A genetic fuzzy expert system for stock price forecasting

Post on: 16 Март, 2015 No Comment

Page 1

978-1-4244-5934-6/10/$26.00 ©2010 IEEE 41

2010 Seventh International Conference on Fuzzy Systems and Knowledge Discovery (FSKD 2010)

A Genetic Fuzzy Expert System for Stock Price Forecasting

Esmaeil Hadavandi, Hassan Shavandi

Department of Industrial Engineering

Department of Industrial Engineering

University of Tehran

Tehran, Iran P.O. Box: 11155-4563

arashghanbari@yahoo.com (arghanbari@ut.ac.ir)

Abstract-Forecasting stock price time series is very

important and challenging in the real world because they are

affected by many highly interrelated economic, social,

political and even psychological factors, and these factors

interact with each other in a very complicated manner. This

article presents an approach based on Genetic Fuzzy

Systems (GFS) for constructing a stock price forecasting

expert system. We use a GFS model with the ability of rule

base extraction and data base tuning for next day stock price

prediction to extract useful patterns of information with a

descriptive rule induction approach. We evaluate capability

of the proposed approach by applying it on stock price

forecasting case study of International Business Machines

Corporation (IBM), and compare the outcomes with

previous stock price forecasting methods using mean

absolute percentage error (MAPE). Results show that the

proposed approach is able to cope with the fluctuation of

stock price values and it also yields good prediction accuracy

in short term stock price forecasting.

Keywords- Stock Price Forecasting; Genetic Fuzzy

systems; Expert systems

I. INTRODUCTION AND LITERATURE REVIEW

A. Stock price forecasting

Forecasting stock price time series is very important

and challenging in the real world because they are

affected by many highly interrelated economic, social,

political and even psychological factors and these factors

interact with each other in a very complicated manner.

Stock market forecasters focus on developing

approaches to successfully forecast/predict index values

or stock prices, aiming at high profits using well defined

trading strategies. The central idea to successful stock

market prediction is achieving best results using minimum

required input data and the least complex stock market

model [1]. Considering this idea an obvious complexity of

the problem paves the way for the importance of

intelligent prediction paradigms [2].

Artificial Intelligence techniques such as artificial

neural networks (ANNs), fuzzy logic, and genetic

algorithms (GAs) are popular research subjects, since they

can deal with complex engineering problems which are

difficult to solve by classical methods [3]. Artificial

intelligence techniques can be combined together in

various ways to form hybrid models. Hybrid models have

more flexibility and can be used to estimate the non-linear

relationship, without the limits of traditional models such

as Time Series models. Therefore, more and more

researchers tend to use hybrid forecasting models to deal

with forecasting problems.

Chang et al. [4] used a Takagi–Sugeno–Kang (TSK)

type Fuzzy Rule Based System (FRBS) for stock price

prediction. They used simulated annealing (SA) for

training the best parameters of fuzzy systems. They found

that the forecasted results from TSK fuzzy rule based

model were much better than those of back propagation

network (BPN) or multiple regressions.

Atsalakis et al. [5] proposed a hybrid model that linked

two Adaptive Neuro-Fuzzy Inference System (ANFIS)

controllers to forecast next day’s stock price trends of the

Athens and the New York Stock Exchange (NYSE). The

proposed system performed very well in trading

simulation and comparisons with 13 other similar soft

computing based approaches demonstrated solid and

superior performance in terms of percentage of prediction

accuracy of stock market trend. One of the most popular

approaches is the hybridization between fuzzy logic and

GAs leading to genetic fuzzy systems (GFSs) [6].A GFS

is basically a fuzzy system augmented by a learning

process based on evolutionary computation, which

includes genetic algorithms and other evolutionary

algorithms (EAs) [7].

In recent years some articles have been published in the

favor of using GFS in modeling and forecasting area

[8,9,10]. They have all obtained satisfactory results and

concluded that using GFSs is very promising for these

areas. but there is not any research in the literature that

uses a GFS with the ability of extracting whole

knowledge base of fuzzy system for stock price

forecasting problem (a complete literature review on

proposed techniques for stock market forecasting can be

found in [1]).

This paper presents a hybrid artificial intelligence (AI)

methodology for next day stock price prediction to extract

useful patterns of information with a descriptive rule

generate one-day forecasts of stock prices in a novel way.

Hassan et al. [12] proposed and developed a fusion model

combining the HMM with an Artificial Neural Network

and a Genetic Algorithm to achieve better forecasts. In

their model, ANN was used to transform the input

observation sequences of HMM and the GA was used to

optimize the initial parameters of the HMM. This

optimized HMM was then used to identify similar data

pattern from the historical dataset. The comparison

showed that forecasting ability of the fusion model is

better than ARIMA model and HMM proposed in [11].

Hassan [13] proposed a novel combination of the HMM

and the fuzzy models for forecasting stock market data.

The model used HMM to identify data patterns and then

used fuzzy logic to generate appropriate fuzzy rules and

obtain a forecast value for next day stock price. The

forecast accuracy of the combination HMM–fuzzy model

was better when compared to the ARIMA and ANN and

other HMM-based forecasting models.

II. DEVELOPING A GENETIC FUZZY SYSTEM

Nowadays fuzzy rule-based systems (FRBS) have been

successfully applied to a wide range of real-world

problems from different areas. Knowledge base (KB) of a

FRBS composed of the rule base (RB), constituted by the

collection of rules in their symbolic forms, and the data

base (DB), which contains the linguistic term sets and the

membership functions defining their meanings. The

difficulty presented by human experts to express their

knowledge in the form of fuzzy rules has made

researchers develop automatic techniques to perform this

task. GAs have been demonstrated to be a powerful tool

for automating the definition of the knowledge base (KB)

of a fuzzy system, since adaptive control, learning, and

self-organization may be considered in a lot of cases as

optimization or search processes. The GFS type which we

use in this article consists of two general stages; stage 1

derives rule base of FRBS and stage 2 tunes data base of

FRBS. In the following we’ll describe theses two stages.

A. Genetic derivation of the Rule Base for FRBS

A previously defined DB constituted by uniform fuzzy

partitions with triangular membership functions crossing

at height 0.5 is considered. The number of linguistic terms

forming each one of them can be specified by the GFS

designer, and then Pittsburgh approach is used for

learning RB. Each chromosome encodes a whole fuzzy

rule set and the derived RB is the best individual of the

last population. Pittsburgh approach can be decomposed

input related each

variable and four fuzzy sets ?B?,B?,B?,B. related to the

output variable and Applying this code to the fuzzy

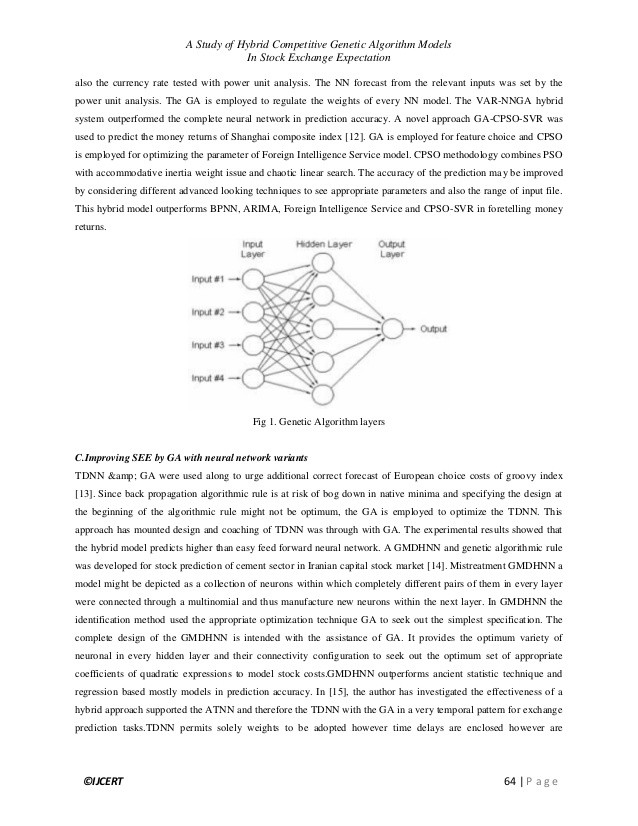

decision table represented in Figure 1.

Step 2 — Generating the initial population

Initial chromosomes ( Npop ) are randomly generated;

while the alleles are in the set ?1,2,…. (NB is the