A Comparison of Vanguard and Fidelity s Mutual Funds

Post on: 8 Апрель, 2015 No Comment

Welcome to My Personal Finance Journey. If you are new here, please read the “About ” or “First-Time Visitor ” pages to find out more about us. If you would like to receive free updates on articles like this by email, then sign up here or you can subscribe to the RSS feed. Also, check us out on Twitter or Facebook. Thanks for visiting! Keep on learning!

%img src=http://gator1523.hostgator.com/

mpfj/wp-content/uploads/blogger/_ySFE6T7lppg/TGP_3M-9m3I/AAAAAAAAAdQ/EjIhdtsua6c/s200/battle-fidelity-vanguard-200x267dr.jpg /%

Yesterday morning, I had the distinguished honor of being on a call with Fidelity, the administrator/provider of my previous companys 401k accounts, to roll over my 401k to a Vanguard IRA .

During this call, the sales agent was fiercely trying to persuade me to rollover the 401k account to a Fidelity IRA. His two major selling points were that he claimed that Fidelity had..

- 1) Lower expense ratios than Vanguard, and

- 2) Better money managers/actively managed mutual funds.

I then proceeded to get in to an argument with the sales rep about how active management is a foolish game in which to play. He fought back valiantly, stating that if you find a good money manager that takes advantage of the Modern Portfolio Theory, you can achieve higher returns through proper asset allocation.

Needless to say, he was digging his own grave with this piece of wisdom, since that has nothing to do with why active management is superior (asset allocation can be done on your own with index funds).

Regardless of how I felt about the validity of reason #2 above (better actively managed funds), reason #1 did in fact get me thinking because I have never done a personal, head-to-head comparison of Fidelity and Vanguard. I merely was trusting that Vanguard was superior because it is the most recommended in the investment books I read by Malkiel , Siegel , et. al.

Because of this, I wanted to dedicate todays post to comparing Vanguard against the largest mutual fund company in the world (as far as quantity of capital invested goes), Fidelity.

Point of Comparison #1 Comparison of Expense Ratios (and subsequently, performance)

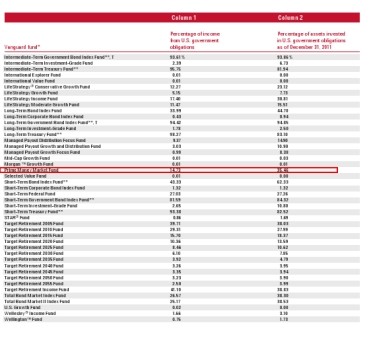

Shown on the table below is a comparison of the expense ratios for each of the 14 mutual funds/ETFs that I am currently holding in my Vanguard investment portfolio. You can find a listing of the ticker symbols of the funds that I am holding in my investment strategy .

As you can see on the table above, Vanguard features lower expense ratios (and therefore higher returns) on 10 of the 14 funds that I am holding. This corresponds to Vanguard beating Fidelity on expense ratios 70% of the time.

Moreover, Fidelity does not even offer index funds for the small cap value, REIT, and Emerging Market arenas. This is rather inadequate for the asset allocation-obsessed investor.

Point of Comparison #2 Trading Fees / Commissions

When it comes to trading fees and commissions for trading ETFs and mutual funds, Fidelity and Vanguard are tied.

They both offer $0 trading on their proprietary mutual funds and ETFs.

Point of Comparison #3 Minimum Balances, Initial Quantities, and ETF Availability

This point is an area where Vanguard shows though as having a clear advantage, at least in my perspective.

Fidelity requires that an investor have (for each mutual fund) a minimum initial investment quantity and continuing investment balance of $10,000. For the majority of investors, especially for younger investors, I feel that this is simply not realistic.

On the other hand, Vanguard requires a minimum initial investment of $3,000. However, once the account is established, the balance can dip below that level without penalty.

As far as ETFs go, Vanguard reins superior over Fidelity because 1) their ETFs feature lower expense ratios and 2) Fidelity does not even offer their own ETFs. Instead, the ETFs listed on the table above are actually iShares ETFs that Fidelity offers with $0 commission trading.

Point of Comparison #4 Ease and Simplicity of Navigating Website

In trying to find the expense ratio data in the above table, I have to admit that I obtained a serious headache in the process.

Even though I am very used to and partial to Vanguard, Fidelitys website is a pain to navigate. It is much harder to sort mutual funds based on asset class and whether they are index funds or actively managed.

Additionally, I feel that Fidelity tries to complicate index investing too much by offering enhanced index mutual funds. This makes it even harder to drill down to the investment vehicle that you want.

Key Takeaway

By the evidence shown above, I believe we have disproved what the sales agent was saying about Fidelity offering lower expense ratio index mutual funds.

As I am wrapping up this post, I am trying to brainstorm in my head just why Fidelity manages the most capital in the world, when Vanguard is clearly superior as far as index investing goes. Thus far, I have thought of the two reasons listed below:

- Fidelity markets itself better to institutions, encouraging them to establish their 401k accounts with their company.

- Fidelity specializes more in active management vs. index investing.

- Since sadly, the majority of investors fall in to the active management trap, I suppose it would make a lot of sense for Fidelity to have an increased amount of capital.

How about you all? Do you all use Vanguard of Fidelity for your index and/or actively managed mutual fund needs? What made you go with the provider you chose?

Share your experiences by commenting below!

Did you like this article? You can get the complete text of all the latest articles at My Personal Finance Journey in your email inbox each evening by clicking the link below and entering your email address. Your address will only be used for mailing you the articles, and each one will include a link so you can unsubscribe at any time.

Related articles comparing Vanguard and Fidelity at several of my favorite personal finance blogs: