national central bank.

A third intermediation alternative, this one initially in direct competition with commercial banks, reached critical mass in the 1980s when mutual funds and pension funds became popular vehicles for household savings, which they invested in securities. These so-called institutional investors provided liquidity to many financial markets whose growth they greatly boosted as a result. Banks met this challenge by setting up their own mutual funds, taking over management of pension funds, and helping to launch hedge funds.

Banks then developed yet another lucrative income source with securitization. the repackaging of loans into securities backed by the income flows generated from those loan pools, which took off in the 1990s when such loan-backed securities began to attract an ever-growing number of investors across the globe.

2.3. From Loans to Securities

19 Those four alternative intermediation networks contributed to a historic shift in the preferred form of credit from loans to securities. We can see this trend take hold with the spread of money-market instruments into a gigantic inter-bank market at the center of the world economy, with the gradual extension of the Eurocurrency market beyond deposits and loans toward a fully developed, truly international capital market, with institutional investors helping to launch financial markets in emerging-market economies, and above all with the securitization of loans. Add to this the success of high-yield (“ junk ”) bonds, which have given many smaller firms a welcome alternative to bank loans. The trend towards market-based finance has also been reinforced by derivatives. such as futures, options, forwards, or swaps. These instruments help reduce different types of risks associated with finance, yet also serve as excellent tools of speculation5 .

20 Securities compare favorably to loans for several reasons, depending which side of the transaction we are considering. Suppliers of funds like them better, because these instruments give them an exit option whereas loans do not. Users of funds find them less costly than loans, with larger amounts available all at once. They also may prefer the formal information-disclosure rules associated with securities over the informal, often too intimate relationships with nosy loan officers. The switch from loans to securities as principal form of credit has been greatly facilitated by the parallel shift from bank deposits to funds as principal savings outlets, which has generated a huge demand for securities. It has, of course, also benefited the investment banks and their brokerage, dealership, and underwriting of securities. Commercial banks, facing a potentially lasting decline of their traditional intermediation function, reacted to this threat by getting into the fund business themselves. They have also taken over the creation of informal and decentralized over-the-counter (OTC) markets in which many of the new derivatives and securitization instruments have come to be traded. This market-making activity earns them large sums of fees. Finally, banks also provide liquidity to these markets with broker loans, emergency lines of credits, and other funding facilities, all of which earns them additional interest incomes.

2.4. Fictitious Capital

21 The structural shift in our credit system described here brings to mind an important distinction made by Marx (1895/1959, ch. 25) between interest-bearing capital, based on bank loans, and fictitious capital, applying to “ tradable paper claims to wealth ” or what we refer today as securities. Marx deemed such claims fictitious inasmuch as they had no counterpart in real physical asset values and instead generated their income from capitalization of an anticipated payment to which ownership of the claim entitled its holder. Marx viewed the emergence of fictitious capital as a byproduct of the development of the credit system and joint-stock system. To him, credit-money generated by the banking system without counterpart in gold was itself the most fundamental form of fictitious capital, because its creation ex nihilo generates purchasing power unrelated to the value of any real production, consumption, or underlying physical assets6. The other two forms of fictitious capital he discussed were government bonds to finance deficit spending and equity shares traded in the stock market whose valuation (a firm’s “ market value ”) was unrelated to what a business or its production were really worth (in terms of its “ book value ” based on replacement costs of its plant and equipment).

22 Marx’s “ fictitious capital ” concept implies above all that the market value of paper claims could be driven up without any parallel increases in the valuation of any tangible assets, through the use of credit, for the benefit of trading those claims profitably. What he describes here amounts to trading of securities and other financial claims for capital gains that arise from the difference between the (presumably lower) purchase price and (higher) sales price. The possibility of artificially inflating prices of securities for potential capital gains stems not least from demand and supply factors that are themselves subject to manipulation for precisely that purpose, including use of credit to boost demand and having intermediaries (e.g. underwriters, dealers, brokers) control supply.

23 Compared to Marx’s time we have nowadays an infinitely more advanced formation of fictitious capital, with much of the recent shift from bank loans to securities amounting in effect to a quantum leap in its development. In other words, FLC has given priority to fictitious capital whose new conduits, such as derivatives or asset-backed securities, are several layers removed from any real economic activity of value creation. In that realm the key objective is to trade paper assets profitably for capital gains, an activity best described as speculation 7. Many recent developments of finance, such as securitization, the explosion in the volume of trading of derivatives, the spread of hedge funds, massive purchases of securities by banks, etc. must be understood from this angle.

