A Brief History of Mutual Funds and Exchange Traded Funds

Post on: 6 Апрель, 2015 No Comment

A Brief History of Mutual Funds and Exchange Traded Funds

Exchange Traded Funds

A Brief History of Mutual Funds and Exchange Traded Funds

Exchange traded funds (ETFs) are a recent innovation and the twentyfirst-century version of the traditional mutual fund. They first appeared on the scene in 1993. Before learning more about this

investment vehicle, lets take a brief look at the mutual fund industry and how it all began.

HISTORY

As noted earlier, public investors did not always invest their money in stocks. As recently as 100 years ago, no professional financial advisor would ever suggest that average investors place any savings in the stock market. But the world changed when the first official mutual fund, The Massachusetts Investors Trust (MIT), opened for business in March 1924. This fund is still in existence today. By establishing the minimum investment at $250, and a sales charge (load) of 5 percent, the fund managers made it easy for public investors to buy shares. MIT is an open-ended fund, meaning that new shares are issued to anyone who wants to buy them. The fund management team takes the newly invested cash and issues shares to the investor. The managers keep the cash in reserve or use it to make additional investments for the funds portfolio. Investors can redeem shares by notifying the fund management of their desire to sell. New shares are issued, and existing shares are redeemed, at the true value of the fund, called the net asset value (NAV).

The existence of mutual funds such as MIT gave public investors an easy way to own a diversified portfolio of stocks and opened the gates of Wall Street to the masses. And eventually the masses became very interested. As of June 2004, the mutual fund industry managed more than $7.59 trillion of the public investors assets, according to The Investment Company Institute (www.ici.org).

The first closed-end mutual fund arrived on the scene in 1927. Initially called investment trusts, closed-end funds do not issue additional shares. Instead, existing shares trade on an exchange where they can be bought or sold in a manner identical with stocks. The price of such shares is determined by supply and demand, not by the true value of the underlying fund (NAV). Most of the time these funds trade at a discount to their true NAV, but they have been known to trade at a premium.1

In April 1928, the no-load fund was born when the Norfolk Investment Corporation was established without a purchase fee (load). A month later the fund changed its name to the First Investment Counsel Corporation. Today it is part of the Scudder family of funds.

The market crash in 1929 and the depression that followed brought many changes to the investment industry. The Securities Act of 1933 required all funds to sell shares through a prospectus that points out the risks associated with such investments. Previously, salesmen were allowed to sell mutual funds without any government regulations. Three years later the Securities and Exchange Commission (SEC) was created, naming Joseph P. Kennedy (father of future president John F. Kennedy) as its first chairman. In 1946 funds allowed investors to reinvest dividends without payment of the sales load for the first time. In 1951 the total number of mutual funds surpassed 100.

Money market funds appeared in 1971, giving investors an easy method of holding the equivalent of cash for those periods of time when they did not want to be invested in any of the mutual fund companys other offerings.

In 1976 Vanguard issued the first index fund, whose goal is to capture almost 100 percent of the markets annual return and is based on the belief of Vanguards founder, John Bogle, that beating the market is so difficult that people are better off trying to match the market. 2 They accomplish

this goal by buying all the stocks in the Standard & Poors 500 index and holding them forever. Today index funds are extremely popular, but the idea did not immediately catch the fancy of public investors, and the second index fund did not appear until 1984.

In 1993 the modern version of the mutual fund, the exchange traded fund, was brought to the market by State Street Global Advisors and the American Stock Exchange. Standard & Poors Depository Receipts, nicknamed spiders, attempts to provide investors with the same return as the S&P 500 index.

As the technology bubble was expanding in the final years of the 1990s, the number of funds exploded. According to the Insurance Information Institute, there were more than 8,300 funds in existence at year-end 2001. Today some of those funds have disappeared, but the mutual fund industry remains huge and influential. How well it survives the competition provided by exchange traded funds and the scandals of the early 2000s is an open question.

For those interested in additional history of the mutual fund industry, Jason Zweig wrote an article commemorating the seventy-fifth anniversary of the mutual fund industry in 1999.3

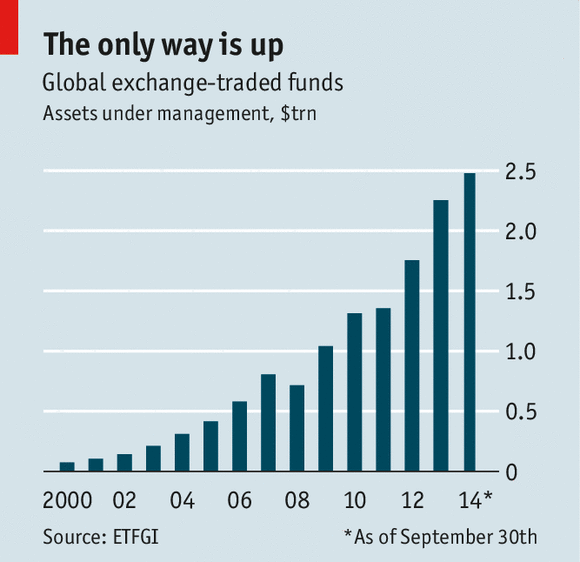

HISTORY OF EXCHANGE TRADED FUNDS

It started in 1993 with spiders. Diamonds, qubes, webs, and vipers were added later. These newcomers to the investment world, with strange nicknames, have exploded in popularity, and a little more than one decade after their birth, this new class of securities has grown so rapidly that as of June 2004, investors had poured over $178 billion into them. At that time, there were at least 143 different ETFs, and the number is growing steadily. ETFs are not only American products; they exist overseas as well.

What makes these newcomers so popular? Well take a look at how this modern version of the traditional mutual fund can be used by a great many (but not all) investors to obtain benefits not available from traditional funds. As you will see, ETFs provide an easy way to get around the high expenses and poor performance associated with the mutual fund industry.

ETFs can be considered as hybrid securities, part mutual fund and part stock. Theyre not exactly mutual funds, although they invest in a diversified basket of stocks, just as mutual funds do. Theyre not exactly stocks, but they trade on an exchange, just as stocks do. If these two attributes make you think they resemble closed-end mutual funds, that resemblance is superficial.

ETFs have advantages over traditional mutual funds that make them more attractive to both public and institutional investors. Well discuss the advantages of ETFs in Chapter 6 after taking a look at traditional mutual funds and how well they serve the needs of todays public investor in Chapter 5. One major advantage of ETFs is that, unlike traditional mutual funds, many are optionable. This means investors can buy and sell put and call options on these ETFs. Optionability is important because you will learn how to incorporate a conservative strategy, called covered call writing, into your investment program to enhance the performance of your investment in the stock market. Part IV presents a detailed discussion of this topic.