A Better Way to Invest in Commodities or Even the Fear Index Focus on Funds

Post on: 25 Май, 2015 No Comment

By Brendan Conway

Plenty of investors want to own commodities and inverse assets in theory. The trouble comes with executing it. The oft-published disclaimer says this index or that is not directly investable. The commodity futures market, which is where funds resort unless they store gold or silver in a vault, is a slippery beast.

In this vein, theres an interesting regulatory filing overnight which reveals ambitions to build something better.

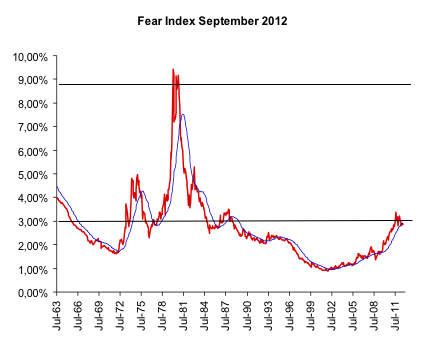

Startup AccuShares Investment Management submitted plans to regulators for a series of funds for widely followed S&P GSCI indexes of oil. natural gas, metals, agriculture. broad commodities and CBOEs market volatility index, the fear index. Right away the reader sees the word spot is included in the fund names. Spot means the market price.

AFP Not directly investable but check out the new AccuShares plan.

Spot commodity prices and the indexes tracking them are generally out of reach for the average investor, which is also true for spot volatility. The phrase not directly investable is nowhere in this filing. Thats because the idea effectively is to make the indexes directly investable.

It hasnt been done before with any success. Heres how AccuShares hopes to change that.

The envisioned method creates 1933 act funds with up and down share classes which receive distributions, or experience reductions in value, according to changes in the respective indexes. The funds wont invest in commodity futures or swaps at all, which is what trips up many existing ETFs and mutual funds. Theyll instead hold cash and cash equivalents.

The innovation: Investors effectively swap value with one another, depending whether they were in AccuShares Spot CBOE VIX Up Shares or AccuShares S&P GSCI Spot Up Shares or the corresponding down shares for a given rise or fall in spot prices. The investors are entitled to the gains and losses in a way that isnt true in other fund structures. None of this is possible in a conventional 1940 act fund.

Will it work? Its worth noting right away that AccuShares isnt envisioning set-and-forget investing. The distribution mechanism means investors would have to watch closely and rebalance frequently. Distributions are envisioned coming in the form of cash, but the prospectus makes clear they could also come as shares.

If youre getting shares when you win, you need a heavily-traded, efficient market for those shares, or else theres less of a point. Having a critical mass of investors using the funds looks necessary.

But the idea has a number of things going for it. Getting spot returns is, after all, what most investors want when they say theyd like to own commodities or inverse assets. Its effectively what they get in SPDR Gold Trust (GLD ) and iShares Silver Trust (SLV ), which own metal in a vault. Holding a hunk of metal sidesteps futures-market problems like contango , which erodes the value of long-term positions.

But the idea potentially relieves an investor frustration over the absence of spot or market returns in products like Barclays iPath S&P 500 VIX Short-Term Futures ETN (VXX ), ProShares Ultra VIX Short- Term Futures ETF (UVXY ), United States Oil Fund (USO ) and United States Natural Gas Fund (UNG ). Those ETFs and ETNs simply arent built to give you spot price moves.

Another interesting item: AccuShares has managed to avoid the K-1 tax headaches common in other commodity ETFs. It instead envisions issuing 1099s.

Its just a filing. Its not yet clear whether it will work or even whether these will launch. But the AccuShares plan is different enough that it bears watching.

WisdomTree Cut to Sell: Little Room for Error Next

The Importance of Being Earnest (or at Least Consistent)