24 One only has to look at the proliferation of new financial instruments and the phenomenal increase in their trading volumes to get a sense of how dominant fictitious capital has become over the last couple of decades. Much of that growth has been fuelled by a significant shift in the portfolio composition of banks from extending loans to purchasing securities. As banks get vested significantly more in securities than they used to, a lot of money creation gets directed toward financial markets where it boosts trading volumes and asset prices. Since such speculative activity creates a lot of new money while at the same time not showing up in the GDP data (except for a small fraction representing service-related income to financial institutions), the velocity of money declines – as it has persistently in the E.U. since 1980 (Plihon, 2008, p. 48). Much of this funding of speculative activity does not even show up in the financial statements of banks, having been moved off their balance sheets to avoid taxes or capital requirements. But its very opacity, implying relative disassociation from the “ real ” world, is also what makes speculation so attractive. Unlike physical capacity constraints pertaining to plant and equipment, financial markets are limited only by the collective imagination of their users, the traders. And while other types of financial income such as interest or dividends are directly deducted from industrial profits, capital gains face no such restraints provided asset prices continue to climb. And climb they do, as long as widespread euphoria directs a lot of liquidity towards these assets and their markets.

3.1. The Leverage Effect

25 In light of its attractive growth potential, banks have built a multi-layered financing machine in support of speculation as major economic activity. Their injection of liquidity extends beyond purchases of securities to funding support for other investors, such as hedge funds, so that those may boost their trading capacity and portfolio size considerably. Many speculators are willing to take on a lot of debt in order to magnify their gains, benefiting so from the so-called leverage effect. A higher level of debt keeps down one’s own investment of capital, enabling speculators to boost their rate of return on capital for any given movement of asset prices in the right direction8. The phenomenal expansion of fictitious capital has thus been sustained by banks directing a lot of credit towards asset buyers to finance their speculative trading with a high degree of leverage and thus on a much enlarged scale.

26 With all this liquidity boosting the number of speculative players and the scale of their trading activity, financial markets have experienced strong growth and price appreciation. Such expansion can easily become self-feeding, as success breeds an inclination for greater risk-taking. That same success also boosts speculators’ capacity to borrow, not least by using higher-valued assets as collateral. Regulationists, notably Aglietta (1995, pp. 22-34) and Orléan (1999 ; 2004), have done a good job attacking the mainstream “ efficient-market hypothesis ” and mapping out a collectively elaborated dynamic of financial-market excess as an alternative. Their notion of “ rationalité auto-référentielle, ” close to Keynes’ beauty-contest metaphor of looking at the market’s psychology, is especially useful in explaining the tendency of highly leveraged speculators to launch self-feeding processes of asset inflation in strategic markets – commodities, real estate, financial claims.

3.2. The “ Bubble ” Economy

27 In recent years we have seen this phenomenon play out recurrently. Just as we have elevated speculation to a core economic activity, so have we created a bias in our economy towards “ asset bubbles, ” a key characteristic of today’s finance-driven economy. The fact that their object is fictitious capital does not mean that those bubbles are without impact on the “ real ” economy. To begin with, the widespread distinction between “ real ” and “ monetary ” spheres makes no sense in an economy composed of (spatially and temporally inter-dependent) monetary circuits whose major purpose is the accumulation of money as capital. Even abstracting from that, the majority of economists concede the impact of the so-called wealth effect whereby rising asset prices boost consumption (FRBSF, 2007). Also noteworthy is the impact on business investment, as implied by a rise in Tobin’s (1969) Q Ratio. the ratio of a firm’s market value to its book value, boosting the willingness and ability of corporations to increase their investment expenditures. Rapidly rising stock prices also enrich greatly the managerial class (via stock options) and provide the financing for more mergers and acquisitions by means of stock swaps using shares as currency.

