A Guide to Using Inverse ETFs for Diversification

Post on: 7 Апрель, 2015 No Comment

Revolutionize Your Trading With ETF Options

1. ETFs Trade Almost Like a Stock

Unlike mutual funds which can only be entered or exited at the market close each trading day, ETFs can be bought and sold intraday. They can be day traded just like stocks. This advantage allows investors to make speculative bets on the direction of an index while still having the ability to exit the trade at any time of the day. ETFs also allow short selling, as well as often being optionable.

2. Diversification

One of the main benefits of trading ETFs is diversification. ETFs were created to track an index, be that a stock index, commodity index, currency index, or almost any other type of security index. The advantage of trading an index is that you are shielded from the volatile up and down swings of an individual security.

3. Liquidity

There are many funds that are highly liquid. The QQQ ETF (follows the Nasdaq-100 Index) has an average daily trade volume of over 47 million shares and over 100 other funds have an average daily volume of more than 1 million shares.

Liquidity is important to get in or out of a position quickly. There are a lot of other buyers and sellers to facilitate your trades as opposed to relying on market makers to do everything for you. If you are trading options on the funds, many of these also have highly liquid options.

As a result of high liquidity, many ETFs have low bid/ask spreads. A high bid/ask spread can cut into your trading profits. Most of the highly liquid ETFs have a bid/ask spread of only a few cents during the trading day.

Whichever sector of the market interests you, you can probably find an ETF for it. There are major index funds such as the QQQ and SPY as well as sector funds such as XLF (Financials), and international funds such as EEM (Emerging Markets).

In addition to sector specific, fund companies are continually introducing Ultra and Inverse ETFs. Ultra ETFs are leveraged funds in which the returns of the fund are double that of the index. For example, if an ETF is up 10% for a given year, then the Ultra ETF for that same index would be up 20% in the same year. Keep in mind that this leverage can work for you, as well as against you.

Inverse ETFs are funds which move in the opposite direction of the underlying index. So if the S&P 500 Index is down 8%, then the inverse ETF for the S&P would be up 8%. To further increase your investing options, some ultra ETFs are also inverse funds as well.

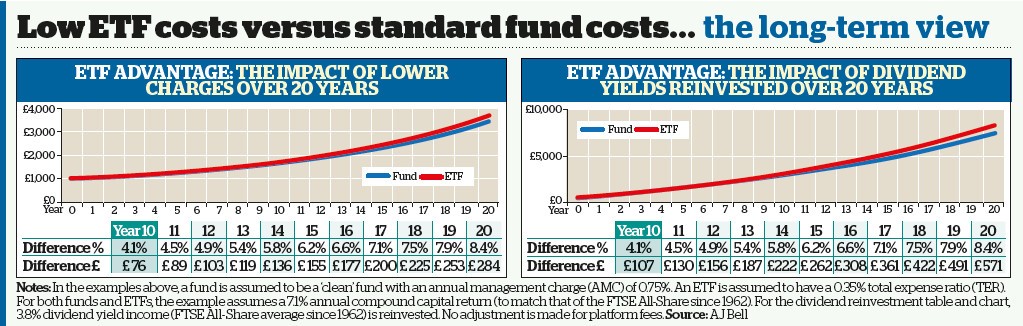

6. Low Expense Ratios

ETFs have much lower expense ratios than most mutual funds. This means that more of your money stays in the investment rather than going to the firm that is maintaining it.

Some believe Exchange Traded Funds will become the primary investment instrument for most investors largely leaving mutual funds behind. This growth is demonstrated by the increasing availability of ETF options.

The benefits of ETFs speak for themselves, thats why we devote time to trading ETFs. The success people have had with ETFs is real, which is why I have decided to share with you all of my secrets to trading the fastest growing trading avenue!

ETFTRADR has been on a roll over the last few months!

Here is a list of some of the big winners recorded since September 1st 2014:

+90% GAIN on GLD September 126/120 Put Spread

+70% GAIN on XLE October 97/88 Put Spread

+67% GAIN on GDXJ October 38 Put

+57% GAIN on IWM October 114/104 Put Spread