A Brief History Of Credit Rating Agencies

Post on: 16 Март, 2015 No Comment

Credit ratings provide individual and institutional investors with information that assists them in determining whether issuers of debt obligations and fixed-income securities will be able to meet their obligations with respect to those securities. Credit rating agencies provide investors with objective analyses and independent assessments of companies and countries that issue such securities. Globalization in the investment market, coupled with diversification in the types and quantities of securities issued, presents a challenge to institutional and individual investors who must analyze risks associated with both foreign and domestic investments. Historical information and discussion of three companies will facilitate a greater understanding of the function and evolution of credit rating agencies.

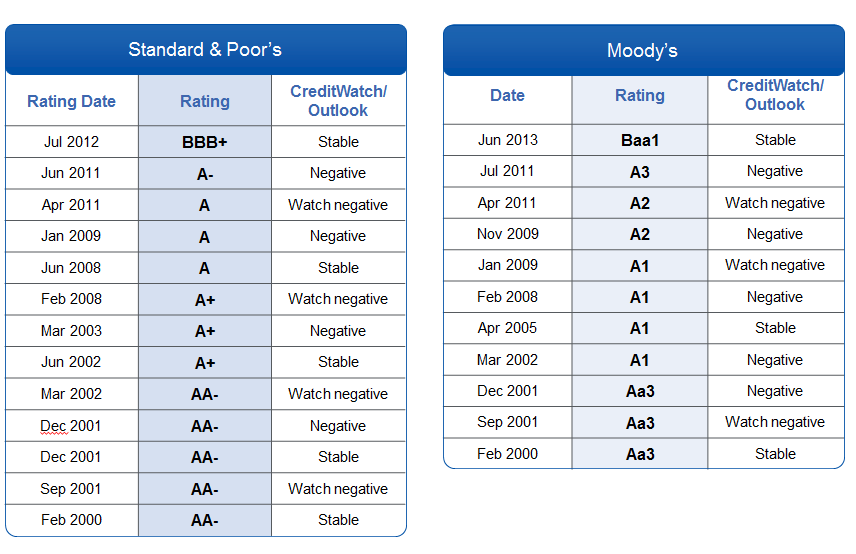

Standard & Poor’s

Henry Varnum Poor first published the History of Railroads and Canals in the United States in 1860, the forerunner of securities analysis and reporting to be developed over the next century. Standard Statistics formed in 1906, which published corporate bond. sovereign debt and municipal bond ratings. Standard Statistics merged with Poor’s Publishing in 1941 to form Standard and Poor’s Corporation. which was acquired by The McGraw-Hill Companies, Inc. in 1966. Standard and Poor’s has become best known by indexes such as the S&P 500, a stock market index that is both a tool for investor analysis and decision making, and a U.S. economic indicator. (See A Trip through Index History to learn more about Standard & Poor’s Indexes.)

Nationally Recognized Statistical Rating Organizations (NRSRO)

Beginning in 1970, the credit ratings industry began to adopt some important changes and innovations. Previously, investors subscribed to publications from each of the ratings agencies and issuers paid no fees for performance of research and analyses that were a normal part of development of published credit ratings. As an industry, credit ratings agencies began to recognize that objective credit ratings significantly increased in value to issuers in terms of facilitating market and capital access by increasing a securities issuer’s value in the market place, and decreasing the costs of obtaining capital. Expansion and complexity in the capital markets coupled with an increasing demand for statistical and analytical services led to the industry wide decision to charge issuers of securities fees for ratings services.

In 1975, financial institutions, such as commercial banks and securities broker-dealers, sought to soften the capital and liquidity requirements passed down by the Securities and Exchange Commission (SEC). As a result, nationally-recognized statistical ratings organizations (NRSRO) were created. Financial institutions could satisfy their capital requirements by investing in securities that received favorable ratings by one or more of the NRSROs. This allowance is the result of registration requirements coupled with greater regulation and oversight of the credit ratings industry by the SEC. The increased demand for ratings services by investors and securities issuers combined with increased regulatory oversight has led to growth and expansion in the credit ratings industry.