28 When we look at the three major asset bubbles experienced by the U.S. economy over the last quarter of a century, we can identify additional sources of impact on the pace and composition of overall economic activity. Each arose in the context of excessive stimulation where the Fed, worried about greater risks of deflation in the wake of recessions, kept interest rates very low a couple of years into recovery. These bubbles were driven forward by financial innovations that proved very effective in mobilizing a lot of additional financing for purchases of booming assets. In the second half of the 1980s junk bonds helped finance the huge wave of hostile-takeover bids by corporate raiders, which prompted the imposition of shareholder value maximization and ruthless restructuring as key pillars of a new corporate-governance regime. In the late 1990s the combination of aggressive venture capitalists, initial public offerings, and a revitalized NASDAQ created a potent mix for funding a new (post)industrial revolution centered on the internet. And in the mid-2000s non-traditional mortgages and new channels of securitization fed America’s spectacular real-estate boom.

29 We have also learned that what goes up must come down, confirming the financial-instability hypothesis of Kindleberger (1978) and Minsky (1982 ; 1986) according to which speculative bubbles trigger sooner or later spectacular financial crises – the stock-market crash of October 1987, NASDAQ’s collapse of March 2000, the disintegration of securitization in August 2007. As the economy was greatly affected by the bubble on the way up, so was it also shaken each time on the way down by the post-burst retrenchment leading to recession (in 90/91, 00/01, and 07/08).

3.3. Global Seigniorage

30 It is not at all surprising that FLC’s propensity for a “ bubble economy ” has been most pronounced in the United States. Apart from cultural proclivities (get-rich-quick mentality, positive attitude toward debt, etc.), there are also institutional factors to consider. Perhaps the most important of those is the privileged position of the United States at the center of a dollar-based international monetary system. Having to supply other countries with dollars for their cross-border payments, the United States must run chronic balance-of-payments deficits in order to maintain steady outflows of dollars to the rest of the world. These external U.S. deficits are financed automatically by non-American actors using dollars as international medium of exchange or store of value. Being thus the only country in the world not to face an external constraint, the United States can run much more stimulative economic policies than anyone else without having to worry about its external position, the level of its foreign-exchange reserves, or exchange rates – a huge advantage which I have termed elsewhere “ global seigniorage ” (Guttmann, 1994 ; ch. 15)9. That advantage extends to having much of the world’s financial capital denominated in U.S. dollars, an asymmetry that helps the United States maintain more easily the deepest and most liquid financial markets.

31 This privileged position has propelled the United States into the role of “ locomotive ” for the world economy ever since the end of World War II. During the Bretton Woods phase (1945-1971) the U.S. acted as global stimulator via overvaluation of its currency and capital exports that helped fuel the catching-up process of other industrial nations (Germany, Japan, etc.) around export-led growth strategies. Dramatic shifts in U.S. policy mix breaking the global stagflation dynamic (1979-82) saw the U.S. economy resuming its locomotive role by becoming the world’s “ consumer of the last resort. ” Ever since 1985 the U.S. has run up rising trade deficits, which have been financed by the growing trade surpluses of the rest of the world being recycled as capital exports to the US. With a trade deficit equaling 7 % of its GDP, the U.S. absorbs almost half of the world’s savings while running a negative savings rate of its own10.

32 America’s latest asset bubble assumed in this context a special role in the growth dynamic of the world economy. Financial innovations related to home ownership, notably mortgage re-financings and home-equity loans, allowed U.S. households (69 % of whom are home-owners) to cash in capital gains from rising housing prices without having to sell off their homes. U.S. banks launched their own mortgage-backed securities in the late 1990s and then, after 2003, found a way to repackage even pools of riskier non-traditional mortgages (subprimes, Alt-As, and piggy-backs) into high-grade securities by bundling MBS into collateralized debt obligations. The influx of funds generated by these securitization techniques financed a historic real-estate boom which fuelled excess consumption in the U.S. and export-led growth elsewhere.

33 Much has been said about the crisis of the “ subprimes ” and its spread into a global credit crunch11. On the one hand, it has followed a classic pattern of euphoria-driven overextension, a moment of acute instability marking a turning point, and panicky retrenchment. Yet, as is always the case with major financial crises, this one too had its unique features which bear reflection.

4.1. The Collapse of Securitization

34 Especially stunning in the current crisis have been the speed, reach, and ferocity of ruptures, once crisis conditions spilled out of a fairly small slice of the U.S. mortgage market to engulf and take down several inter-connected securitization layers. The destruction of this global shadow banking system during the summer of 2007 rendered a trillion dollar of asset-backed securities largely worthless, wiping out a significant portion of the leading banks’ capital cushions. Forced by new (mark-to-market) accounting rules to recognize their losses early, the banks were nonetheless afforded an ironic degree of flexibility during the first phase of the global credit crunch. Since the markets for securitized instruments had largely ceased to exist by late September 2007, the banks had no ongoing price signals to go by and could so estimate their losses instead (i.e. mark-to-“ model ” accounting). Most decided to write down their losses gradually in conjunction with recurrent injections of new capital to match those losses. A series of innovative central bank steps to broaden bank access to liquidity (via regular money auctions, currency swaps, and asset swaps) kept any disruptions in the world’s money markets in check and so bought the banks time to pursue their gradualist strategy of loss recognition.

35 Unfortunately, this strategy proved flawed before the crisis could be resolved. The collapse of Bear Stearns in March 2008 made it clear that, in the face of moral hazard. U.S.-sponsored rescues of failed institutions would wipe out the latter’s shareholders12. This made investors less inclined to beef up the capital of banks and more prone to “ flee the sinking ship ” before it was too late. The situation came to a head in early September 2008 when the U.S. had to bail out Fannie Mae and Freddie Mac which together held over $5 trillion of mortgages in their portfolios. Lehman’s collapse a week after this $200bn. rescue left the Bush Administration so concerned about moral hazard that they preferred to let America’s fourth-largest investment bank go under, intending thereby to send a signal that mistakes would get punished and no institution was “ too big to fail. ”

4.2. The Collapse of the Money Markets

36 That fateful decision created havoc in the world’s financial markets, triggering the collapse of the world’s largest insurance company AIG, the loss of independence for America’s remaining three investment banks (Merrill Lynch, Goldman Sachs, Morgan Stanley), a series of spectacular bank failures (Washington Mutual, Wachovia, Fortis, Dexia, Hypo Real), heavy losses for bondholders, and panicky mass withdrawals from money-market funds. Shaky banks now faced a new squeeze of devastating efficacy whereby rumors of their imminent demise would push up the premia on their credit default swaps which in turn would invite mass sell-offs of their shares to the point of extinction. In light of this they were now no longer willing at all to lend to each other, even in the very short term. Every single pillar of the world’s money markets ceased to function properly in the weeks following Lehman’s collapse – the inter-bank market, repo market, the commercial paper market, money-market funds, etc. All financial institutions borrowing short-term to fund long-term assets, including investment banks, hedge funds, and many of the more aggressively managed commercial banks, found themselves suddenly incapable of managing their maturity mismatch and so faced the danger of collapse.

37 In the face of this unprecedented and rapidly spreading panic governments in the U.S. Europe, and elsewhere had to come up with an absolutely mind-boggling leap in crisis management. It took them a little while to comprehend the magnitude of this chain reaction and figure out how to respond, but respond they did. Central banks all over the world, besides dramatically enhancing their cooperation, turned from “ lender of last resort ” to “ lender of only resort ” as they replaced frozen money markets to give banks and other financial institutions essentially unlimited access to funds. Asset-swap operations and emergency loans basically doubled the size of most central banks’ portfolios in a matter of a few months while leaving them with a much larger proportion of doubtful assets. The E.U. and U.S. launched huge rescue packages for their domestic banking systems which recapitalized banks, guaranteed their liabilities, and took the most toxic assets off their books. Leaders, such as Britain’s Gordon Brown and France’s Nicholas Sarkozy, have been pushing for broader reforms of the international monetary system, with a series of meetings scheduled over the coming year bringing together the governments of the leading industrial and emerging-market (so-called G-20) countries.

38 Now that fundamental reform on a global scale has become a matter of urgency, it makes sense to consider what regulatory regime may prevent such crises from recurring or, once triggered, help us contain them. There are definite lessons to be learned from what has just transpired.

5.1. Restoring Checks and Balances

39 Deregulation of banks in the 1980s gave way to a system of self-regulation whose checks and balances failed. The chief executive officers of the leading banks, a tightly-knit group taking each other as reference and rotating from position to position like a revolving door, pushed aggressive exploitation of innovations and revenue generation at all costs as the central tenets of their institution’s corporate culture. The key revenue generators within the financial group had too much autonomy, did things ill understood by their superiors, and followed an incentive structure bound to encourage excess. Corporate governance rules, in-house communication practices around “ firewalls ” separating different departments, and performance-based remuneration all proved flawed inasmuch as each contributed to a systematic mismanagement of risk-return trade-offs.

40 Banks set up complex structures of special-purpose entities and other risk-transfer mechanisms, which existed outside of their balance sheets and were hence invisible to any third party. Neither internal controls nor external auditors were capable of identifying emerging problem areas before those started to cause major losses. Rating agencies, such as Standard & Poor’s or Moody’s, faced conflicts of interest, which eroded their capacity for objective assessment. Not only were they paid by those whose products they were supposed to rate, but they often also served as consultants in putting together loan securitization packages that they would then agree to give top ratings. Finally, prudential controls placed by regulators on banks, in particular supervision, proved wholly inadequate. Not only do most countries lack qualified examiners able to cope with a bewildering array of new financial products, but they also suffer from outdated regulatory structures which in their functional separation (e.g. between commercial banking and financial markets) no longer correspond to the realities of integrated financial groups.

41 It is obvious that each of these checks will have to be reformed to restore its effectiveness. Much of that correction comes about naturally in the face of post-crisis pressures to learn from past mistakes and figure out better ways to avoid those in the future, the same holds for changes in the structure and corporate culture of banks in the aftermath of huge losses which spark personnel changes among top managers and shareholder revolts. Still, governments will have to use their power as shareholders of banks to impose behavioral guidelines and a new normative context, as they did for instance by limiting executive pay in the U.S. bail-out package. What we need is a wholesale and systematic renewal of the checks and balances, starting with new in-house norms of behavior.

5.2. The Limits of Risk Management

42 Central banks are recapitalizing even relatively well-capitalized banks to make sure that the banking system as a whole has much larger capital cushions than prevailed when the crisis entered its virulent phase on 8 September 2008. They will thus counteract the spirit and letter of Basel II, the new global regulatory regime whose principles of supervised self-regulation ended up allowing banks to keep too little capital13. The basic idea of Basel II. which is to harmonize minimum standards for internal risk controls, loss provisions, information disclosure, and capitalization levels across the globe, is a good one. The question is how best to implement the idea for optimal efficacy. It has become clear already that Basel II. as currently applied, tends to act in pro-cyclical fashion by demanding higher capital levels just when banks retrench during a crunch. This criticism applies also to new accounting rules, known as International Financial Reporting Standards (IFRS), whose pro-cyclical mark-to-market accounting the E.U. has already allowed to relax.

43 An even more important flaw of Basel II is its excessive reliance on proprietary risk-management models developed and applied by the banks themselves. The crisis has made it clear that bankers have a hard time assessing risks properly. They underestimate risks during euphoria-driven booms only to exaggerate them during panic-stricken busts. The new “ generate-and-distribute ” model of making loans, repackaging those into securities, and selling off the latter invites banks to think mistakenly that such a mechanism for transferring risks to others is tantamount to getting rid of the risks altogether. If anything, securitization just transforms a credit risk into a combination of market and counterparty risks. Banks’ delusions about risk have been made worse by the ill-understood nature of their complex instruments as well as by the purposeful opacity of their dealings. Here we need to focus in particular on the special purpose entities created outside of their balance sheets (e.g. structured investment vehicles, collateralized debt obligations) which not only earned banks income but also, as it turned out, incurred costly “ contingent liabilities ” for them.

44 There are inherent limitations trying to transform radical uncertainty, with its innate unpredictability, into measurable risk on the basis of averaging a range of possible scenarios weighted by their respective probabilities. It does not help that the models, even the most advanced ones, tend to look at the different risks individually, as if separated from each other, when in reality they combine and connect in mutually reinforcing fashion during crisis. Credit risks feed market risks which in turn posit elevated counterparty risks, for instance. And in those chaotic conditions of crisis one risk may transform into another : liquidity risks could turn rapidly into solvency risks; today’s operational risks becomes tomorrow’s reputational or legal risk, and so on.

45 The inability of risk models to anticipate such combinations and transformations leaves room for a large number of “ tail risk ” events outside the normal scenario distribution captured by those models for which bankers and their regulators are not prepared, not least of which we must mention the systemic risk of a system-wide breakdown of normalcy.

5.3. Banking Supervision

46 Due to these inherent limits to risk management it is important to affect bank behavior with supplementary means of control. Crucial here is much-strengthened supervision of banking activities, especially among the largest financial groups, by government regulators. This will have to be globally coordinated, since the leading banks are entirely trans-national in nature. Supervision will also be rendered more effective if applied comprehensively rather than divided by function among different regulators, each looking only at the niche under its jurisdiction. The trend towards such supervisory centralization is already under way at least in the United States, with the Fed winning a decade-long turf battle against other regulators, but needs to be streamlined further in the E.U. The effectiveness of supervision would also be greatly enhanced if all kinds of bank activities were rendered much more transparent. This call for transparency needs to be extended to all kinds of financial intermediaries, including the notoriously opaque hedge funds. You cannot identify risky behavior unless you have a chance to know about it.

47 Supervisory capacity needs to be coupled with intervention powers when problematic behavior has been identified. A good idea has been the U.S. practice of “ prompt corrective action, ” implemented by the Federal Deposit Insurance Corporation since 1991, whereby under-capitalized banks are obliged to take progressively tougher and far-reaching steps the lower their level of capital. In the same vein, banking regulators should also have the power to impose maximum leverage ratios on banks and/or to implement asset-based reserve requirements that relate positively to perceived riskiness of the bank’s portfolio.

48 Also needed is a macro-prudential approach to banking regulation, whereby central banks collect data from banks about their sources and uses of funds to trace the unfolding dynamic of a credit cycle in the interest of maintaining financial stability. The idea here is to counteract any tendency toward excess before it feeds into an unsustainable bubble. Central banks should put early warning signals into place which trigger restraints (e.g. leverage-ratio ceilings, reserve requirements) soon enough. Otherwise we will be left with the increasingly intolerable imbalance between privatization of gains and socialization of losses where a few reap huge benefits for their success, but make everyone else pay for their mistakes.

5.4. Fragile Markets

49 Perhaps the most unique aspect of this crisis has been the collapse of several financial markets at the same time. These were in each instance over-the-counter markets. organized by a fairly small number of financial institutions dealing with each other in bilateral deals. In the absence of clearly established rules these more or less informal markets depend to a very large degree on confidence and trust, both among the market-making institutions in their dealings with each other as well as between them and their clientele ending up with the securities. Yet the very informality of OTC markets also renders such confidence vulnerable to shocks.

50 Underwriting banks make OTC markets by initially buying some new securities from each other, using their proprietary models to value the product and agree on a price, which serves as the basis for subsequent distribution of the whole issue to their investor clients. If and when unexpected behavioral characteristics of the product put into doubt its anticipated risk-return profile, OTC markets lack the public-exchange mechanism to establish a new, collectively elaborated price reflecting the troubling information. Doubting each other’s values, banks may well lack the cohesion for a new price consensus among themselves. At that point, when there is no more price recovery, trading ceases. This is exactly what happened in the markets for non-agency mortgage-backed securities, collateralized debt obligations, and asset-backed commercial paper. Their collective paralysis extended the mutual mistrust among banks to the inter-bank market whose recurrent disruption has severely impaired growth prospects for the entire world economy.

51 Other recent innovations have come under great stress during the current crisis – structured-investment vehicles, monoline insurers, credit default swaps, hedge funds, auction-rate securities, and so forth. Any one of them might still break under pressure, a prospect especially likely for the various default-insurance products once recession triggers more defaults and downgrades. And such ruptures may further aggravate loss of confidence and income. In light of such additional stressors we have to be careful that the ongoing process of de-leveraging and re-pricing of risk does not degenerate into panic selling of assets while markets fall sharply which in turn could trigger a sustained debt-deflation spiral in the direction of generalized depression.

5.5. Emerging Polycentrism

52 One added victim of the current crisis may well be the international status of the U.S.-dollar. Still centered in the United States despite its now global contagion, the crisis is bound to accelerate the decline of America’s currency – both in value and market share. Such a development is destabilizing, as can be seen by its impact on global commodity prices. Erosion of the dollar’s position as international medium of exchange may also make it harder in the longer run for the United States to finance its twin deficits from the pool of foreign savings, even service its foreign debt in excess of three trillion.

53 One of the challenges ahead concerns the need to prepare for the newly emerging polycentric world economy, composed of roughly equal regional zones for the dollar, euro, and yuan/yen14. We do not have the multi-lateral institutions of global governance in place with which to practice the necessary coordination among competing power blocs. In their absence frictions between financial centralization and monetary fragmentation, endemic to such a system, may come to dominate the next long wave in the evolution of finance-led capitalism. Finance is too important and unstable to be left to the bankers.